Microsoft (NASDAQ:MSFT) stock has soared by 50% in the last year, largely buoyed by the buzz around its OpenAI division.

The advent of ChatGPT seems to have given Microsoft a golden ticket, packaging AI technology into a subscription-based model. This is no small feat in an industry where many are still stuck in the conceptual phase, offering little beyond buzzwords and pie-in-the-sky AI dreams.

But does this make Microsoft a must-buy for my portfolio? Here’s why I don’t think so.

Second-most overvalued

A recent analysis by New York University professor of finance and equity valuation Aswath Damodaran pegs Microsoft as the second-most overvalued stock among the so-called Magnificent Seven tech giants.

According to the ‘Dean of Valuation’, Microsoft was 14% overvalued as of 9 February.

The Magnificent Seven collectively added a staggering $5.1trn to their market cap in 2023, accounting for over 60% of the S&P 500’s total return that year.

| Magnificent Seven stocks | Overvaluation |

| Nvidia | 56% |

| Microsoft | 14% |

| Apple | Slightly overvalued, specific % not provided |

| Amazon | Slightly overvalued, specific % not provided |

| Alphabet | Slightly overvalued, specific % not provided |

| Tesla | Second-least overvalued, specific % not provided |

| Meta | Closest to fair value, specific % not provided |

Strategic prowess

The latest quarterly earnings report for Q4 2024 underscores Microsoft’s robust performance. The company posted an 18% increase in revenue to $62bn and a 33% jump in net income to $21.9bn. These figures are impressive, reflecting strong execution and the successful integration of Activision Blizzard into its portfolio.

Such achievements highlight Microsoft’s strategic prowess. Particularly impressive has been the company’s ability to leverage AI across its technology stack, securing new customers and driving productivity gains across sectors.

Microsoft Cloud’s revenue alone surged to $33.7bn, up 24% year-over-year. There’s no denying Microsoft is a ‘wonderful company’, as legendary investor Warren Buffett might put it. But is it trading at a ‘fair price’?

The bigger they are…

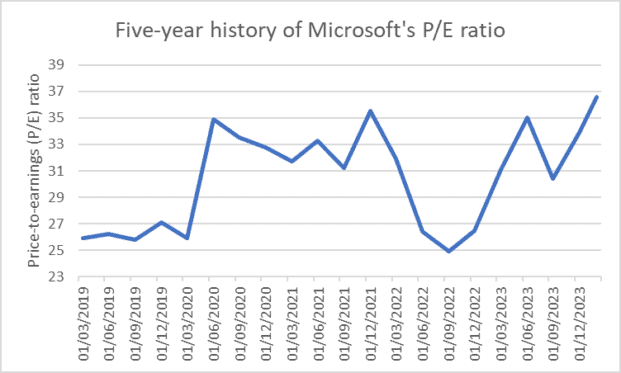

With a price-to-earnings (P/E) ratio of 36, significantly higher than its five-year average of 31, the market’s enthusiasm for Microsoft’s growth prospects seems to have reached fever pitch.

Source: Simply Wall Street historical P/E data

The company’s market cap has ballooned by 280% over the past five years to $3trn. Going forwards, there are natural limits to how quickly it can continue to expand due to its already ginormous size.

Moreover, the broader tech landscape is fraught with competition and regulatory challenges.

Although Microsoft’s recent performance and strategic investments in AI and cloud computing are exciting, the current hype and valuation raise questions about the sustainability of its stock price growth.

The attraction of Microsoft’s success story must be balanced against the realities of its valuation and growth potential.

Personally, I’d rather look at less hyped-up areas of the global stock market for undervalued gems. Currently, I’m focusing on the FTSE 100 for basement-bargain deals on growth and dividend stocks.