With a market cap of £421m, The PRS REIT (LSE:PRSR) is below the radar of a lot of investors. But I think the stock could be a great source of passive income.

The company is a real estate investment trust (REIT) that owns and leases houses across the UK. After a 10% fall in the share price, I think there’s an opportunity here for investors looking for stocks to buy.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Should you invest £1,000 in Amino Technologies Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Amino Technologies Plc made the list?

Real estate

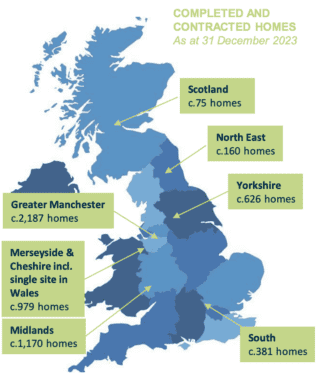

PRS currently owns 5,264 properties, of which 5,087 are currently leased to tenants. The largest concentration of these (around 40%) is around Manchester.

Source: The PRS REIT

The company’s business model is reasonably straightforward. It buys houses from developers and leases them to tenants, distributing the cash it generates as dividends to shareholders.

With a market cap of £421m, the firm’s portfolio generates around £63m per year in rental income. Accounting for around £460m in debt facilities, that’s a return of around 7% per year.

At today’s prices, the stock comes with a dividend yield of just over 5%. But with the UK officially in a recession at the end of last year, should investors be worried about the sustainability of this payout?

Recession?

The UK economy officially declined in December, meaning the country is in a recession. Nobody seems to have told PRS this, though.

During the last three months of 2023, the company added 135 homes to its portfolio, collected 99% of its rent, and experienced rental growth of 11%. In other words, it kept performing well.

There are reasons to think this can continue, as well. The first is the tenant base that PRS leases to — rent accounts for an average of 22% of household incomes, limiting the risk of unpaid rent.

Furthermore, despite the downturn at the end of last year, there are signs that UK construction might be starting to pick up. That’s positive for a company looking to add to its portfolio.

Energy efficiency

It’s always wise to be mindful of the risks with investing in property. In the case of PRS, this comes with the potential for a change in requirements for residential properties, particularly in an election year.

Energy efficiency is a good example. From 2025, the minimum standard for new rental properties is set to be an energy performance certificate of ‘C’ or above.

At the moment, all of the company’s portfolio meets this standard. But things could change in the future and it’s worth noting that the firm has basically no say in determining these requirements.

Focusing on buying new homes directly from builders is likely to help PRS stay ahead of the curve in this area, though. So I think the stock looks like a durable investment prospect.

A stock on my buy list

The idea of earning passive income from property sounds great. But dealing with tenants, mortgages, and maintenance can make that income more active than it might seem.

With £20,000, I’d buy 12,987 shares in The PRS REIT and let the company take it from there. I think it goes under the radar of a lot of investors, but it’s continuing to perform well even in a recession.