For decades, investment strategies focused on FTSE 100 shares have proven to be a great way to generate long-term wealth. My own stock-buying philosophy is geared heavily towards Footsie shares, complemented with a peppering of FTSE 250 stocks.

Who can blame me? The UK’s leading share index has delivered a brilliant 7.5% average annual return since 1984. That’s much better than the return investors could have made with low-yielding savings accounts over that period.

Past performance is no guarantee of future gains. But let me show you how I could make a healthy passive income for retirement with FTSE 100 stocks.

A £25k+ passive income

On my journey to create long-term wealth I’ve laid down the following criteria:

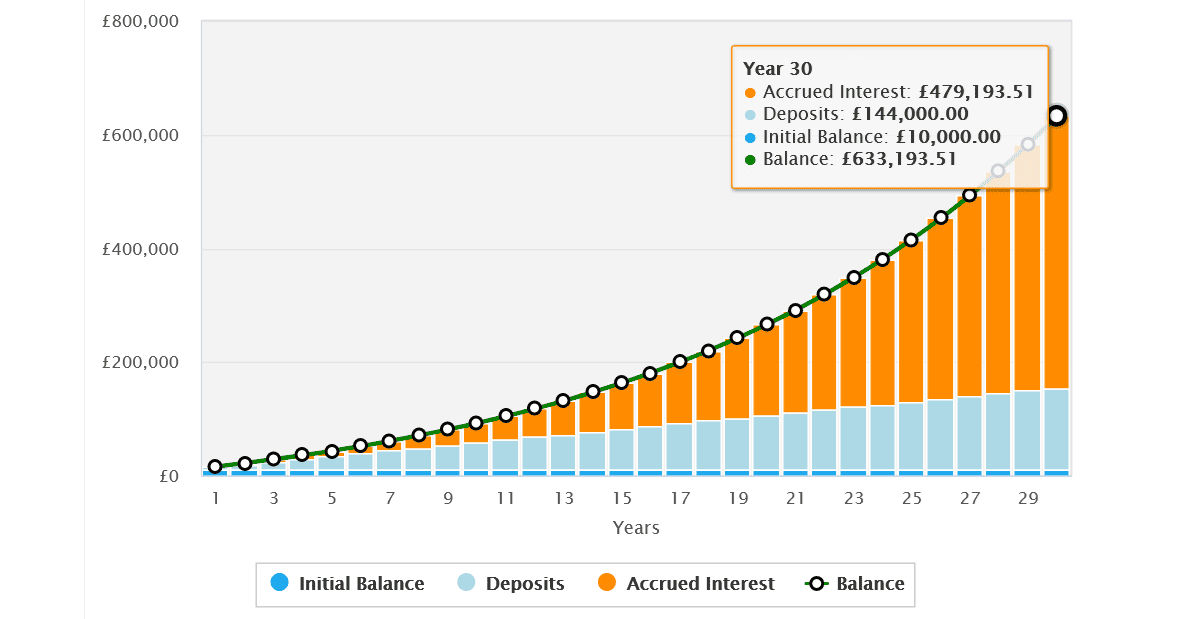

- To put £10,000 in a tax-efficient Stocks and Shares ISA at the beginning

- To invest this sum — along with an extra £200 each month — in FTSE 100 shares

- To reinvest any dividends I receive in more Footsie stocks

- To retire in 30 years, giving my retirement fund plenty of time to grow

If I manage to meet all of these criteria — and assuming that the Footsie’s 7.5% average yearly return remains in tact — I would have made an impressive £633,194 by the end o it.

If I then chose to withdraw 4% of this sum down each year I would enjoy a decent income of £25,327. Why 4%, you ask? At this level, I could draw a passive income for three decades before my retirement pot ran dry.

A FTSE 100 share I’d buy

I would also need to spread my net wide and not just invest in a small pool of similar Footsie stocks. This narrow focus could see me miss out on growth opportunities elsewhere, and leave me exposed to greater risk from industry- and economic-related factors.

Instead, I’d look to build a broad portfolio of at least 15 stocks that span different sectors, geographies, and which perform differently at each stage of the economic cycle. This way I can continue growing my portfolio when times are good as well as when things get tough.

I’d also seek companies that boast robust economic moats, as investing expert Warren Buffett would describe. These are competitive advantages that safeguard long-term earnings and defend market share from rival businesses. GSK (LSE:GSK) is a perfect example of one such stock, I feel.

Buffett once held the company’s shares through his Berkshire Hathaway firm, and it’s easy to see why. Many of its drugs (like its Shingrix shingles treatment) are leaders in their fields. The firm is also a leading force in the fast-growing vaccines market thanks to heavy investment in recent years.

It’s also not easy and cheap to develop pharmaceuticals products, which protects the firm from the threat of new market entrants. GSK spent a whopping £5.5bn on research and development in 2022. That’s more than the market-cap of many FTSE 100 companies.

Developing drugs is an expensive and complicated business. And troubles at the lab bench can have a significant impact on earnings. But GSK has an excellent track record on this front, which is why I’m looking to add it to my portfolio when I next have cash to invest.