Tesco (LSE: TSCO) is one of the most traded stocks on the FTSE 100. Investors buy thanks to steady earnings through recessions or economic down periods, topped up by an above-average dividend. With my eye on such a safe income source, let’s look at the Tesco dividend forecast through to 2026.

Cashing in

To start with, my potential return is a tricky thing to unpack because Tesco spends a large amount on share buybacks. For 2023, the firm spent £858m on dividend payouts along with a £750m buyback program.

Based on the current share price of 277p, that’s a total capital return of 7.46% over the year – far higher than might be suggested from the dividend yield alone.

Buybacks can be frustrating when the share price remains unmoved. Many investors prefer to see the cash hitting their account rather than spent on the less tangible removing of shares in issue.

Tesco shares are up around 13% in the last year though, so this buyback program looks like it’s having some effect.

What about the years ahead then? Well, CEO Ken Murphy hinted at an increase when he said “we are committed to a progressive dividend policy”, but we don’t have much more to go on from Tesco itself than that.

Cut in payments?

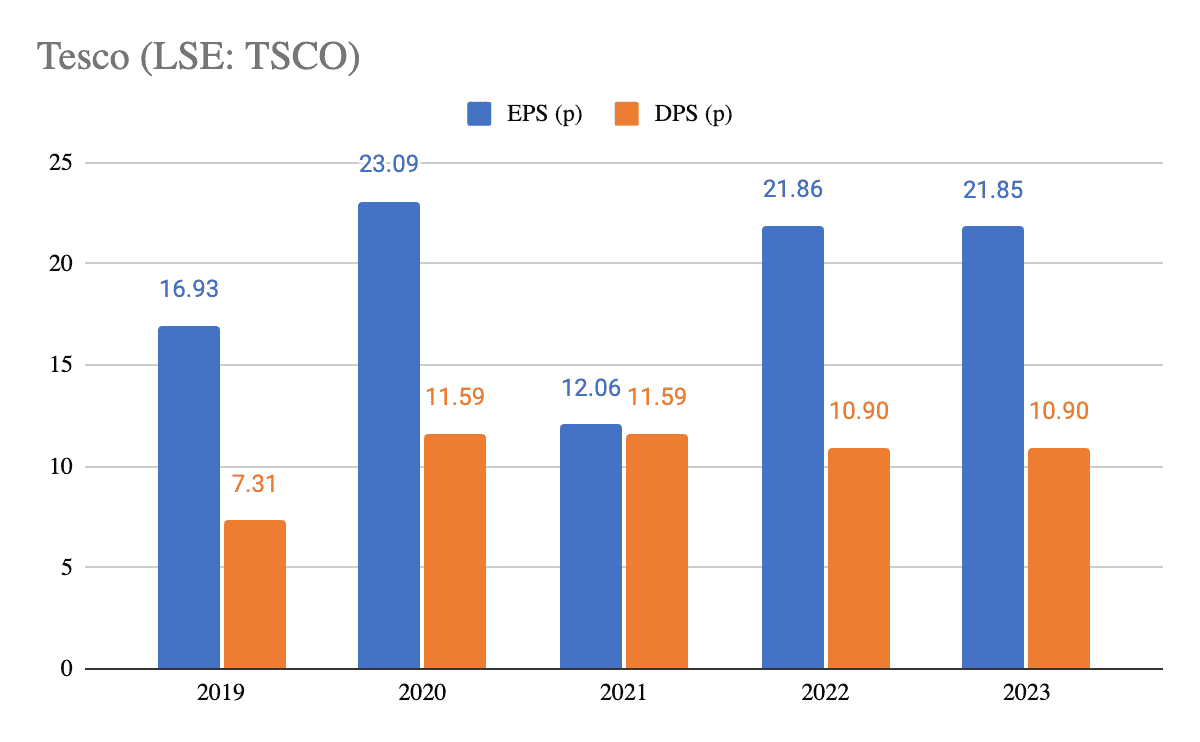

While a progressive dividend is normal for many companies, it hasn’t been for Tesco. The supermarket cut the payment in 2022 and kept it the same in 2023 after a couple of uncertain years thanks to inflation and supply costs.

Based on the table above, earnings seem to be back on track. Cooling inflation is a boost for the sector and like-for-like sales showed strong growth in the latest Q3 report. Tesco even grew market share – some feat considering the cost-of-living crisis.

Previous dividends have been well covered by earnings which led to Tesco being able to reduce its debt pile four years in a row. I like that the balance sheet shows no signs of impacting future payments.

The forecast

Let’s look at the forecast then. In terms of numbers, the London Stock Exchange Group analyst consensus predicts earnings-per-share to rise around 10% over the next two years, which should support an increasing dividend.

As we are nearing the end of fiscal year 2024, I’ll focus on the dividend yield for the upcoming two years. Tesco is forecast to pay out 4.62% in 2025 and 4.95% in 2026.

If the company allocates cash to buybacks – and it looks like it will have the earnings to do so – then total shareholder return could be much higher than that too.

I do own the shares already and find the combination of high capital return and dominant market share to be attractive. With this rising forecast, I may even be tempted to buy more.