Cars that accelerate fast can often lose speed quickly too. That is true of luxury vehicle marque Aston Martin (LSE: AML) — and its stock market performance. Since July, the Aston Martin share price has more than halved.

Over a longer term view, things look even worse.

From its 2018 listing to now, the Aston Martin share price has collapsed by 93%.

But the company has a well-heeled customer base, high selling prices, and legendary brand. Its results this week showed revenues last year grew 18%, on wholesale volumes up 3%.

So not only are sales volumes growing (albeit fairly modestly), the company’s pricing power is enabling it to increase revenues faster than volumes.

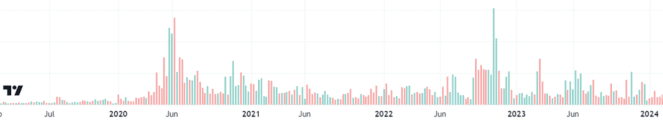

The shares continue to attract a lot of attention from investors, as trading volumes show.

Should I invest?

Valuation concerns

My answer, quite simply, is no.

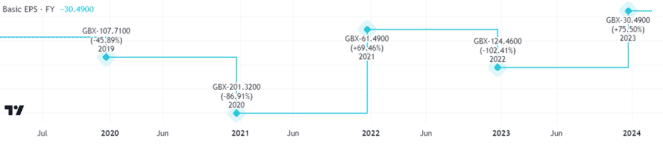

Although it has great assets, I do not like the business performance. It continues to be heavily loss-making as shown by its track record of negative earnings per share.

The loss before tax last year more than halved. That is progress in the right direction. But it was still £240m, which is a sizeable amount.

Nor can that just be put down to the cost of servicing the company’s costly debt pile. Even at the operating level (before such financial costs are factored in), the company recorded a loss of £111m.

Meanwhile, net debt last year actually went in the wrong direction. It grew by 6% and ended the year at £814m.

Servicing such a balance sheet is costly. The company paid over £2m per week on average in net cash interest payments.

Why I am not investing

The dramatic long-term decline in the Aston Martin share price may look scary. Then again, it could seem like a buying opportunity. After all, past performance is not necessarily an indication of what will happen in future. In some ways, the business currently has momentum.

But what puts me right off investing is the company’s financial performance. It continues to lose money and has a large debt load. For now that needs to be serviced, eating into cashflows. Longer term it will need to be paid off at some point.

The company is targeting “sustainably positive” free cash flow for 2027/28. Last year, though, free cash outflow was £360m, even more than the prior year’s £299m. In other words, nearly a million pounds a day more in cash is going out the door at Aston Martin than is coming in.

Can management fix the economics?

Possibly they can, by growing revenues, reducing costs, and reducing or eliminating the debt. That is a lot to do, however, and for now I reckon the indicators of progress are mixed. Losses and debt remain substantial. I have no plans to invest.