Shares of booze behemoth Diageo (LSE: DGE) are down 28.5% in just over two years. This decline has left the FTSE 100 stock cheaper than it’s been for over a decade, according to one valuation metric.

Therefore, I think today — Valentine’s Day — could be a great time to show this rejected share some loving affection.

Slowing sales

Diageo has experienced slower-than-expected growth recently due to surging inflation and higher interest rates. With budgets squeezed, some drinkers have been trading down to cheaper brands and/or consuming less alcohol.

This has been painfully evident in the company’s Latin American and Caribbean (LAC) market. Sales there plunged 23% year on year for the six months ended 31 December (H1).

The firm had originally been slow to spot this deceleration, resulting in a build-up of unsold drink. It could still take a while to get wholesale inventory levels back to normal.

Furthermore, Diageo has been losing some market share in North America, where sales dipped 1.5% in H1. This is arguably more worrying because it accounts for over a third of total revenue compared to around 11% for the LAC region.

However, management says it’s willing to cede US market share in the short term by not lowering prices on its premium brands. This is to preserve brand equity and future pricing power.

New CEO

Meanwhile, the company has new leadership following the untimely passing of long-serving CEO Sir Ivan Menezes in July 2023.

Naturally, some investors have expressed doubts about management following the Latin America issues.

While a potential risk, I think it’s far too early to form such judgements. Excluding the LAC region, organic net sales actually grew 2.5% in H1 due to strong growth in Asia Pacific, Africa and Europe.

Once-in-a-decade cheapness

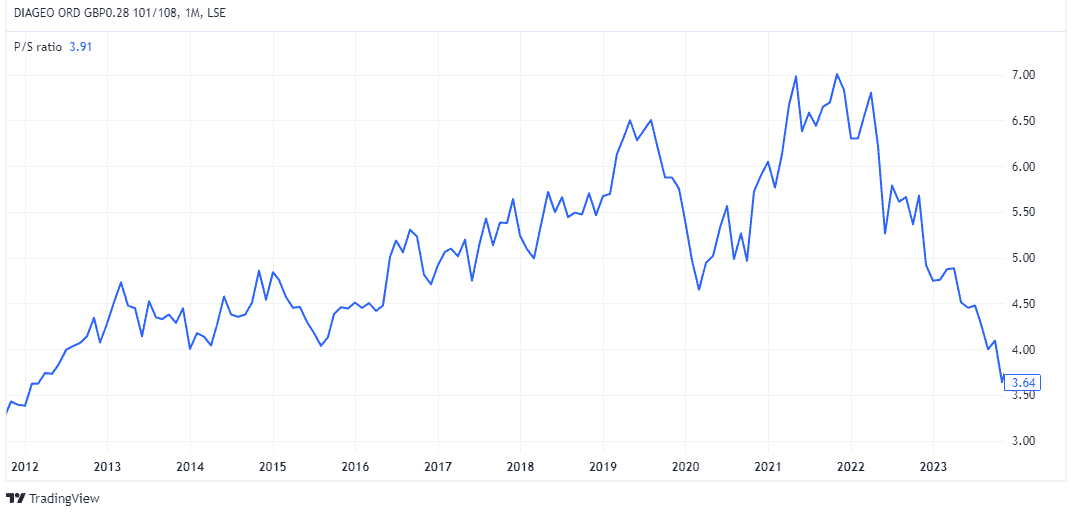

All this uncertainty has left the stock’s valuation looking attractive. In fact, it’s currently trading on a price-to-sales (P/S) ratio of around 3.8. That’s the lowest this metric has been since 2012.

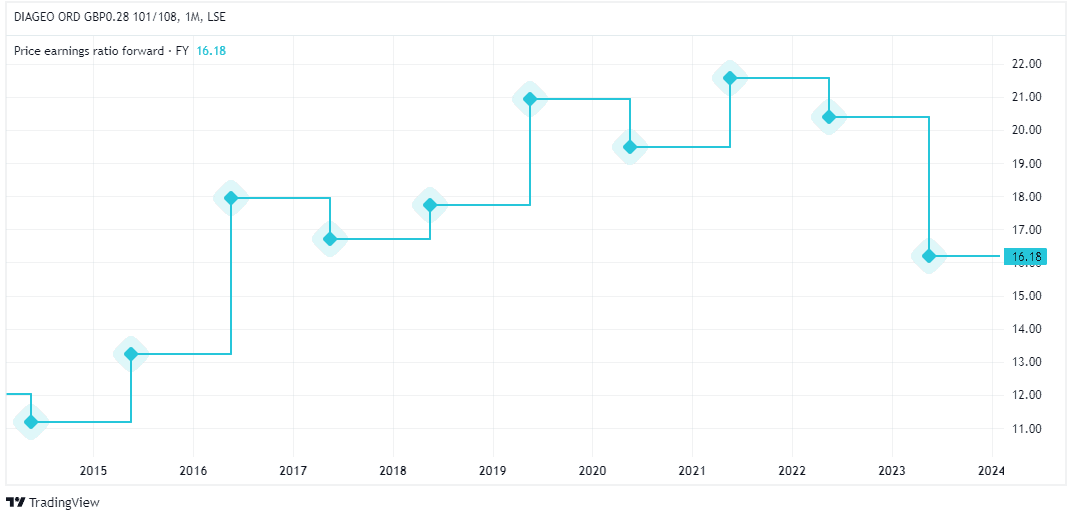

The stock is also nearing an eight-year low when looking at the forward price-to-earnings multiple.

Taking the long view

Warren Buffett says to buy stocks that “you’d be perfectly happy to hold if the market shut down for 10 years.”

Diageo strikes me as such a business. In 10 years, I’d expect to find brands like Johnnie Walker, Guinness and Baileys still thriving and selling for a healthy profit.

Diageo top brands

And if the firm successfully takes tequila around the world — as it intends to and has already done with other drinks — then I’d also expect its Don Julio brand to be a lot more valuable in 10 years.

Over the medium term, the spirits giant aims to deliver organic net sales growth of 5%-7%. Long term, it expects organic operating profit to grow faster than organic net sales.

And it has an ambitious target to increase its global share of the total beverage alcohol market from 4.7% today to 6% by 2030.

If it can achieve these targets, then I think today’s issues will look like mere speed bumps in the rear-view mirror.

Therefore, I see Diageo as a solid long-term investment at today’s valuation. And if I wasn’t already a shareholder, I’d be investing while the stock is down.