My investment strategy puts dividend-paying shares as a fundamental element of my retirement strategy. Passive income means money in my pockets that can help me pay my bills.

The trick I’ve learned that’s paramount is to choose investments that aren’t high risk. That’s especially important during my older years.

A high dividend yield but a falling share price is essentially worthless to me. It’s common to find high dividends and an unstable share price or a growing share price and low dividends. However, it’s rare that I find a company offering both.

Luckily, IG Group (LSE:IGG) seems to be a pretty good choice for me to get the best of both worlds. That’s because it’s risen 490% since 2005 and has high dividend payments.

Company overview

The organisation is a worldwide online trading and investments provider, with services ranging across forex, shares, indexes, commodities, and more.

The business model relies on contracts for difference (CFDs) and spread betting services. These financial products offer speculations on price movements in financial markets without needing to own the underlying asset.

IG also offers traditional share dealing services, with clients buying and selling full shares. Also, it operates a range of trading platforms.

At present, it is focusing on technological innovation and entering new markets, as its clients are limited mainly to Britain, Europe, and Australia at this time.

Potential rewards

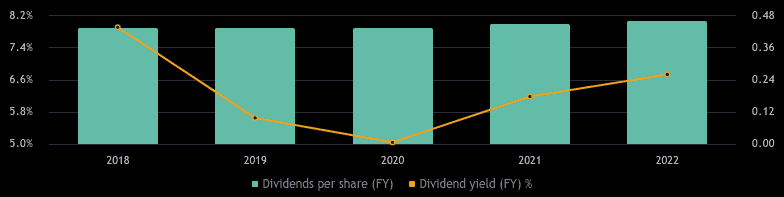

While the dividend yield of 6.4% at the moment is very high, I wanted to take a look to see if this is common for the firm or more of a rarity. I found out it has some volatility in yield but very stable payments overall:

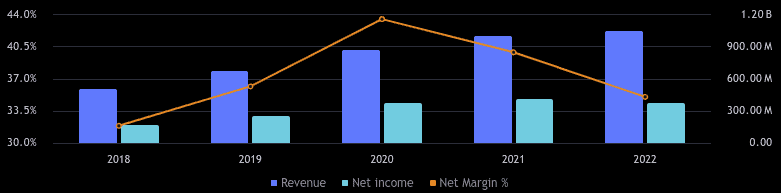

Additionally, I wanted to know how profitable the business might be, so I tracked its net income margin from 2018 to 2022. I found out that it has been somewhat less profitable recently than over its history. However, all in all, its net margin ranks in the top 25% of companies in the capital markets sector.

Critical risks

By scanning over IG Group’s risk management objectives it outlines four major areas of concern:

- Regulatory risks

- Commercial risks

- Business model risks

- Conduct and operational risks

Of these four, I think its regulatory and business model risks could cause the most immediate and probable negative effects on the firm.

A significant amount of money, including legal fees, will need to be spent by IG Group in managing the complex, internationally shifting rules surrounding its leverage products and client money protection. Any breakdown of its protocol could cause hefty fines or suspension in areas of its operation.

Additionally, its business model suffers when clients fail to pay the money they owe, and if IG Group is unable to meet its financial obligations when they are due, its balance sheet and growth could suffer.

Watching carefully

I don’t own a stake in this company yet, but it’s certainly way up there on my watchlist for a later time when I want to focus more on dividends than growth.

I consider an investment like this a rare find indeed, with minimal risks in its financials if it continues to operate effectively according to its risk management framework.