Two FTSE shares I’m holding have been dipping for a while now, so I’m evaluating my position.

I know that long-term investing requires patience and resilience, particularly during market dips. Sometimes you just have to hold tight and weather the storm to see sunny skies again. Company share prices often trade down for years before making a spectacular recovery and outperforming the market.

Of course, every now and again a company doesn’t recover and investors are left empty-handed. This makes me wonder — should I cut my losses or wait for a recovery?

Let’s see what the charts say.

Not so healthy now

Health and hygiene retailer Reckitt Benckiser Group (LSE:RKT) released its full-year 2023 earnings last week. Unfortunately, results were disappointing.

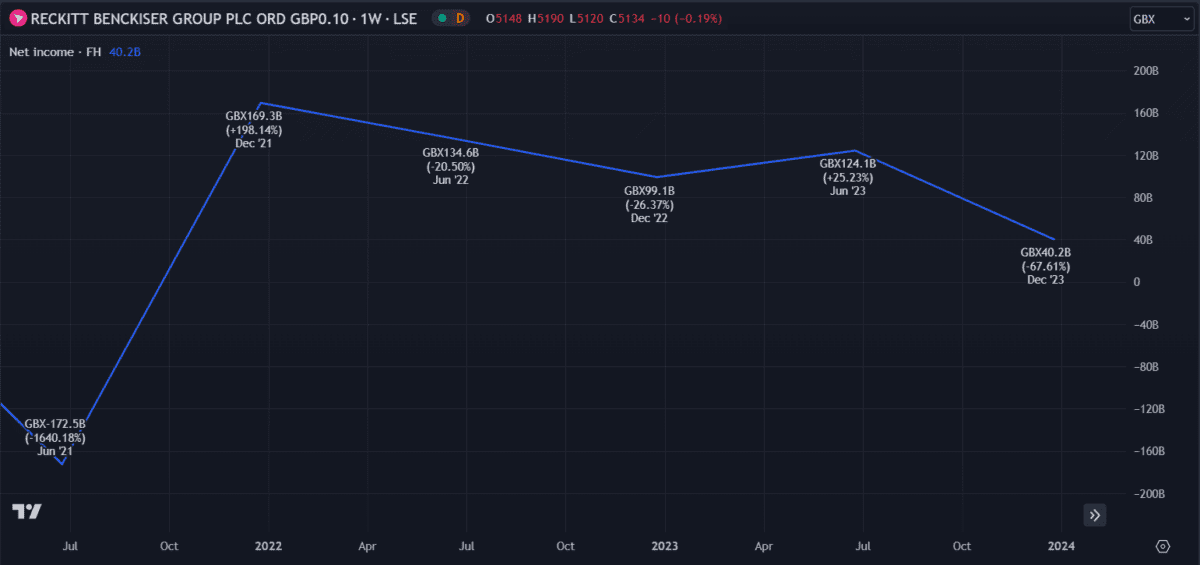

The report revealed a net income reduction of 30%, with profit margins down 11%.

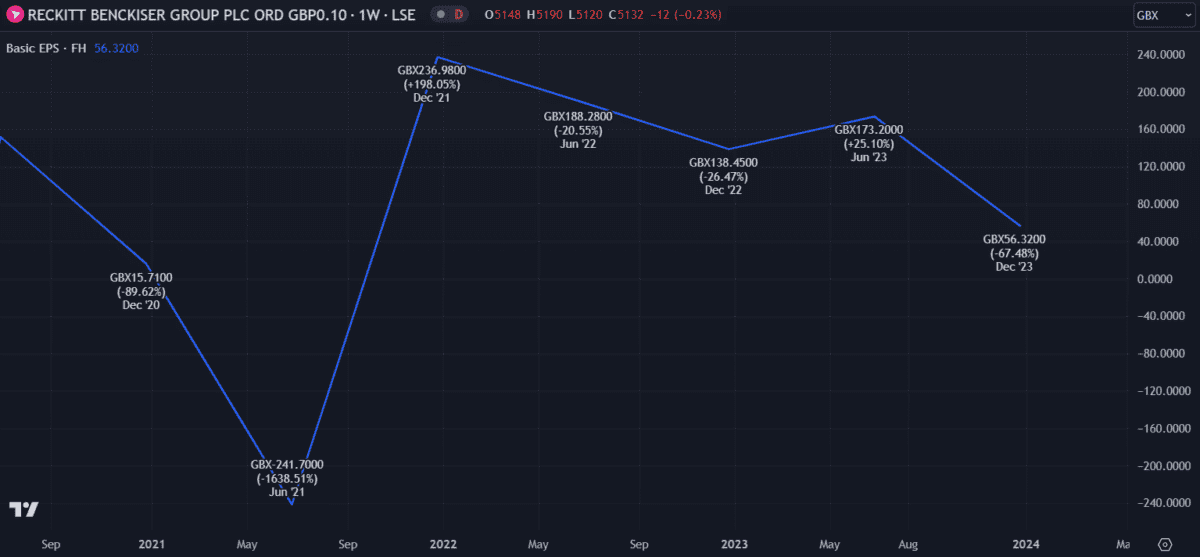

If that wasn’t bad enough, earnings per share (EPS) are down from £3.27 to £2.28 — 31% below analyst estimates.

That’s a direct indication that my shares are now less valuable to the company than before.

I had high hopes for Reckitt Benckiser but the past few months have proven tough. This latest earnings report has really pushed me to question my investment.

What might sway my opinion?

Well, Reckitt is a long-standing company that has operated successfully for over 200 years. It’s unlikely this market dip will spell the end for it. It also sports a decent and reliable 3.7% dividend yield so I’m still getting returns even with price depreciation.

I honestly like the company — I like the business model and its products. But emotion is not a good reason to remain invested.

For now I’ll hold out with Reckitt and monitor the coming months — but my finger is hovering near the sell button.

Digging deeper

Not long ago, I’d have thought mining firm Glencore (LSE:GLEN) was one of the most promising FTSE shares in my portfolio.

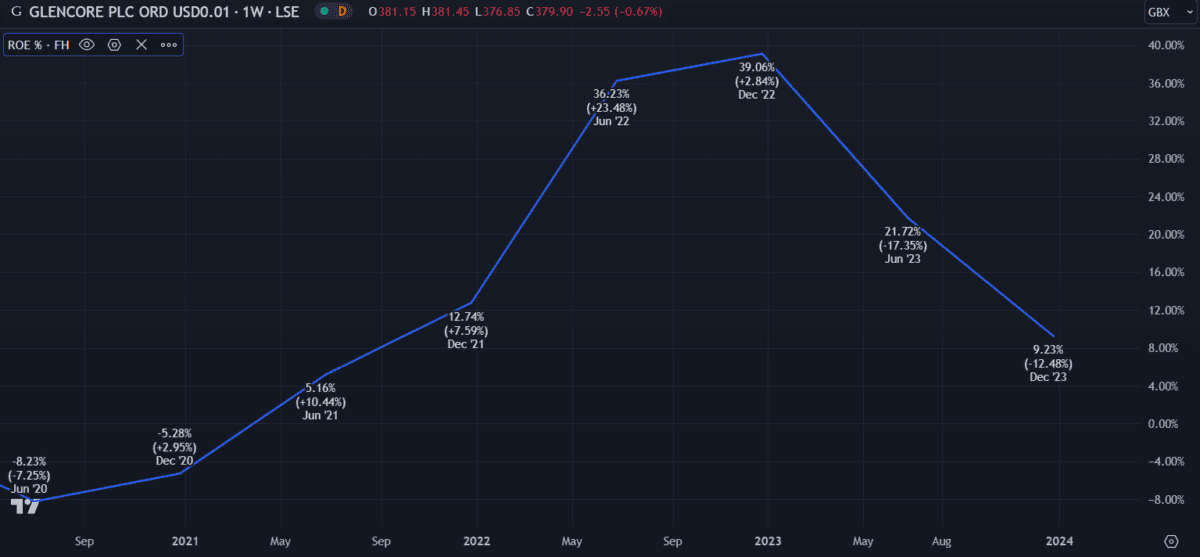

Now the stock is down 19% this year with little sign of recovery on the horizon. Return on equity (ROE) has fallen from 39% in late 2022 to 9.2%. Analysts expect it to remain below 9% in the coming three years.

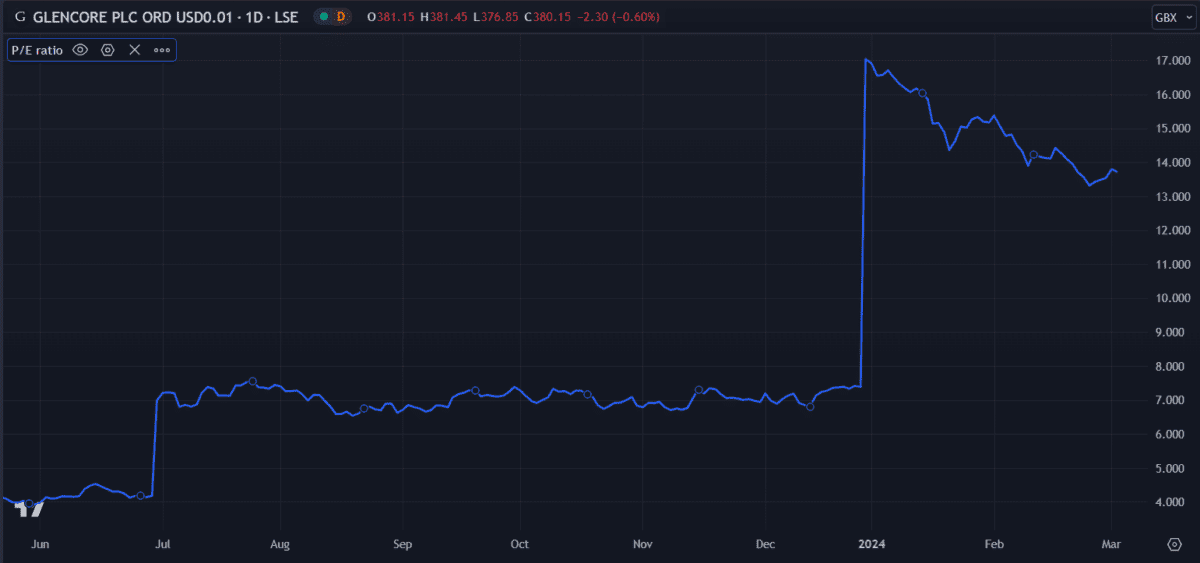

Now at 13.7, Glencore’s price-to-earnings (P/E) ratio has increased significantly in the past year. It was as low as four in mid-2023 but shot up in early 2024 to 17. During the same period, the share price fell from around 480p to 380p.

What could sway my opinion?

Glencore recently opened a new nickel mine at it’s Raglan Mine in Nunavik, Canada. If reports are accurate, the new opening promises 20 years of further production for the Raglan operation.

Founded in 1974, Glencore is a relatively new company. A confident 20-year forecast seems optimistic for a 50-year-old firm. However, analysts appear to be onboard. The average forecast estimates a price of 485p for Glencore in the coming 12 months — a 26% increase from current levels.

Admittedly, this price dip is nothing compared the 80% loss made 2015, from which Glencore made a full recovery by 2017. Although recent performance is concerning, mining is not an industry likely to go anywhere soon.

For now I’ll put my trust in the company’s new mining ventures and re-evaluate my position in Q2.