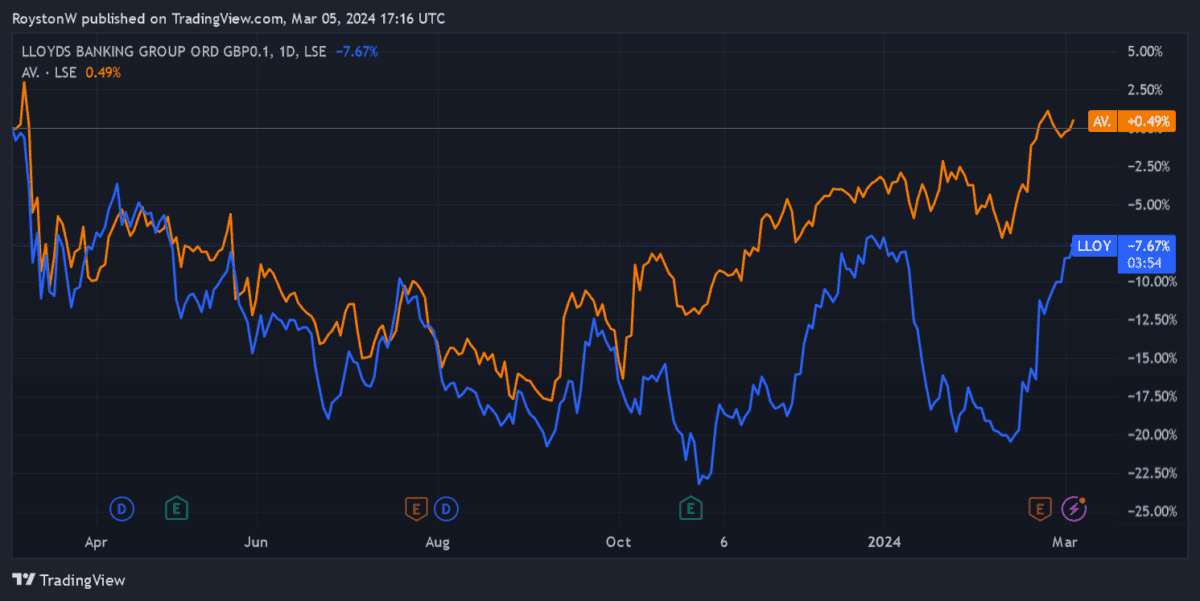

Lloyds Bank (LSE:LLOY) and Aviva (LSE:AV.) shares look like brilliant bargains at current prices.

But which is the better value stock for me to buy today? I’ll be using three key measures to assess this: the price-to-earnings (P/E) ratio; the price-to-book (P/B) ratio; and the dividend yield.

P/E ratio

Largely speaking, UK shares currently look attractively priced from an historical perspective. The FTSE 100 currently boasts an average forward P/E ratio of 10.5 times. This is well below the traditional average around 16 times.

That said, Aviva shares don’t look massively cheap today. Its earnings multiple for 2024 sits at 10.9 times, just above today’s Footsie average.

Lloyds shares, on the other hand, look far more attractive on this metric. They trade on a multiple of 8 times, some distance below that of the life insurer and the broader index.

Aviva 0: Lloyds 1

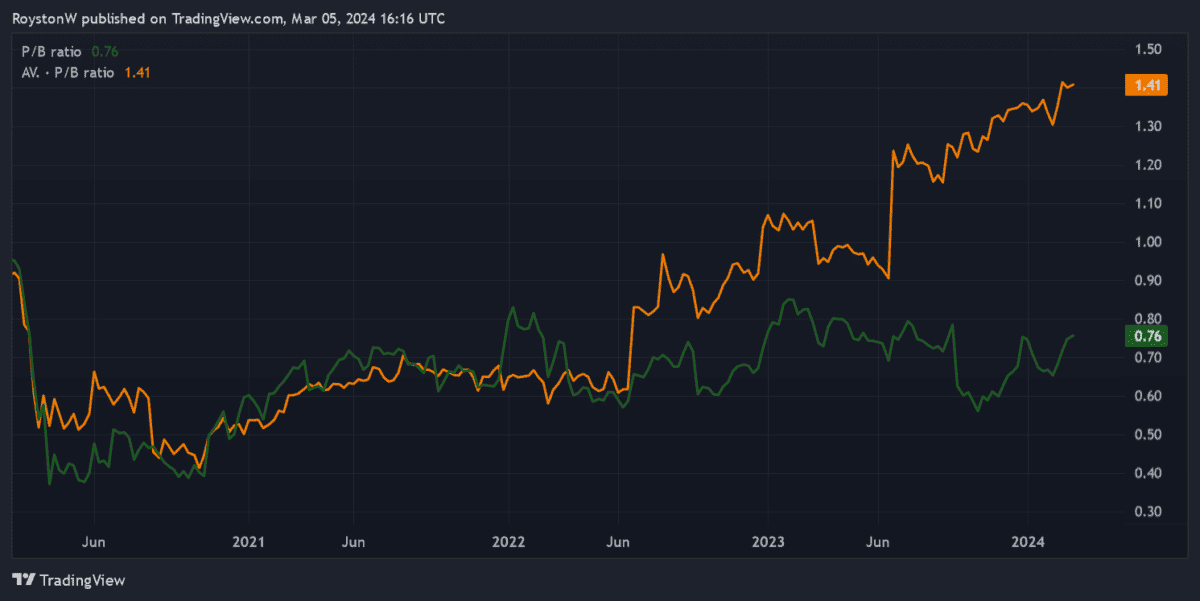

P/B ratio

Next we’ll look at how both shares look relative to the value of their assets. Their readings can be seen in the chart below:

As you can see, Lloyds carries a P/B ratio of 0.76. This falls well below Aviva’s reading of 1.41. And, critically, this falls below the threshold of 1 that indicates a share is undervalued.

Aviva 0: Lloyds 2

Dividend yield

Both Footsie companies have strong records of delivering above-average dividends. The regular premiums it collects allows Aviva to pay consistently large rewards to its customers. Lloyds meanwhile, can do the same thanks to the interest it receives on the loans it supplies.

The forward dividend yields for both shares beat the FTSE average of 3.8%. However, Aviva’s reading of 7.9% tops Lloyds’ corresponding figure of 6.4%.

While dividends are never guaranteed, both businesses look in good shape to make good on these forecasts. Lloyds has strong dividend cover (1.9 times) for 2024, while it also has a strong balance sheet (CET1 capital ratio stood at 13.7% as of December).

Aviva is also cash rich and boasted a Solvency II ratio of 202% at the mid-point of 2023. Its dividend cover sits back at 1.2 times though, I still expect it to meet current forecasts.

Aviva 1: Lloyds 2

The verdict

Based on the metrics discussed, Lloyds shares top those of Aviva in the value stakes. In fact, it may look like a slam dunk buy given its cheapness relative to the life insurance giant and the broader FTSE 100.

But I’d be reluctant to buy the Black Horse Bank for my portfolio today. Both companies face significant risks as the UK economy struggles and competition heats up in their marketplaces. But Lloyds faces a greater struggle to grow earnings in the future, in my opinion.

And the market agrees with my take, hence its lower valuation.

I actually believe that Aviva’s profits could rise strongly in the years ahead. Like many other protection and retirement product specialists, revenues could rip higher as Britain’s elderly population rapidly grows.

Furthermore, the company — unlike Lloyds — has a significant presence in overseas markets that could help it grow earnings, even if conditions in the UK remain tough.

While Lloyds looks like better value, I’d much rather buy more Aviva shares right now.