I’m hoping to have cash in my pocket in March to buy some FTSE 100 value stocks. I’m searching for companies that both trade on low price-to-earnings (P/E) ratio and boast market-beating dividend yields.

M&G (LSE:MNG) and WPP (LSE:WPP) are two blue-chip companies I’m currently looking at. The cheapness of their shares can be seen below.

| FTSE 100 stock | Forward P/E ratio | Forward dividend yield |

|---|---|---|

| M&G | 10.4 times | 9.1% |

| WPP | 8.5 times | 5% |

Here’s why I’d buy them in my Stocks and Shares ISA next month.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

M&G

Investment specialists like M&G face continued uncertainty right now. For one, financial markets could remain choppy in the current macroeconomic and geopolitical environment. Demand for their services may also remain patchy if high interest rates remain in place and the economy performs poorly.

But I’m still considering buying this FTSE 100 stock for my portfolio. The long-term outlook for companies such as this remains highly encouraging as demographic changes drive demand for wealth and retirement products.

I especially like M&G because of its gigantic dividend yield. This is approaching double-digit percentage territory, with generous broker forecasts supported by the company’s strong balance sheet. Its Solvency II capital ratio stood at a terrific 199% at the midpoint of 2023.

Finally, I’m encouraged by the firm’s ongoing transformation strategy to help it grow profits and support the balance sheet. This includes doubling down on its asset management and wealth divisions to rejuvenate its sagging net inflows of recent years, and focusing on cutting costs across the group.

These measures could help it deliver gigantic dividends for years to come. Of course, dividends are never guaranteed.

WPP

Media stocks like WPP may also remain under pressure in 2024 should the global economy remain under strain. Marketing budgets are one of the first things to suffer when companies scale back spending.

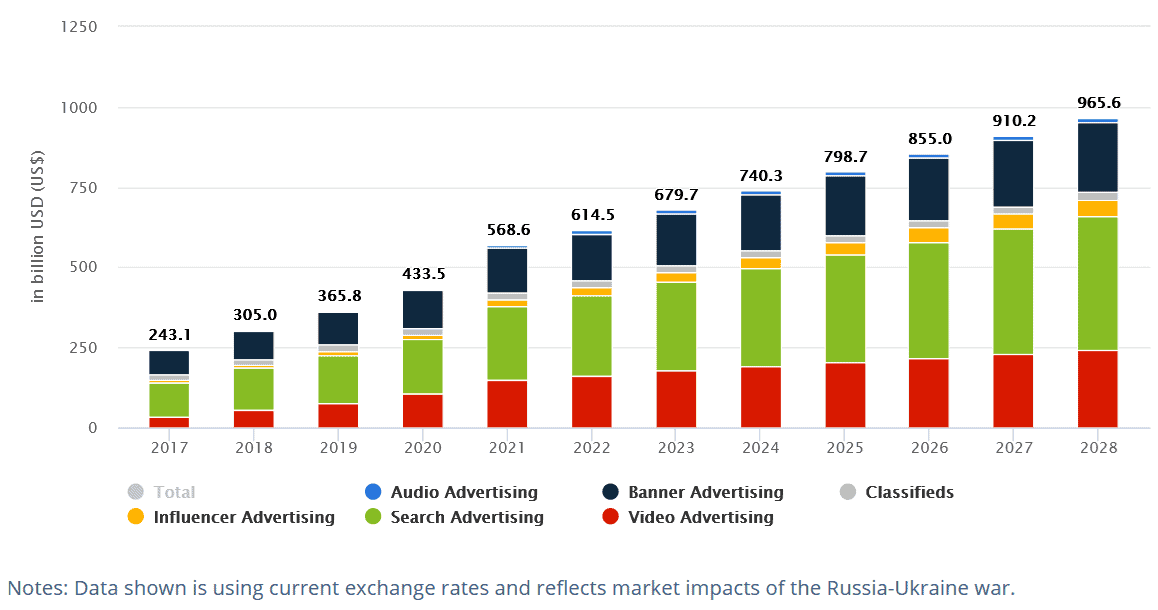

But I believe the FTSE firm’s growing focus on the more resilient digital advertising segment may help it to weather the worst of the storm. As the chart from Statista below shows, digital ad sales are tipped to continue rising strongly this year and all the way through to 2028.

Predicted growth in digital advertising sales

WPP’s heavy investment on the digital side of things appeals to me as a long-term investor. And so does the huge sums it is spending in the field of artificial intelligence (AI). Last month it pledged to spend “around £250m in proprietary technology to support our AI and data strategy” every year.

Debt has crept up at the FTSE 100 firm more recently. But it still looks in good shape to continue growing its strategic and geographic footprint through organic investment and via further acquisitions. This month it it also acquired a minority stake in ‘digital first’ agency OH-SO Digital ahead of its launch in March.

WPP will have to keep paddling hard to succeed in a competitive and changing advertising landscape. But I believe it has the scale, the expertise, and the strategy to thrive. And given the cheapness of its shares, I think it’s a top value stock to buy in March.