Down 22% over the past year, the Lloyds Banking Group (LSE:LLOY) share price has underperformed the broader FTSE 100. The full-year results are due out on 22 February. Ahead of this, I think it’s important for investors to take a step back and consider if Lloyds shares are undervalued as we currently stand.

Noting changes in interest income

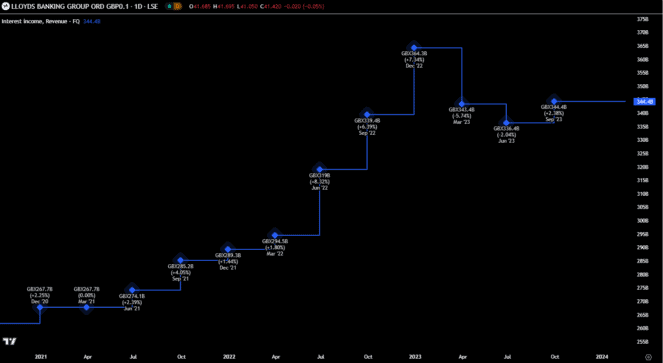

A key metric to check on the health of Lloyds is the revenue derived from interest income. This money is made thanks to the difference in the rate it charges on loans versus what it pays on deposits. Due to the rise in the base rate from the Bank of England, this margin has risen significantly over the past couple of years. This is shown in the chart below.

However, interest income has been stalling for the past couple of quarters, as interest rates remain on hold. Looking forward, I expect interest rate cuts later this summer. This could act to reduce the interest income for the bank, lowering overall revenue.

Should you invest £1,000 in Vistry right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Vistry made the list?

For the share price, I don’t see it undervalued when I consider that the impact of lower interest rates is unlikely to have been fully factored in to the current price.

Relative value metric looks interesting

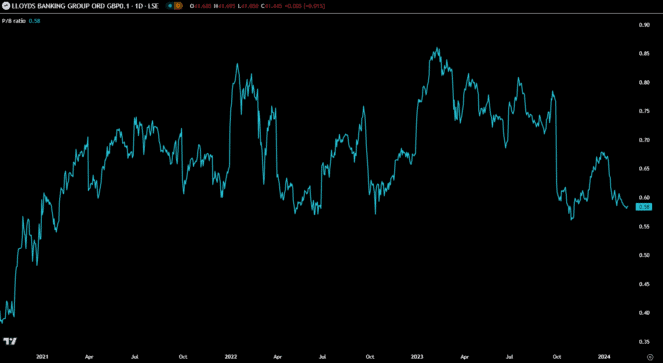

Many look at the price-to-earnings ratio to see the value of a stock. As an alternative, I like to also use the price-to-book (P/B) ratio. This looks at the share price relative to the firm’s book value, essentially its raw value if all the assets and liabilities were settled today. A figure of 1 would equate to a fair value. The P/B ratio for Lloyds is currently 0.58 and is at a low level when scanning the past few years.

From this chart, I’d say that the stock does look undervalued. Granted, the ratio might not jump back to parity anytime soon. But a move back to 0.80 is realistic. Assuming the book value stays the same, the share price would need to jump by 38% to get back to this fairer value.

Looking at peers

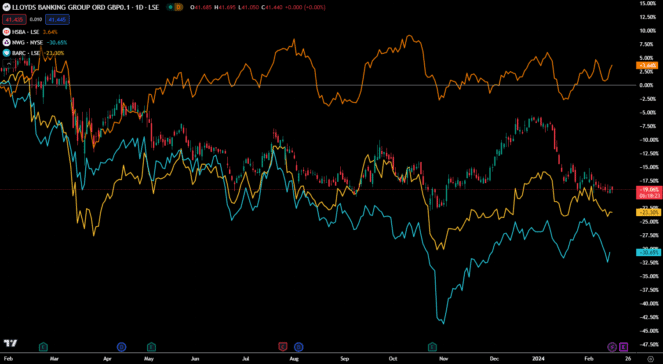

Finally, I want to look at how the stock has performed relative to peers. Instead of just comparing it to the FTSE 100 index, I get a better feel when I compare it to competitors. Below shows the 12-month share price percentage gains/losses for Lloyds. Yet I’ve also included HSBC (orange), Barclays (yellow) and NatWest Group (blue).

As can be noted, Lloyds isn’t the worst performer, with both NatWest and Barclays experiencing steeper slumps over this time period. As a shrewd investor, it makes me want to look at the two other banking stocks instead. I think there could be a likelihood that either firm offers better value right now.

Although the price-to-book ratio looks attractive, it’s outweighed by the concerns about interest income. This means that I don’t think that the Lloyds share price is truly undervalued. When I compare it to peers, I feel there are better value options out there from the same sector. Therefore, I’d look elsewhere if I was wanting to add a value stock to my portfolio right now.