I’ve a little bit of money in an HSBC active savings account — the type you can withdraw from immediately — and, for the first time in 12 years, I’m actually getting some noteworthy interest. However, this isn’t going to last for long. With a couple over years, interest on this account will be close to zero. It’s not a long-term passive income option.

So what’s the alternative? Well, personally, I have the majority of my wealth in a Stocks and Shares ISA. Through this tax-efficient vehicle — I pay no tax on capital gains or dividends earned within the wrapper — I invest in stocks with the long-term objective of earning a passive income.

Time + contributions = growth

The reality is, that even with £20,000 invested in stocks, I’m not going to be able to generate a particularly large passive income. Taking 8% as the very best dividend yield achievable, I’d only be able to earn around £1,600 a year.

Should you invest £1,000 in Greggs Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Greggs Plc made the list?

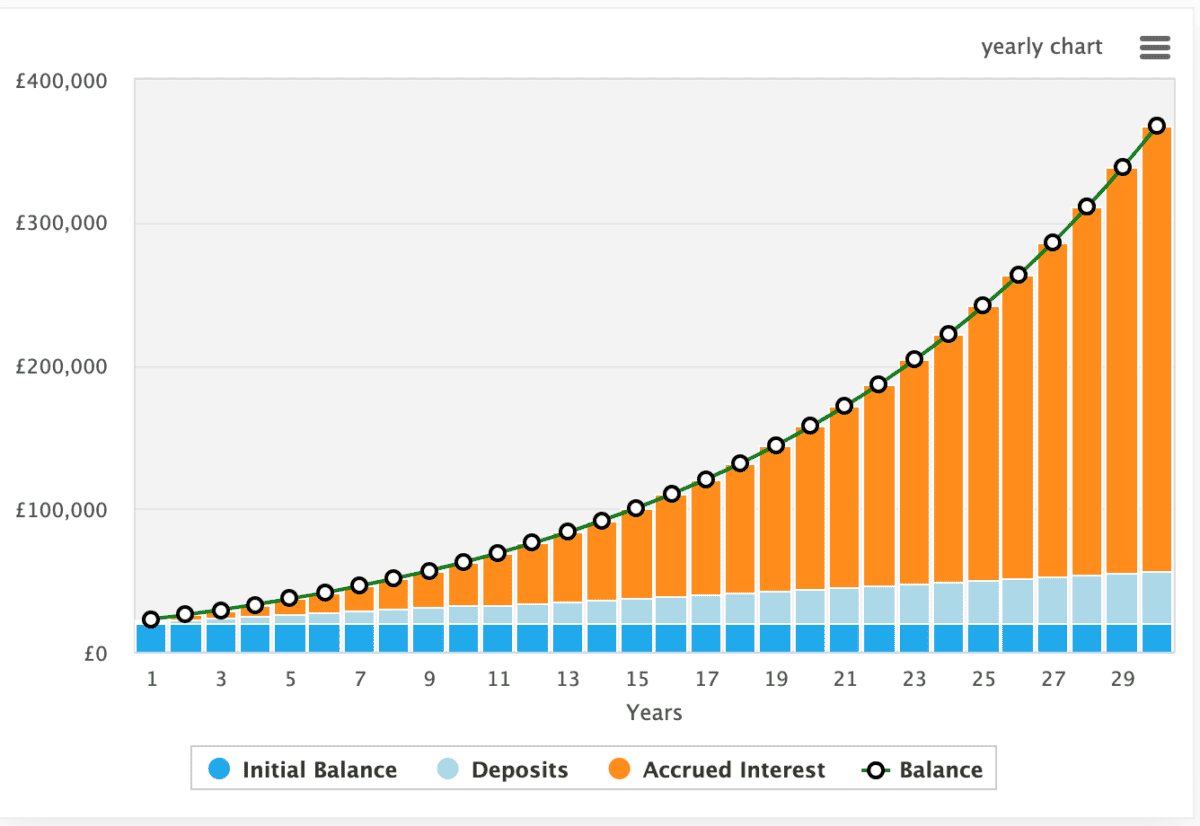

This is where time and regular contributions are phenomenally important. When we invest, and then reinvest our returns, we allow our money to grow. And the longer we leave it, the faster it grows because we start earning interest on our interest. As highlighted by the below, interest compounds.

Next, I’ve got to think about making regular contributions. This is another way to get my portfolio growing, even if it’s just £100 a month. Collectively, over time, reinvesting and making monthly contributions will see my portfolio grow significantly.

In fact, keeping the annual return/dividend at 8%, after 30 years, including a £100 monthly contribution, I’d have £390k! That could generate £28,133 of passive income in the 30th year.

The growth phase

I’ve used 8% as an example throughout because it happens to be a strong return for a novice investor. But it’s also, as mentioned, pretty much the best dividend yield I could receive right now when investing in a handful of stocks.

Personally, I’m looking to grow my portfolio faster than 8% annually. This involves investing in a diverse portfolio of stocks, many of which have great growth prospects and excellent metrics. In turn, that means I should have a large pot for generating passive income in the future.

One of these companies is Super Micro Computer (NASDAQ:SMCI). I’ve jumped in and out of this stock, but up 748% over the past 12 months — yes 748% — I think it’s still got further to go.

Super Micro is one of the enablers of the artificial intelligence (AI) revolution, providing high-performance, application-optimised server and storage solutions. These solutions, enhanced by proprietary-cooling technology, allow powerful semiconductors to work at peak efficiency.

Of course, there’s a risk other companies will enter the market. But, for the foreseeable future, Super Micro has the market cornered, while benefitting from key partnerships with Nvidia and AMD.

Looking at the metrics, the stock still looks undervalued. It has a price-to-earnings-to-growth ratio of 0.86. Anything under one infers a company is undervalued. And remember, this stock keeps on beating expectations.

Not every pick will be a winner, but the big winners certainly help my aggregated performance. In the last few months I’ve been fortunate with Super Micro, Nvidia, Rolls-Royce, GigaCloud, Powell Industries, Meta, and Celestica all up more than 30%.