I’m searching the FTSE 100 for the best dividend shares to buy in the coming days. I already own these particular blue-chip shares in my ISA and am thinking about increasing my stake.

Here is why.

Housing hero

Should you invest £1,000 in Ds Smith right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ds Smith made the list?

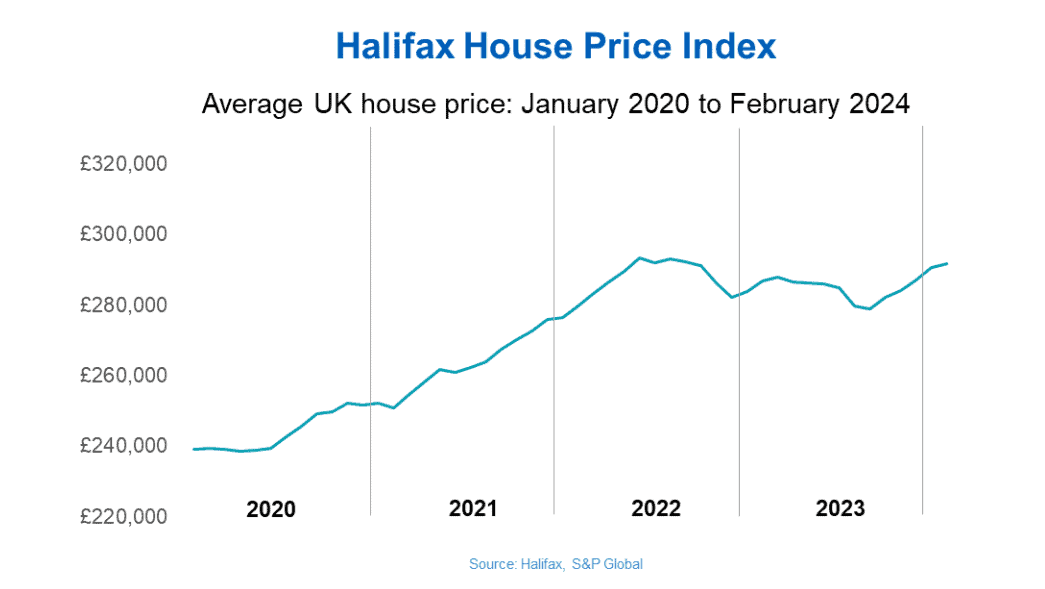

A steady flow of positive price data suggests the worst may be over for the country’s housebuilders. For this reason, I’m considering snapping up more Taylor Wimpey (LSE:TW.) shares for my portfolio.

Just this week, Halifax said that average home values rose 0.4% month on month in February, to £291,699. This was the fifth consecutive rise, and reflects a steady improvement in mortgage costs since the end of last year.

A series of encouraging updates from across the building sector has echoed these improving conditions. Taylor Wimpey’s weekly net private sales rate per outlet was at 0.67 between 1 January and the end of February, it announced last week. This was up from 0.62 in the same 2023 period.

Cancellation rates also dropped 5% year on year, to 12%.

The UK housing market isn’t out of the woods just yet, however, and not just because of the struggling UK economy. Home loan rates are also edging higher again as swap rates have increased.

But the market’s continued improvement — allied with Taylor Wimpey’s 6.7% dividend yield — suggest now could be a good time to increase my stake in this highly cyclical share.

On the other hand, I already have decent exposure to the housing sector through additional holdings in Persimmon and Barratt Developments. I’ll carefully consider building my exposure in the coming days.

Another top FTSE stock

Packaging manufacturer DS Smith (LSE:SMDS) is another economically sensitive share I hold in my Stocks and Shares ISA. But positive news here in recent days suggests now could be a time to increase my stake.

Like-for-like corrugated box volumes for the firm’s November-February quarter matched the previous year’s levels, the business has just announced. This marked a healthy improvement from the prior six months when volumes dropped 4.7%.

I’m also attracted by the excellent all-round value of DS Smith’s shares. It trades on a rock-bottom price-to-earnings (P/E) ratio of 9.9 times, below the FTSE 100 average of 10.5 times.

As an added bonus, the business also offers significantly higher dividend yields than the Footsie and its major competitors. At 5.4% for this financial year, its yield sails above the FTSE 100’s 3.8%. It also beats International Paper‘s 5.1%; Mondi‘s 4%; WestRock‘s 2.6%; and finally Smurfit Kappa‘s 4%.

The packaging industry’s recovery could run out of steam if interest rates remain well above historical norms. But a solid long-term outlook suggests DS Smith shares are still an attractive investment.

Mordor Intelligence thinks the global packaging market will grow at an annualised rate of nearly 4% between now and 2029. And it is likely to continue expanding strongly beyond this point as the e-commerce and food retail segments steadily expand.