For decades, the FTSE 100 has proven to be an excellent way to make money. Since its inception in 1984, the UK’s leading share index has delivered a stunning 7.48% average annual return. It’s a record that has enabled thousands of Stocks and Shares ISA investors to build a healthy nest egg for their retirement.

Past performance isn’t always a reliable indicator of future returns. And investing my money in stocks is certainly riskier than parking it in a bog-standard savings account.

But focusing on Footsie shares can for the large part be a stable way to generate wealth. Most large-cap companies have market leading products, strong brand recognition, robust balance sheets and multiple revenue streams. These qualities can all make them solid long-term investments.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

Building a big ISA

Let me show you how I could make money with buying UK blue-chip shares. First, we’ll put down a few ground rules to follow. We’ll say that:

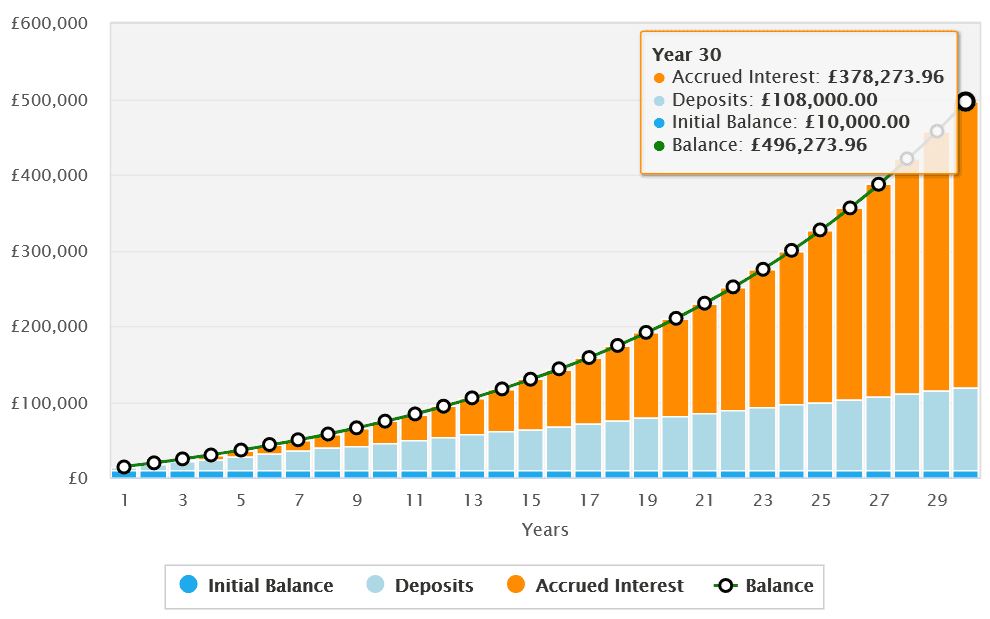

- I have £10,000 to invest in my Stocks and Shares ISA at the beginning

- I set aside £300 each and every month to buy Footsie shares

- I reinvest any dividends I’m paid to acquire more FTSE 100 stocks

Now let’s assume that the FTSE 100 continues to provide that average annual return of 7.48%. If I stick to the plan outlined above, I would have a majestic £496,273.96 sitting in my ISA account after three decades.

A top FTSE 100 share

I’d aim to hit that £496k target with a mix of riskier, cyclical shares and more dependable growth stocks such as Diageo (LSE:DGE). Companies like this have the mettle to increase profits through good times and bad which, over the long term, can help me steadily build wealth.

There are multiple reasons why Diageo is a reliable pick. The iconic branding and high quality of products like Captain Morgan rum and Guinness stout guarantee high demand at all stages of the economic cycle.

This is helped significantly by the drinks giant’s monster advertising budgets which makes them essential purchases. Last year, it spent £1.4bn just in North America to market its fashionable labels.

Now Diageo isn’t totally immune to economic downturns. At the moment it’s suffering as consumers in Latin America and Caribbean feel the pinch.

However, the company’s wide geographic wingspan still allows it to grow earnings almost every year, despite trouble in one or two regions.

A near-£20k passive income

So let’s say I’ve built that big ISA nest egg of nearly half a million pounds. How could I then translate that into a regular passive income?

I’d do so by applying the ‘4% drawdown’ rule. This would give me a regular income for 30 years before the well ran dry.

At this rate I’d enjoy a healthy £19,850.96 second income. When combined with the State Pension, I’m confident this could give me a decent standard of living in retirement.

As I mentioned earlier, investing in FTSE shares involves more risk than simple saving. But the chance I have to make life-changing wealth still makes it the best choice for me.