For the best part of the last decade, it was assumed by many investors that a normalisation of interest rates would be a positive catalyst for Lloyds (LSE: LLOY) shares.

Has this been the case? Well, in November 2021, when the Bank of England first started increasing rates back towards more normal levels, the share price was 49p. Today, it’s at 42p, so this theory hasn’t played out.

Currently, some investors think a cut in interest rates could be a big catalyst for the share price. So it’s like there’s always one last missing piece.

Should you invest £1,000 in Hansa Investment Company Limited right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hansa Investment Company Limited made the list?

Alternatively, of course, the Lloyds share price could be like the play Waiting for Godot, where the characters wait endlessly for the arrival of someone who never shows up.

That is, investors waiting for market conditions or other factors to align favorably might be locked into a perpetual cycle of hope and disappointment.

So, given this possibility, why have I been buying the shares?

Margin of safety

Firstly, the stock is dirt cheap. And while I doubt Lloyds stock will ever be highly valued again, I also — famous last words — can’t see it getting much cheaper.

Right now, it trades on a price-to-earnings (P/E) ratio of just 6.3 for the next 12 months. That’s considerably cheaper than the FTSE 100 average of around 11.

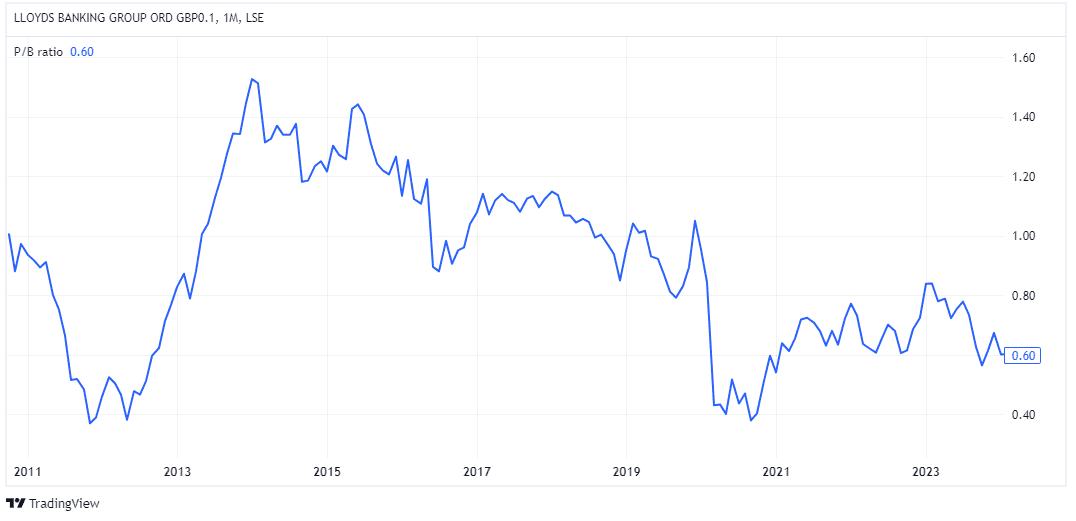

Its price-to-book (P/B) ratio, which compares its market valuation with net assets, is 0.63. Of course, it may not get back to fair value (1) anytime soon, but this does suggest the stock is significantly undervalued.

Overall, I can’t help thinking this valuation provides a solid margin of safety here for investors. The chart below seems to suggest so, too.

High-yield income prospects

Additionally, the passive income prospects look as good as ever right now.

Analysts expect Lloyds to pay out 2.78p per share in dividends for 2023, followed by 3.15p per share for 2024. At today’s share price of 42.7p, these prospective payouts translate into yields of 6.4% and 7.3%.

Of course, no dividend is guaranteed. But the dividend coverage ratios for 2023 and 2024 are 2.7 and 2.1, respectively. Given that a ratio of two generally suggests a firm’s payout is safe, I find this reassuring.

Risks

Now, there are still a couple of risks here.

Firstly, the UK economy officially dipped into a recession at the end of last year. Economists are forecasting this to be a relatively shallow downturn, but it still adds risk to bank stocks, especially domestic-focused Lloyds.

The recession could force interest rate cuts, which might squeeze profits somewhat.

Furthermore, the Financial Conduct Authority investigation into discretionary commission arrangements (DCA) in the car financing market could be an issue here. Lloyds is a major player in car financing and could face a massive fine.

In fact, some fear this could become another PPI-style scandal. It’s too early to tell, but it’s worth bearing in mind.

I’d still invest for income

Despite these risks, Lloyds still strikes me as a stock that could be dishing out dividends for many years to come.

My strategy then is to automatically reinvest my dividends back into buying more Lloyds shares. I don’t do that with all my income stocks, but I am here. Doing so, I can let compound interest do its thing over time.