By investing £20,000 in UK shares, I think I could get into a position where I never have to worry about petrol costs again. That sounds like an enticing prospect to me.

The idea is that I’d be able to earn more in passive income than I spend on petrol. And with interest rates at multi-year highs, I think there are some great opportunities.

Petrol

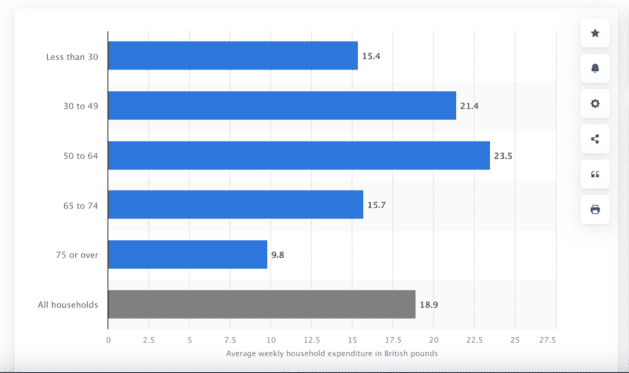

On average, I spend around £80 per month on petrol. According to Statista, that puts me slightly below the average for my (30-49) age bracket, but roughly in line with the national average.

Average weekly fuel expenditure per week in GBP by age group

Earning £80 per month – or £960 per year – with a £20,000 investment would mean a dividend yield of 4.8%. And various UK stocks currently offer that return.

One thing to keep in mind before getting into the details of stocks to buy is the tax implications. From April, the threshold for dividend tax is set to fall from £1,000 to £500 per year.

That’s important for someone aiming at £960 per year in passive income. But this can be avoided by investing using a Stocks and Shares ISA, where dividends and capital gains are exempt from tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

6% dividends

Shares in Dr. Martens (LSE:DOCS) aren’t as cheap as they were at the start of the year. The stock is up around 7% since the beginning of January.

Nonetheless, at today’s prices, the shares come with a 6.1% dividend yield – well above the 4.8% I’d need to aim for. And things appear to be picking up for the underlying business as well.

Management announced recently that earnings are set to be in line with expectations, after numerous profit warnings. That’s a sign the unusual costs the firm has been dealing with are starting to taper off.

An improving environment in the US in terms of inflation is another positive. This has also been an issue for the likes of Burberry, Diageo, and Nike, but it looks like things are starting to improve.

Risks

The biggest risk to my plan is probably inflation, for a couple of reasons. One is that it is likely to make the cost of petrol go up and the other is that it might weigh on margins at Dr. Martens.

I’ve got a plan for limiting both types of risk, though. It involves not putting all my eggs in one basket with a £20,000 investment and buying Dr. Martens shares as part of a diversified investment portfolio.

In general, equities offer a natural protection against inflation – share prices tend to go up as the value of cash deteriorates. This should hopefully go some way towards offsetting the rising cost of petrol.

Spreading my investment across various different businesses should also help limit specific risks associated with Dr. Martens. And there are several other UK dividend stocks on my radar right now.

Free petrol

By investing £20,0000 today, I think I could eliminate petrol from my monthly budget permanently. Is that a good deal?

I think it is. Even with interest rates at their current levels, I think UK shares offer better long-term prospects, so this is where I’d look for passive income on an ongoing basis.