NIO (NYSE:NIO) stock can be very volatile. That certainly makes it interesting for traders, but not necessarily for investors. After all, as investors, we’re looking for companies with strong fundamentals and attractive valuations, instead of betting on market sentiment and momentum indicators.

During the pandemic, NIO stock traded as high as $62.8. As such, the stock is down 90% from its high. A $1,000 investment back on 8 February 2021 would now be worth less than $100. The stock is also down 42% over the past 12 months.

The question is, are we looking at an opportunity to invest, or a value trap?

Metrics

The best way to understand whether a company is overvalued or undervalued is by looking at its metrics. However, we need to start by recognising that NIO is not profit-making. That means we can’t use earnings metrics to value this stock. Originally, NIO said it would turn its first profit in 2024/2025. However, analysts don’t expect that to happen now until 2026.

| 2023 actual | 2024 | 2025 | |

| Earnings per share (CNY) | -10.87 | -6.09 | -3.43 |

The figures here for 2024 and 2025 are estimates, and as NIO missed estimates again for the last quarter, it’s likely analysts will revise their estimates downwards for 2024 and 2025, especially given slowing electric vehicle (EV) sales across the Chinese market.

Underperforming

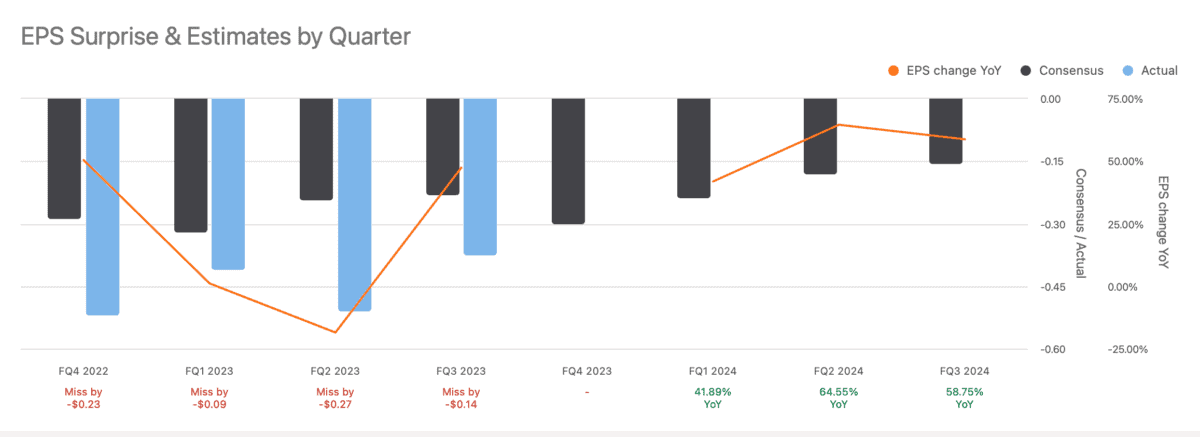

The latest quarterly and annual results were published on 5 March, and investors weren’t impressed. As we can see below, NIO has continually underperformed analysts’ expectations over the past 12 months. There are few worse signals than this.

The company missed earnings expectations by ¢14, while beating revenue forecasts by $70m. There were some additional positives in that the vehicle margin was 11.9% in the fourth quarter of 2023, compared with 6.8% in fourth quarter of 2022. NIO’s margins had plummeted in 2022 amid pricing pressure from peers and as the company looked to shift older stock.

Down and out?

NIO has over $6bn in cash reserves. So while it lost over $600m in the previous quarter, at this burn rate it won’t run short on cash for another 10 quarters. That’s clearly a positive.

However, one risk may be NIO’s intention to open over 1,000 battery-swapping stations over the next year. Each station will cost is estimated $420,000, adding further pressure to NIO’s capacity to swallow losses.

In short, there’s a lot of talk and conjecture about NIO’s future among analysts. Many just don’t see a future, and others see it surging. In fact, the gap between the highest and lowest share price target is 232%.

Personally, I find NIO really interesting. It’s got a great range of vehicles, and uses unique battery-swapping technology that’s currently far quicker than conventional charging.

The problem is, it’s been underperforming and the EV market is getting more crowded while momentum is slowing. Personally, I don’t see it as a bargain now, and there are clear risks that NIO may never turn things around.