Viewed over multiple different timeframes, BT (LSE: BT.A.) shares have quite literally destroyed shareholder wealth.

The stock’s poor long-term performance highlights the dangers of buying shares in a company solely based on a consistently low price-to-earnings multiple (P/E). Often, a business will have a lowly valuation for a reason.

That’s why I don’t make investment decisions solely based on a share price chart. First and foremost, I invest in businesses which I believe the market is undervaluing given its future prospects. On this basis, do BT shares fit the bill?

Capital investment

When the recently departed CEO took charge back in 2019, his strategy to enable continued growth was by means of capital investment. And BT has certainly done that.

It has been in the thick of huge investments in new network technologies like full fibre and 5G. I can’t dispute that this was the right thing to do. After all, this investment isn’t in blue-sky projects. This essential infrastructure investment should ultimately power a new phase of economic development for the UK.

However, all that shareholders have seen is falling cash flows and a weakening balance sheet.

Renewal of debt

The company’s mounting debt profile remains my number one concern. As of November 2023, it stood at £19.7bn, twice the entire market cap.

A significant portion of this debt was added at ultra-low interest rates. But as more and more of that debt matures, it will need to be refinanced at higher rates.

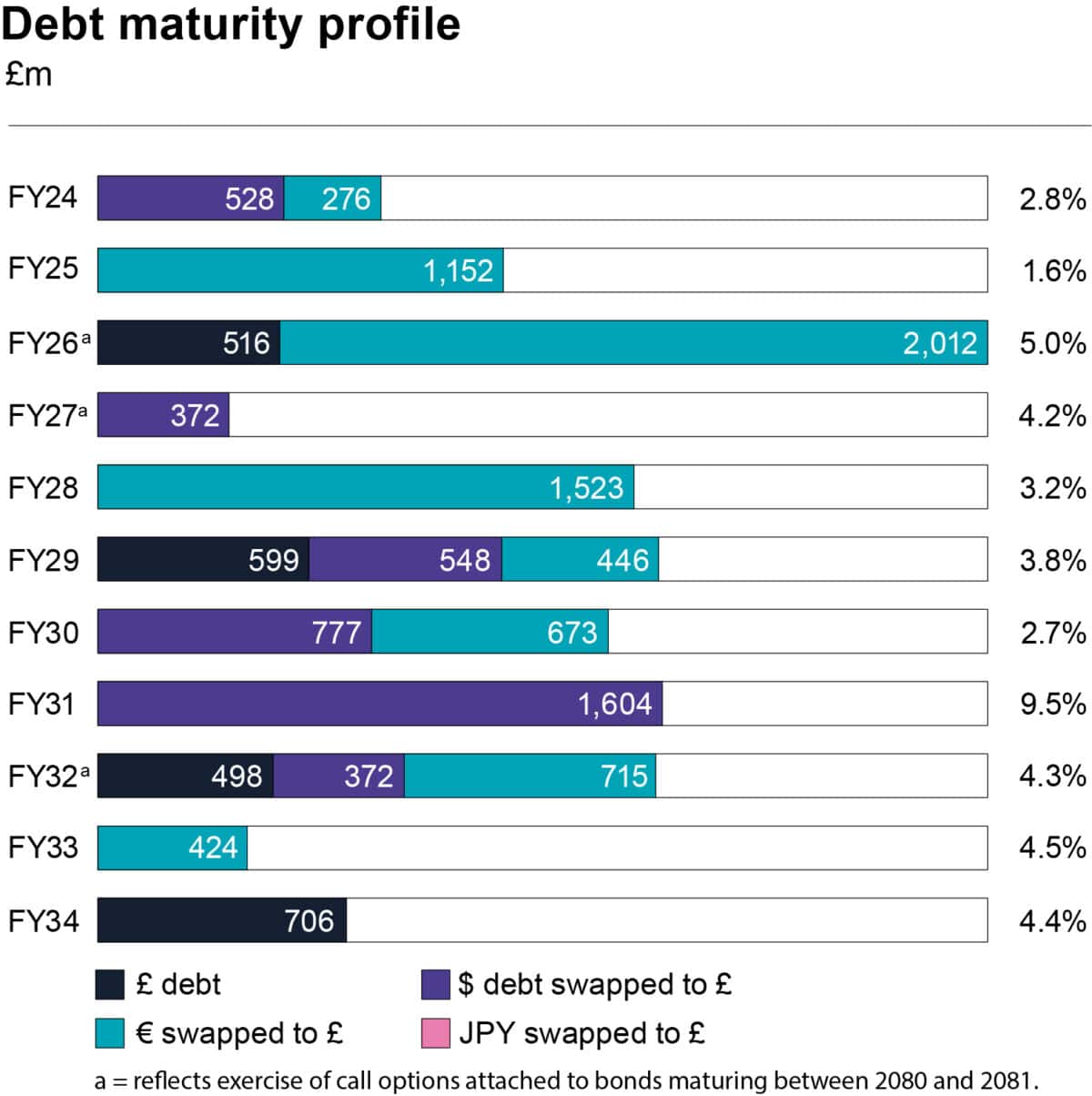

The following chart shows the company’s debt maturity profile over the next 10 years.

Source: BT Annual Report 2023

In the next three years, about £4bn will need to be refinanced. That’s a ticking time bomb for me.

Of course, one needs to factor in that rates are expected to fall over the coming years. But that in itself remains a risky bet. Inflation is far from tamed. Rate cuts could well stoke a new inflationary wave.

One thing I remain confident about is that we are unlikely to be going back to a zero-rate environment any time soon. Therefore, interest payments on its debt will end up being significantly higher.

Long-term potential

In H1 FY24, build efficiencies, primarily in Openreach, have enabled it to slightly reduce its full-year Capex outlook. Ultimately, this will feed itself into an improving cash flow position. But this could just be the beginning.

Over the next few years, BT expects its build of fibre to premises will peak. Beyond that peak, it’s guiding to expect at least a £1bn reduction in capex. By the end of the decade, it forecasts that normalised free cash flow will be twice what it was last year.

As more consumers and businesses migrate away from traditional copper lines to fibre optics, repair volumes are expected to fall by as much as half.

If I invest today, I’m being amply rewarded to wait out the next few years with a 7% dividend yield. And this is comfortably covered by earnings.

Nevertheless, the macro picture to me doesn’t look good. The UK is now officially in recession. BT’s Business division EBITDA is falling and unlikely to bounce back quickly. Competition remains intense and the regulatory environment generally unfriendly. I don’t rule out an investment, but not now.