Despite the company announcing strong earnings in 2023, the Admiral (LSE:ADM) share price is largely unmoved. But with a price-to-earnings (P/E) ratio of 24, is the stock still expensive?

In my view, Admiral is one of the best UK insurance stocks on the market. For investors with a long-term approach, I think it’s worth considering at today’s prices.

Earnings

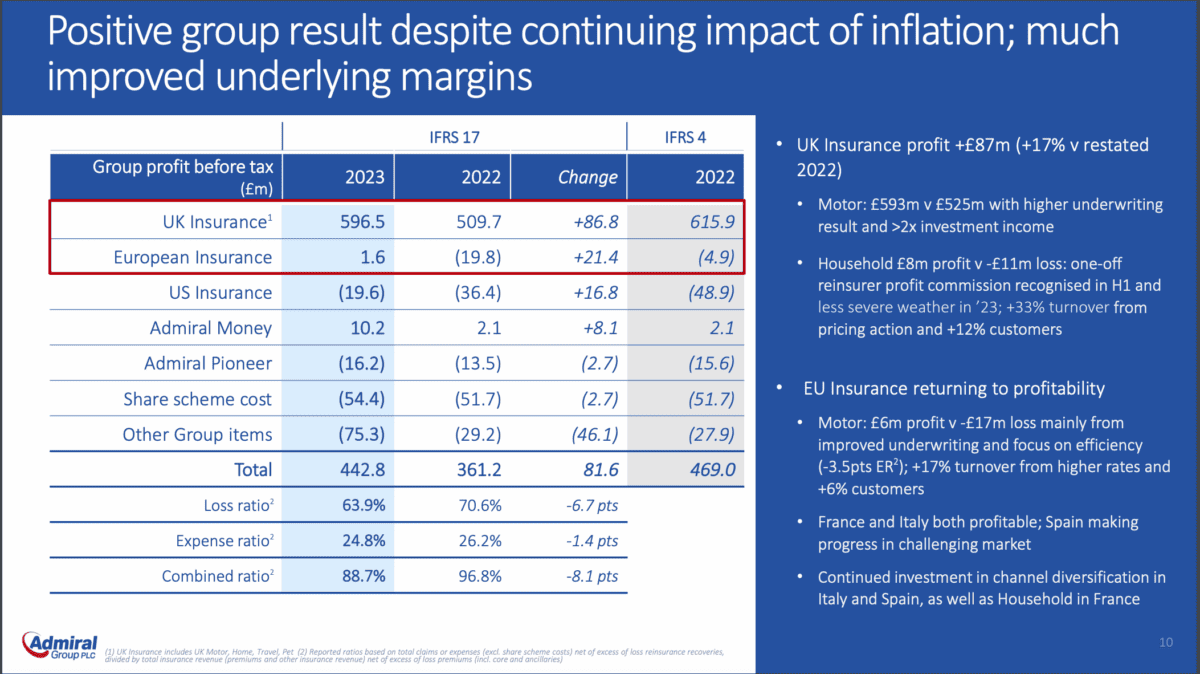

Admiral’s earnings report from 2023 is full of impressive numbers. Turnover was up 31%, operating income increased by 23% and earnings per share grew 16%.

None of these, though, is the main number that stood out to me from the report. In my view, the biggest highlight was the company’s combined ratio falling from 96.8% to 88.7%.

In this context, a lower number is a good thing. The combined ratio measures how much of an insurer’s premiums it pays away in costs and claims.

A declining combined ratio, therefore, means Admiral’s underwriting is becoming more profitable. And this is clearly a good thing for investors.

Improved trading conditions

Admiral also benefitted from an improving macroeconomic environment, especially late in the year. Specifically, lower inflation provided a boost to the company’s margins.

Lower residual car values helped decrease the rate at which replacement costs rise. And if the Bank of England sticks to its plan to bring down inflation, I think the outlook for 2024 is also positive.

One of the advantages of the car insurance industry over the life insurance industry is that policies typically only last a year or so. This allows insurers to adapt quickly to changes in conditions.

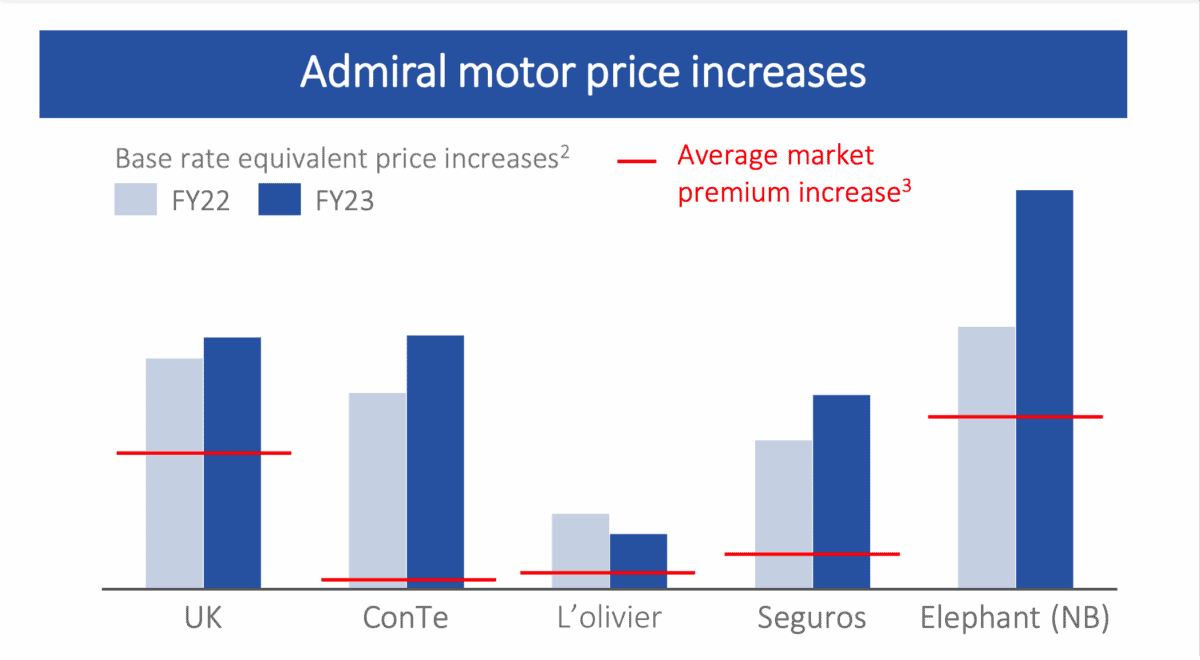

Admiral managed to outperform its peers in this area, too. During 2023, it managed to increase its prices by more than its rivals, while adding more customers.

A stock to consider buying?

One of the risks with Admiral is that it operates in an industry where switching costs are low. When the time comes to renew, customers have little incentive to stick with their current provider.

The danger is that this can lead to irrational competition. Even if rivals make a mistake and price policies too low, this could still lead to the company’s customer numbers falling.

One reason I prefer Admiral to other UK insurers, though, is that its telematics initiatives help it price policies more accurately. And the company has a big lead in this area.

That’s why I think Admiral shares are worth considering for investors. The company has come through a difficult trading period and I think it can do well going forward.

The investment case

Put simply, the investment case for Admiral consists of two points. The first is that it provides a product people need and the second is that it does it more efficiently than its rivals, in my opinion.

Together, I think that adds up to a powerful case. Profits might fluctuate from year to year, but I’m looking at this as a stock to own in my portfolio for the long term and the shares are firmly on my watchlist.