The Stocks and Shares ISA provides us with the opportunity to invest and pay no tax on the money we generate within the wrapper. Regardless of whether it’s dividends or capital gains, we can keep all the money for ourselves. And this is very beneficial when building wealth. It means our investments can grow to their full potential without any of our gains being rerouted to the taxman.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Doubling my money

So, just how quickly could I double my money in a Stocks and Shares ISA? Well, it depends on the rate of growth — how quickly our investments are growing.

Should you invest £1,000 in Applovin right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Applovin made the list?

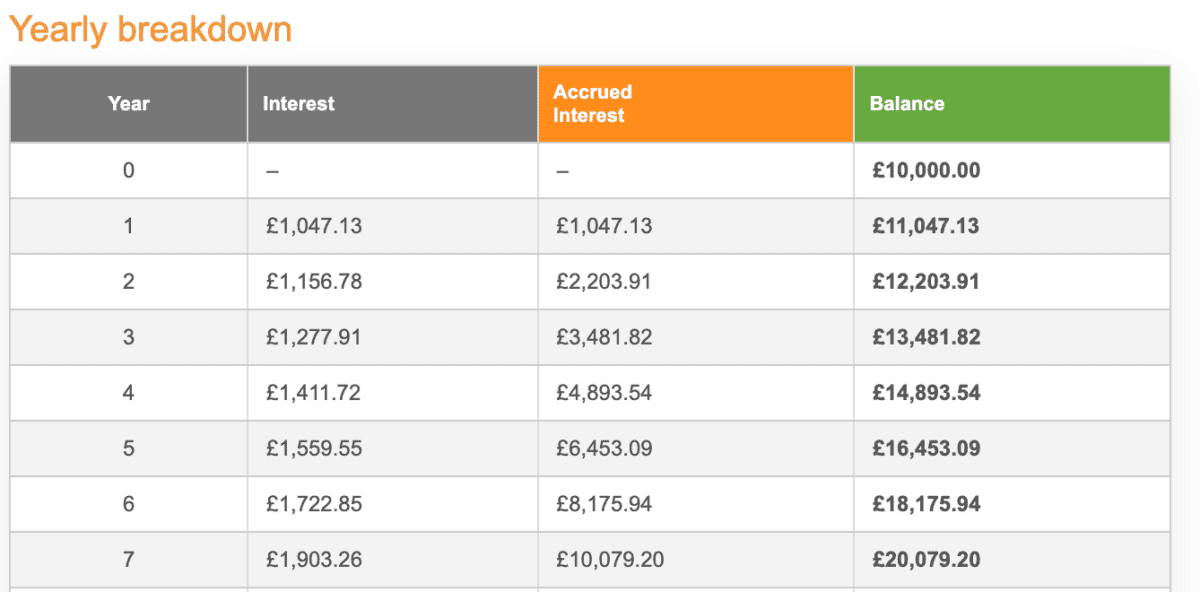

For example, if I were able to actualise 10% growth annually — this is towards the higher end of what most novice investors may achieve — I’d be able to double my money in just seven years.

Here’s how it looks when starting with £10,000. As we can see, the speed of growth increases over time. This is the impact of compound returns.

Of course, I could make this grow faster if I were to make regular contributions. This could involve me depositing as little as £50 or £100 a month in order to further fuel my investments. In fact, when contributing £100 a month, my £10,000 would become £20,000 in just four years!

Investing wisely

The problem is, many novice investors make mistakes — pick the wrong stocks, sell too soon, or hold onto their losses for too long. And if I do this, I could lose money. It’s important I don’t fall foul of those pitfalls.

Thankfully, nowadays there’s a wealth of resources, notably online, to help me make the right decisions. Investing wisely also means doing my research and looking at data, and not being influenced by personal bias.

This is why I invest is companies with strong metrics like AppLovin (NASDAQ:APP). The company helps app and platform operators maximise their advertising revenues through its proprietary technology and focus on the mobile app ecosystem. Its primary clients are mobile app developers and publishers, and AppLovin provides the tools to improve user acquisition, engagement, and advertising.

It’s a growing market, one with huge potential, but also one that is arguably less stable than standard website advertising monetisation. This is reflected in AppLovin’s revenue growth — it’s been quite erratic. Moreover, AppLovin’s $2.8bn of debt may put some investors off. Nonetheless, this appears to be more than priced into the company’s valuation.

And valuation is what interests me most. AppLovin trades with a price-to-earnings growth (PEG) ratio of 0.73. The PEG ratio is essentially price divided by earnings per share, divided by the expected annual growth rate over three-five years. Anything under one is worth considering very strongly.

The bottom line is that the metrics here are very strong. So, despite historically unstable growth and a sizeable debt burden, the investment proposition is very appealing to me. And this is why I’ve invested in AppLovin, along with other grow-focused companies with PEG ratios below one — like Nvidia, Super Micro, and Celestica.