The 2020 pandemic lockdown grounded planes around the world, decimating the International Consolidated Airlines Group (LSE:IAG) share price.

The company operates several airlines including British Airways, Iberia, Vueling, and Aer Lingus. With passengers unable to fly during COVID, the company lost business. But despite air travel opening up again in the past years, International Consolidated Airlines Group shares are struggling to recover.

Currently trading at 145p, they’re a long way from the high of 486p reached in 2018. For the past year, the share price has fluctuated between 133p and 171p, down by 10% since February 2022.

But it climbed from 100p to 400p between 2012 and 2015, so can it do it again?

Let’s see what the charts say.

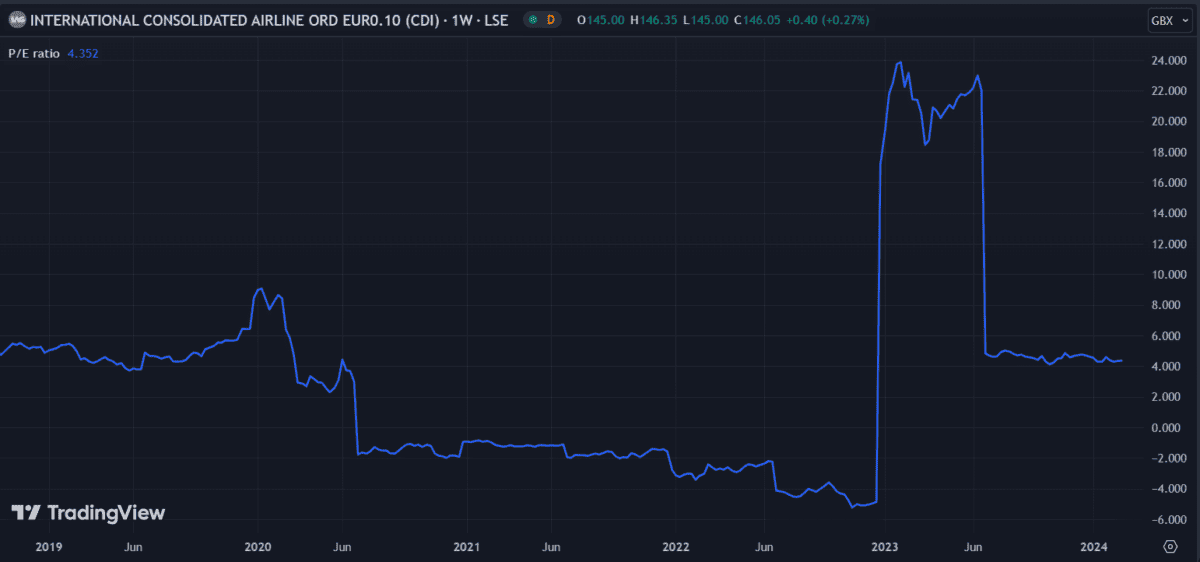

Price-to-earnings (P/E) ratio

P/E ratio gives us an idea of how well priced a stock is. It compares the share price with a company’s earnings, indicating whether the stock is undervalued. At 4.3 times, International Consolidated Airlines Group has a low P/E ratio, suggesting its share price is cheaper than it should be. By comparison, competitors easyJet and Wizz Air have P/E ratios of 13 and 23.6 times respectively. The industry average is 8.8 times.

A low P/E ratio could also be an indication that investor confidence is shaken, resulting in shares selling at a discount. While this could be a good time to get into the stock, its important to first evaluate whether the business is likely to improve going forward.

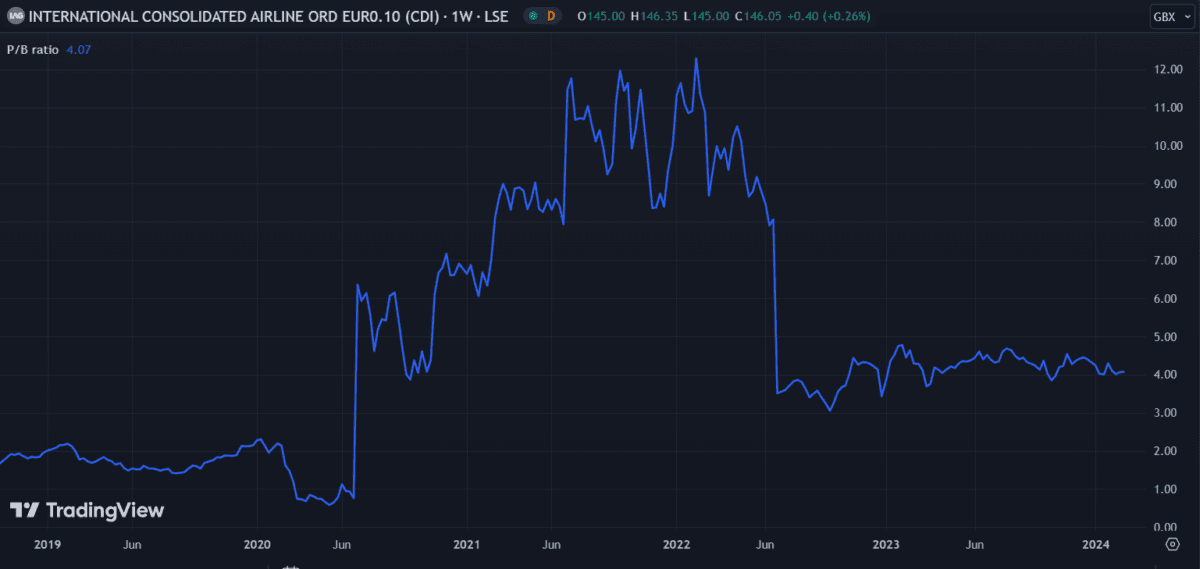

Price-to-book (P/B) ratio

P/B ratio is another metric that I use to measure value. International Consolidated Airlines Group has a P/B ratio of 4.07, which is slightly higher than the industry average of 3.43. The P/B ratio is calculated by comparing a company’s market value to its book value, indicating whether shares are undervalued.

I get the book value by calculating total assets minus total liabilities. The company’s low P/B ratio suggests the share price could increase if improved earnings reinvigorate investor confidence.

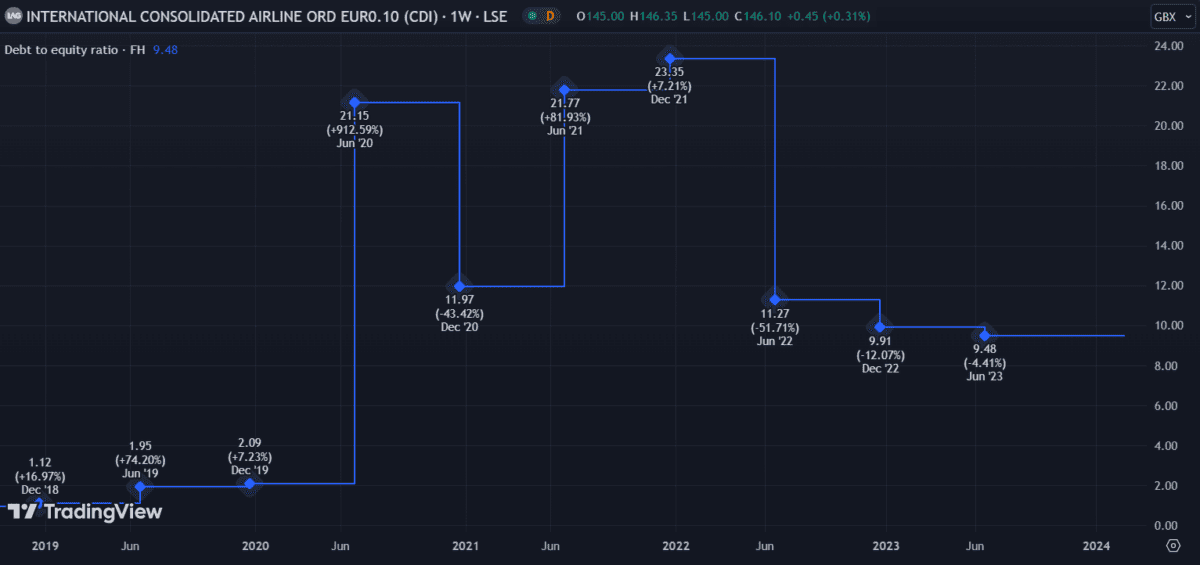

Debt-to-equity (D/E) ratio

Debt can be an asset to a business if it manages it properly. Almost all companies use debt to fund day-to-day operations and increase profits. But if not managed effectively, debt can ruin a business, potentially leading to bankruptcy.

The D/E ratio is a way of evaluating a company’s debt position with a single figure. It’s calculated by comparing how much debt a company has versus its shareholder equity.

With an estimated €19.6bn in debt and €2.08bn worth of equity, International Consolidated Airlines Group has a D/E ratio of 9.48, down from 23.35 in December 2021. For reference, most companies would try to keep this figure under one.

However, in International Consolidated Airlines Group’s case this isn’t as bad as it looks because the firm has a high level of operating cash flow. So despite the high level of debt, the interest payments are well covered by earnings before interest and taxes (EBIT), at 4.4 times.

My verdict

As we can see from the charts above, several indicators are moving closer to pre-pandemic levels. International Consolidated Airlines Group is also reducing its debt level and covering its interest payments.

I can’t say for certain that the share price will regain 400p but it looks likely to improve. Analysts forecast an average price of around 200p in the coming 12 months, which I think is fair.