I’m building a portfolio of formidable FTSE 100 shares in my Stocks and Shares ISA. Here’s one I think could help me eventually retire in comfort.

Investing in FTSE 100 shares has proven a lucrative investment strategy for a great many investors. Since its inception in the mid-1980s, the UK’s leading share index has delivered an average annual return of 7.5%.

This is far better than the return cash accounts have provided over that period. And it shows that investors don’t need to invest in high-risk securities like cryptocurrencies to build wealth either. It’s why I’ve invested heavily in UK blue-chip companies.

However, I’m not limiting my shopping list to Footsie shares. My portfolio is also packed with FTSE 250 shares that could provide a tasty blend of capital gains and passive income.

It’s a plan that could take my wealth to the next level if history repeats itself. The FTSE 250 has delivered an even better average yearly return of 11% since the early 1990s.

A BIG passive income

Of course past performance is no guarantee of future returns. But let me show you the sort of money I could make if these two UK share indices retain their impressive records.

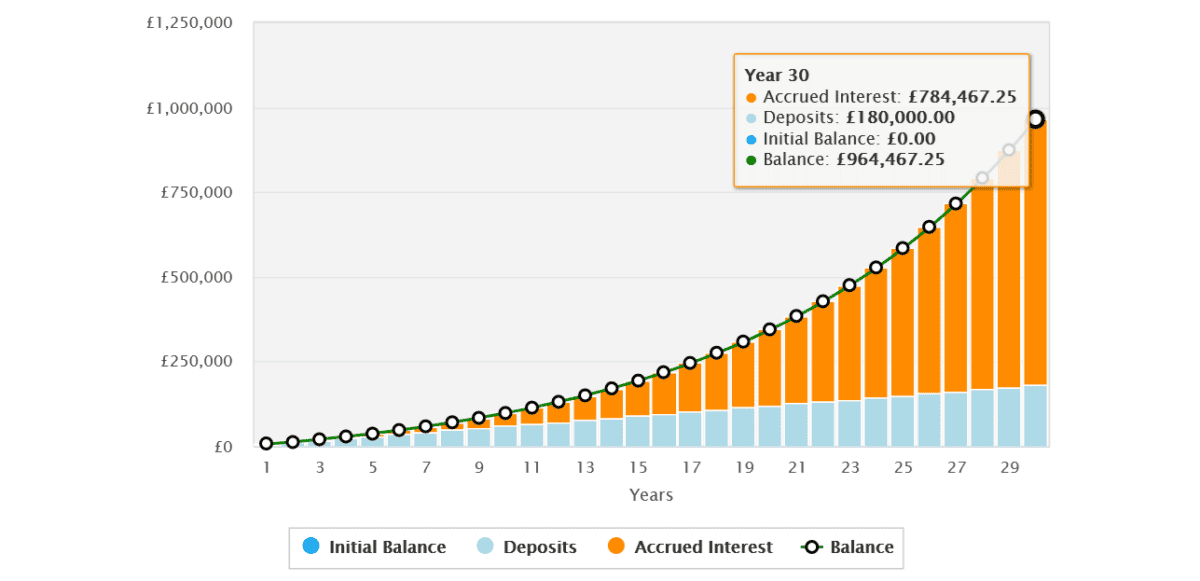

We’ll say that I aim to invest equally across FTSE 100 and FTSE 250 shares. We’ll also assume I have £500 to invest each month, I reinvest any dividends I receive, and I don’t touch my hard-earned gains for 30 years.

Based on this criteria, I could make a life-changing £964,467. And if I then decide to take 4% of this amount a year as passive income, I’d have a juicy £38,579 to retire on.

A top FTSE 100 stock

One way I could hit these figures would be by buying one or two tracker funds. The iShares 350 UK Equity Index Fund for instance tracks the performance of both FTSE 100 and FTSE 250 shares.

Alternatively, I could try to achieve market-beating returns by buying individual stocks. This is a path I’ve preferred to go down. And I’ve loaded my Stocks and Shares ISA with stable growth and dividend stocks along with riskier shares to hit this goal.

BAE Systems (LSE:BA.) is one ultra-robust Footsie firm I’d buy today. Its shares have rocketed since 2022 following the start of the war in Ukraine. I’m tipping them to continue rising too, as nations embark on a long rearmament process.

Countries across North America and Europe are hiking arms spending in response to the growing budgets of China and Russia. It’s a cycle that’s likely to drag on — Beijing announced plans to raise defence expenditure by 7.2% this year — and in the process drive business at major Western defence contractors like BAE Systems.

Orders here jumped to a record of £37.7bn in 2023 against this supportive backdrop. And this in turn pushed its order backlog to an all-time high of £69.8bn.

Although project execution problems are a constant risk that could dent earnings, I still think the potential benefits of owning BAE Systems shares outweigh these dangers. It’s why I’ll be looking to add the company to my ISA when I next have cash to invest.