Investing in penny stocks is a high-risk, high-reward strategy that can pay off handsomely for experienced share pickers.

Prices of such low-cost growth shares can be prone to periods of extreme turbulence. But ownership of them over the long term can provide exceptional (and in some cases life-changing) returns. Many global giants like Apple, Tesla and Amazon all spent time trading in penny stock territory before taking off.

With this in mind, here are two cheap shares I’m considering buying for my Stocks and Shares ISA.

Should you invest £1,000 in IAG right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if IAG made the list?

Michelmersh Brick Holdings

Building materials suppliers like Michelmersh Brick Holdings (LSE:MBH) have been casualties of the recent housing market cooldown. But as demand for homes picks up again now could be a good time to open a position.

The UK’s homes market isn’t out of the woods yet as the economy slows and high interest rates remain. But recent Halifax data showing house prices in January rising for the fourth successive month indicates the tide may be turning.

Michelmersh’s share price has risen strongly on the back of this encouraging data. But on paper it still looks dirt cheap, trading on a forward price-to-earnings (P/E) ratio of 9.9 times.

The long-term outlook for the brickmaker remains a compelling one. Housebuilding activity is tipped to ramp up over the next decade as pressure on politicians to solve the property crisis grows. Research institute Centre for Cities says that 654,000 new homes per year are needed to 2033 to fix the housing deficit.

Brickmakers like Michelmersh will also benefit from ongoing demand from the repair, maintenance and improvement (RMI) market. The UK has has the oldest housing stock in Europe (if not the world), which in turn means constant need for updating and restoration.

Kodal Minerals

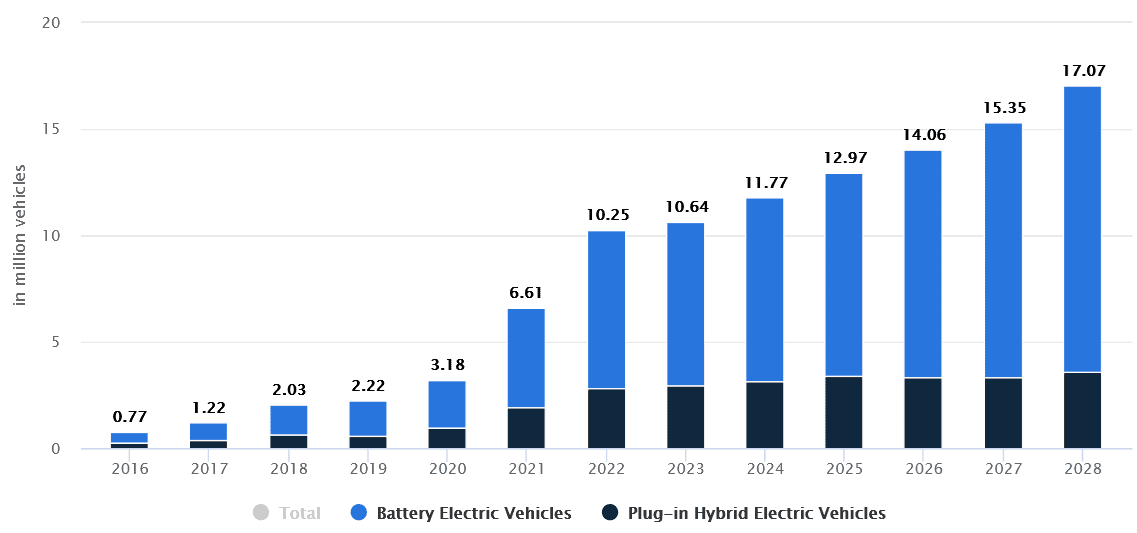

Investing in commodity stocks can be a bumpy ride when conditions in end markets worsen. Take lithium miner Kodal Minerals (LSE:KOD), whose share price has slumped due to slowing sales of battery-powered electric vehicles (EVs).

I think recent weakness could represent an attractive buying opportunity, however. This penny stock — which is developing the Bougouni mine in Mali — could still deliver stunning profits growth when its flagship asset is up and running.

EV sales have hit a bump in the road recently. But demand for low-carbon technologies is still tipped to soar over the long term as the fight against climate change intensifies and lawmakers take steps to encourage product adoption. Sales of EVs should also recover as charging infrastructure steadily improves.

I like Kodal in particular because of the quality of its African asset. High-grade Bougouni could produce up to 220,000 tonnes of lithium-rich spodumene each year based on current estimates.

An added bonus is that Kodal received $100m from stakeholder Hainan Mining to fully finance the mine’s development. Getting projects like this off up and running is complicated and expensive work. So having the backing of a major partner like this helps reduce the risk to investors.