I believe investing in FTSE 100 stocks is an excellent way to build long-term wealth. It’s why I continue prioritising blue-chip shares from the Footsie index (along with a smattering of top FTSE 250 stocks).

Investing in stocks can be a wild ride when news flow changes and investor confidence sinks. But over the long term it can provide life-changing wealth in retirement.

And following fresh research on how much money I may need once I finish work, my strategy of investing any extra cash I have has taken on greater importance.

£738k pension pot

As I’ve previously reported, the Pensions and Lifetime Savings Association (PLSA) last week upgraded its forecasts for how much the average single Brit will need to retire comfortably. Its latest estimates can be seen below:

| Standard of living | Former forecast | New forecast | YOY change |

|---|---|---|---|

| Minimum | £12,800 | £14,400 | + £1,600 |

| Moderate | £23,300 | £31,300 | + £8,000 |

| Comfortable | £37,300 | £43,100 | + £5,800 |

Not to be outdone, financial services provider Quilter also raised its estimates on the size of the pension pot the average single person will need for a comfortable lifestyle in retirement.

The new figure stands at an eye-popping £738,000. That’s up a whopping £100,000 from Quilter’s previous forecasts.

Jon Greer, head of retirement at Quilter, said that the PLSA’s latest forecasts show that it “will take a concerted effort to achieve a pension pot required to meet the difference between the [required income level] and that provided from the full State Pension“.

Hitting the target

The exact amount needed to retire differs from individual to individual. But that research provides a useful guide for all of us. And it clearly makes for sobering reading.

However, I’m not letting panic take over. By starting my investment journey early and regularly buying FTSE 100 shares, I have a good chance of hitting that target laid down by Quilter.

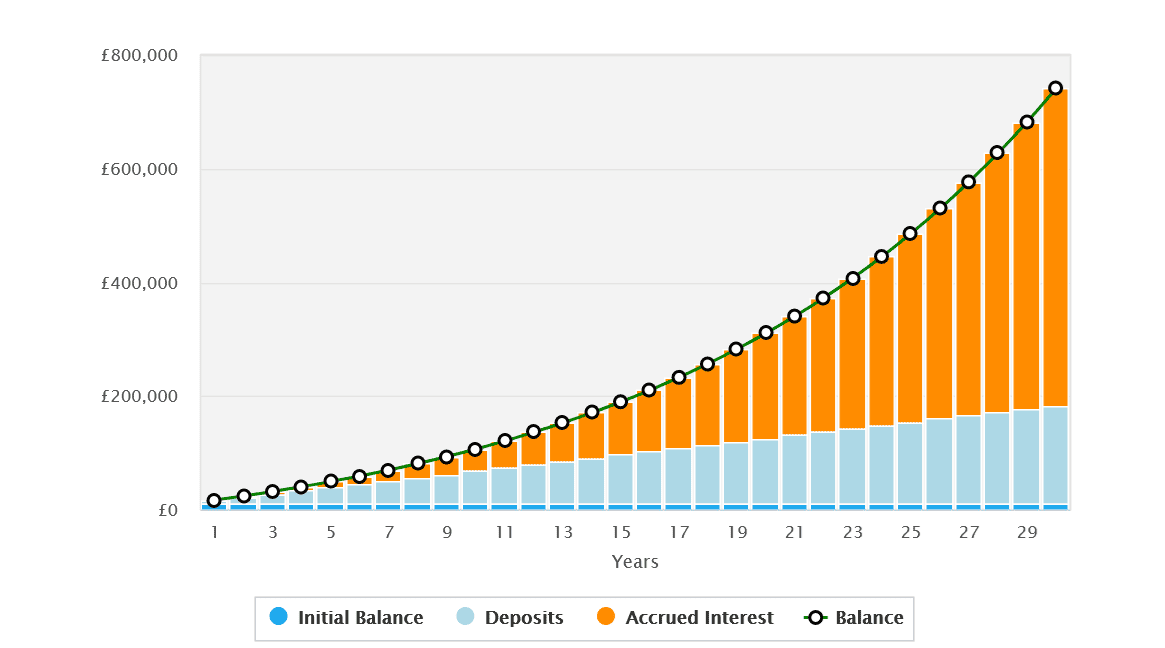

The UK’s premier share index has delivered an average annual return of 7.5% since 1984. If this trend continues, after 30 years I would — with an initial investment of £10,000 and a regular monthly investment of £480 — create that pension pot that Quilter identified.

A top FTSE 100 stock

Past performance is not a reliable guide of what I can expect. But the Footsie‘s excellent long-term returns show what I could potentially achieve over the long term.

And by building my portfolio around robust, multinational companies with strong balance sheets, I can boost my chances of hitting my retirement goals. We’re talking about businesses like Reckitt (LSE:RKT), which owns leading consumer healthcare brands like Strepsils lozenges and Durex condoms.

Despite the problem of rising costs, this Footsie share still has an exceptional record of growing profits with its popular labels. And it has considerable financial clout that it can use for marketing and product innovation to keep sales rising.

Reckitt also has significant exposure to fast-growing emerging markets that it can leverage to generate long-term profits growth. By surrounding these sorts of shares in my portfolio with some high-risk, high-reward FTSE shares, I think I have a great chance of enjoying achieving a comfortable lifestyle when I retire.