Growth stocks are typically all about good long-term increases in earnings rather than dividend payments or value.

Thankfully, I think this company has a pretty good score on all three of those elements, with an emphasis on its growth.

So, let’s take a look at why I’m interested in Computacenter (LSE:CCC), which has risen 277% over the past 10 years. It’s an IT infrastructure company offering a range of products and services to improve customers’ digital capabilities.

Should you invest £1,000 in Town Centre Securities Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Town Centre Securities Plc made the list?

Solid earnings growth

The business is listed in the FTSE 250. And it’s been growing its net income at quite a fast rate over the last decade. I’ve noted its 16% annual earnings growth as an average over 10 years and an even higher 24% as an average over five years.

Basic EPS

Source: TradingView

Analysts also expect the earnings per share (EPS) results to keep on rising from £1.7 as of the last annual report to £1.9 in 2025.

I also find it rare for a company with such high growth to have a low price-to-earnings ratio of just 17. That’s in the best 30% of companies in its industry and is an important indicator of its value.

However, while the future results are forecasted to be good, there’s no guarantee it will perform as expected. Critical shifts in the IT services business could knock Computacenter off course. This is especially true as technology consumers are beginning to prioritize artificial intelligence (AI) operations, which are difficult to stay competitive in.

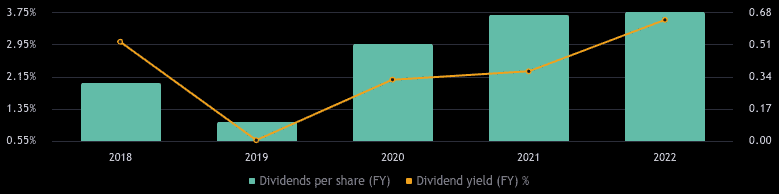

Good dividend, weaker balance sheet

One of the great things about this company is that while it’s high growth, it also pays a dividend. At this time, it yields 2.4% per year. While that’s not big, it still contributes to what I think could make a wonderful investment for me.

However, my number one risk if I invest in Computacenter at this time is its balance sheet. It has more debt than equity on its books.

What this means is that if future conditions worsen, such as its earnings or revenue growth slowing down, and it still needs to invest heavily in technological advancements, like machine learning tools related to AI, the firm might struggle as it will sometimes have to make paying down its debt a priority.

At the moment, the company already has AI operations and machine learning investments. This includes a collaboration with HPE GreenLake to aid it in overcoming barriers to entry into AI markets. For example, there are high security risks and complexity related to large language models like ChatGPT. That stops it from being as involved as it could be without assistance from experts.

Partly, its liabilities have helped it to finance acquisitions it has made. These include Business IT Source and FusionStorm, which have aided its expansion into the US market.

However, it might find purchasing businesses in the future harder if it doesn’t have the free cash flow. That could be a result of its balance sheet weakness.

High up on my buy list

As far as technology companies go in the FTSE 250, Computacenter certainly stands out.

While I’m not in these shares at the moment, I’m going to continue analysing the business, and it’s way up on my watchlist.