Dividends are never, ever guaranteed. Even the most stable, financilly-robust FTSE 100 and FTSE 250 shares can reduce or axe dividends when crises emerge. The widescale toppling of dividends during the Covid-19 crisis is a recent example of how investors’ passive income can unexpectedly plunge.

That said, buying UK shares has proven a great way to make a second income from a long term perspective. Investing in companies with strong balance sheets, competitive advantages (like winning brands and low cost bases), and multiple revenue streams can be a winning strategy.

The following FTSE 100 and FTSE 250 shares have great records of delivering dividend income. Here’s why I’m hoping to buy them when I next have spare cash to invest.

Assura

Real estate investment trusts (REITs) like Assura (LSE:AGR) can be a great source of passive income. This is thanks to rules that require at least 90% of annual rental profits to be distributed by way of dividends.

I’m a fan of this REIT in particular due to its focus on the stable healthcare market. Operators of medical facilities like this can expect rent collections to remain stable at all points of the economic cycle.

Furthermore, the rental income Assura charges is guaranteed by government bodies. This means that the chances of recording rent defaults sits at slim to none.

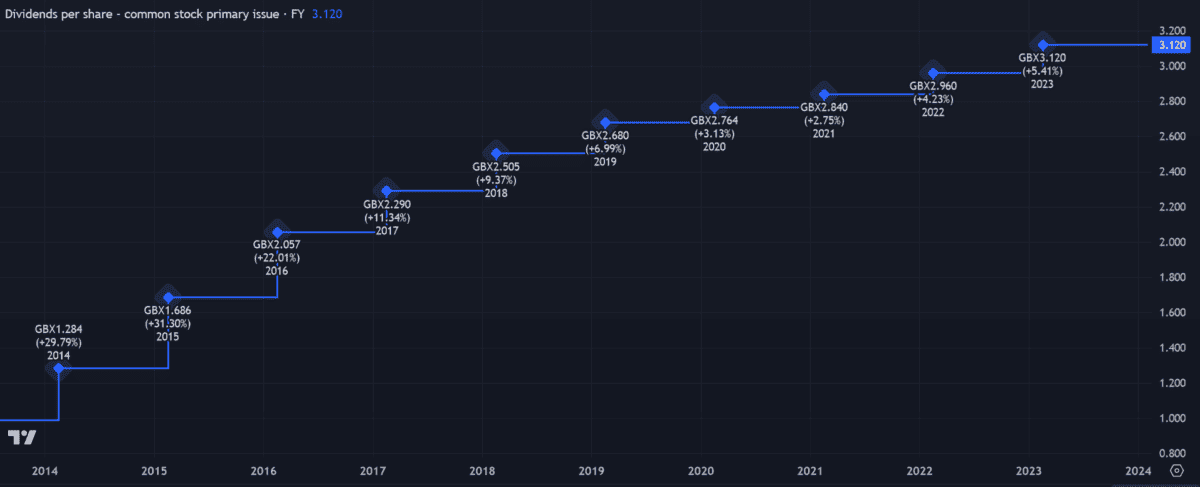

All of these defensive qualities have underpinned a long record of unbroken dividend growth, as the chart above shows. I’m expecting profits and shareholder payouts to continue climbing too, as the UK’s rising elderly population boosts healthcare demand.

Profits at the FTSE 250 firm may be impacted by changes to NHS policy. But for now, the outlook remains encouraging as governments demand greater use of primary healthcare premises to relieve the pressure on jam-packed hospitals.

Oh, and one final thing, today Assura’s forward dividend yield sits at a brilliant 7.6%.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

BAE Systems

Defence giant BAE Systems (LSE:BA.) doesn’t have the same show-stopping dividend yields as Assura. For 2024, its forward figure sits at a solid-if-unspectacular 2.6%.

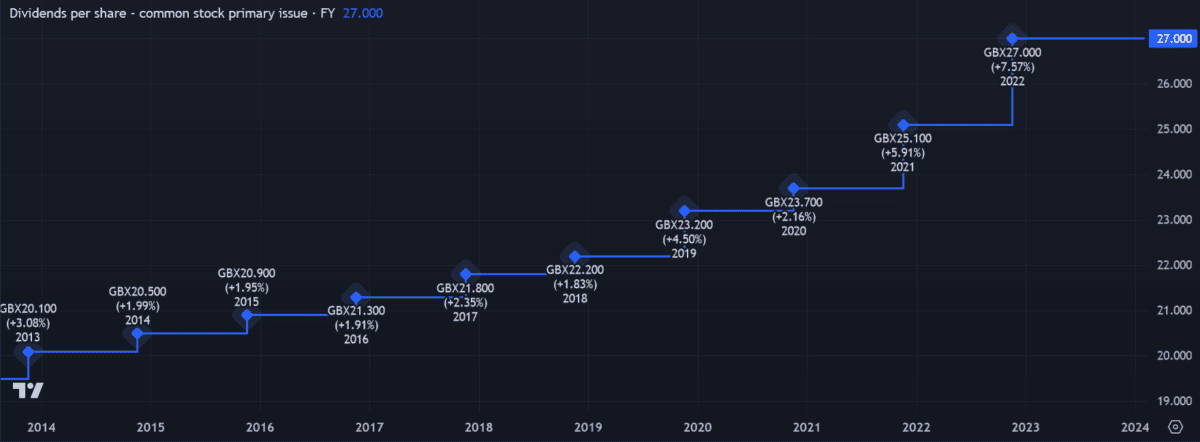

But its reputation as a reliable dividend grower still makes it an exceptional buy, in my opinion. Its strong record of payout growth is shown below.

The FTSE 100 firm’s operations are very capital intensive. Making submarines, tanks and other critical mission hardware doesn’t come cheap. And this poses a threat to dividends going forward.

That said, BAE Systems is highly cash generative, which still helps it to pay decent and growing dividends despite those big costs. It also operates in a very defensive sector, meaning its ability to report stable profits — a critical requirement for the best dividend stocks — remains unchanged regardless of economic conditions.

I think now could is a great time to buy BAE Systems shares too, as global defence budgets move higher. The company’s record order backlog of £69.8bn at the end of 2023 reflects the strength of industry conditions today.