The interest rate on UK savings products has picked up in recent times. But the returns I can expect to make from UK shares remains far superior. So I continue to use most of my extra cash each month to buy FTSE 100 stocks in a Stocks and Shares ISA.

Don’t get me wrong: products like the Cash ISA have a place in my investing plan. I use one to hold money for a rainy day or to fund large, upcoming purchases. I also use it to de-risk: after all, I know that £1,000 invested in one today will still be there to draw upon 5, 10, or 30 years from now.

I have no such guarantee by investing in stocks. Share prices can go up as well as down, while listed companies can also go bust.

But with added risk comes extra reward. And history shows me that the return from investing in British businesses can make share investing the best way to make my money work for me. Here I’ll show you how.

A £538K+ nest egg

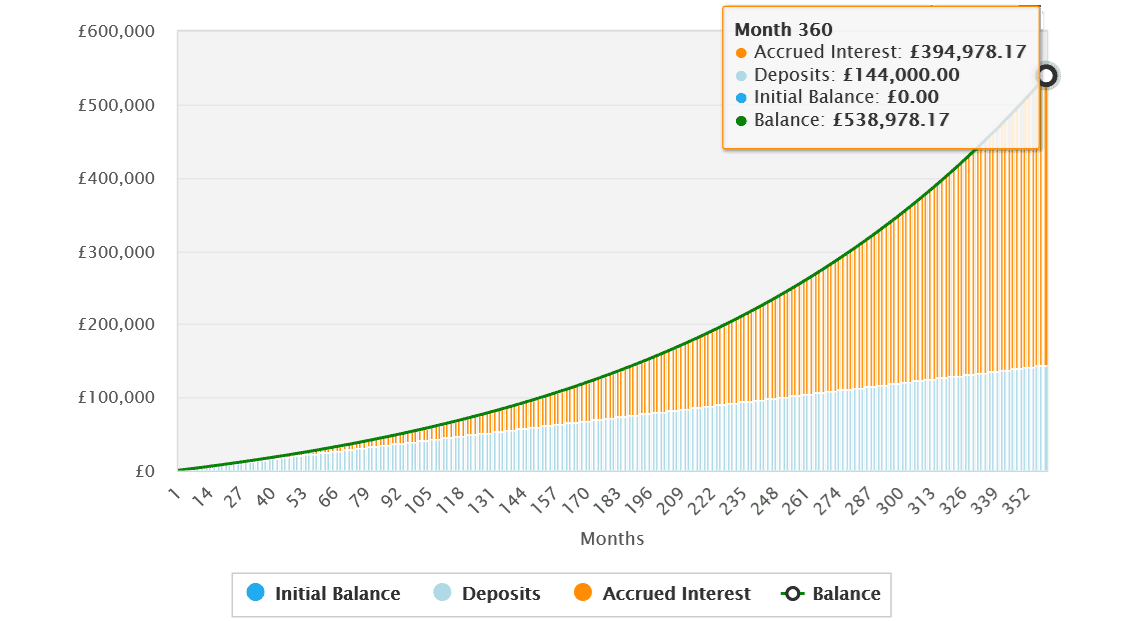

Let’s say that I have £400 spare each month to invest in FTSE 100 shares. This could be a profitable strategy based on the 7.5% average yearly return the UK index has yielded since 1984.

If this historical rate continues I would, after 30 years, have made a healthy £538,978.17 for my retirement fund.

Projected returns after 30 years

A solid strategy

A good way to make long-term returns with FTSE 100 shares could be to buy riskier growth shares with solid-if-unspectacular companies with long records of earnings expansion.

We’re talking about the likes of Diageo, Reckitt, and Coca-Cola HBC, for example. While they face significant competitive pressures, they have several of the qualities I talked about above: fashionable, industry-leading products, rich balance sheets, and multiple income streams (thanks to their wide geographic footprints and broad ranges of goods).

Added to more cyclical shares like HSBC and Aviva, I think I could be onto a winner.

A FTSE 100 share on my radar

Food and household goods giant Unilever (LSE:ULVR) is one such stock I’d buy today. Its ability to grow earnings even during tough times is illustrated in current broker forecasts: growth of 5% is forecast for 2024, and expansion of 7% is predicted for 2025 and 2026.

Some of Unilever’s market-leading labels

On the downside, profits here are vulnerable when costs suddenly soar. This was a problem in 2022 when high inflation caused the bottom line to fall year on year.

But over the long-term Unilever is able to weather such problems. This is because its market-leading products sit high in terms of both quality and consumer desirability. This means prices can be hiked across its territories to offset price pressures without a large loss of volumes. So, for the most part, it can be relied on to grow profits every year.

I already own this Footsie company in my ISA. And I’ll be looking to add to my holdings when I next have cash to invest.