I believe that a Stocks and Shares ISA is one of the best tools I can have in my arsenal. Over my lifetime, it can save me hundreds of thousands of pounds when I come to sell my investments if I’ve held them long enough.

All of my investments are in an ISA, and here’s what I think is a new no-brainer buy for me. I’ve decided it’s going to be my latest addition.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

Making money while I sleep

ResMed (NYSE:RMD) is the company I’ve found. My analysis of it sees great growth and profitability but with a moderate risk in its valuation.

The company helps people in more than 140 countries sleep healthily if they’re dealing with sleep apnoea.

Its operations can be broken down in to sleep and respiratory care that’s 88% of revenue and software that’s 12% of revenue.

Comparing the stock to its US benchmark, the S&P 500, we can see how I expect to make substantial money in my sleep from this one while also doing good in the world.

On average, ResMed has grown in price by 30% per year since 2014. The S&P 500 has gained just 17% annually on average over the same time frame.

Here’s what sold me

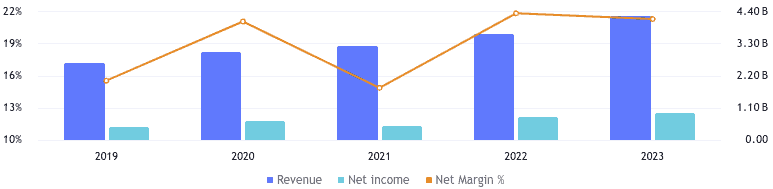

The company has excellent margins, with a net margin in the top 13% of businesses in its industry. Also, its revenues have been growing at a strong 12%, and its earnings have been growing at 15% a year on average over the last three years.

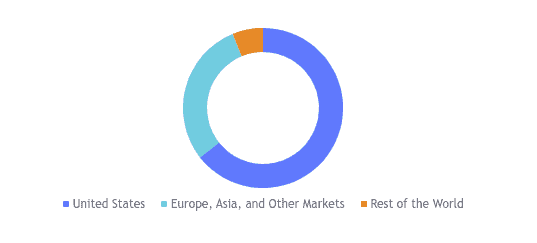

Also, I like the fact that the business is diversified across Europe, Asia, and other markets. That means I’m protected if there’s an economic downturn that primarily hits the US.

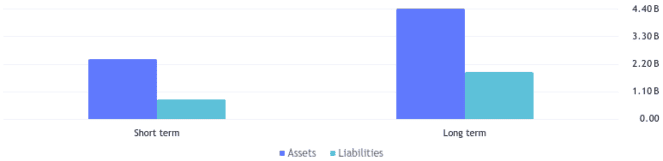

The company does have quite a lot of debt for its industry, but the balance sheet looks healthy enough overall for me. It has more equity than liabilities, which is a good sign, I feel.

Understanding the value

Considering the shares are down over 40% from their all-time high right now, it’s tempting for me to think I’m getting a good deal. However, it’s not that simple.

The shares have a price-to-earnings ratio of around 25 right now. That’s quite high considering the price has dropped so significantly recently.

What this means is that while the investment might be ‘on sale’, it’s still selling at a risky premium to what’s normal in its industry. But I’m not surprised by that, considering its stellar results.

The risks are worth it to me

Also, I’ve seen evidence that the company could be getting less efficient. Its assets are growing at a faster rate than its revenues, and this means the firm isn’t managing to get the same value out of its investments as it was in the past. That can be an indicator of a slower-growth future to come.

However, I love the shares, and I think the pros outweigh the cons. Even at such a high price, I believe the firm has a strong future ahead of it and is managed well. So, I’ll be a shareholder this month.