There are plenty of ways to earn a second income, especially if we believe all the adverts shared across social media. While I’ll dabble in currency trading, my preference is to invest in stocks today for a second income in the future.

Three core tips

So just how can we turn a monthly contribution, like £200, into a significant second income? Well, here are three core tips I incorporate into my investing strategy.

Firstly, I’d be using a Stocks and Shares ISA. That’s because the ISA wrapper allows me to benefit from the appreciation of stock values and receive dividends without paying tax. This is hugely important as I look to build my £200 a month into a much larger portfolio. It’s even more important when I want to drawdown a second income.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

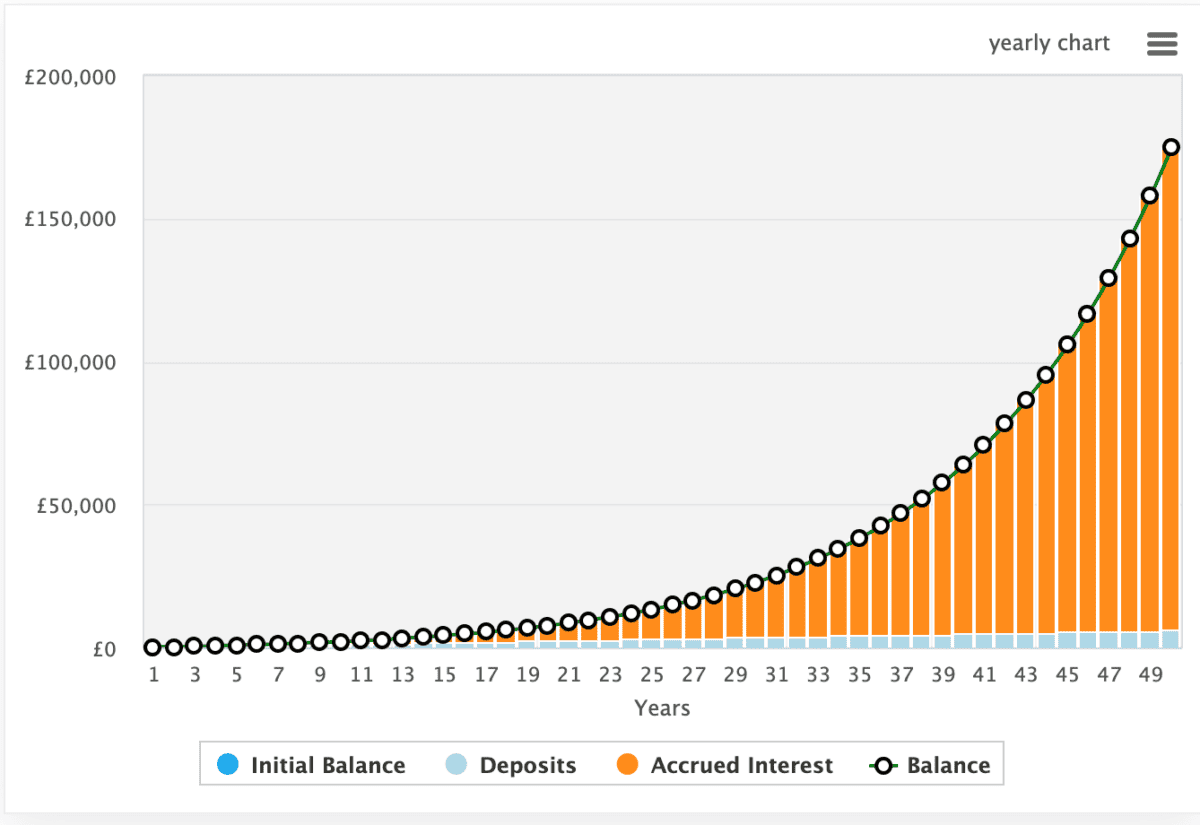

Then next step is reinvesting. Reinvesting what my portfolio earns allowing me to benefit from something called compound returns. This is simply the process of earnings interest on my interest. And the longer I reinvest for, the faster it grows. Just look at how £10 a month grows over 50 years.

And finally, it’s about making sensible investment decisions. The reality is, many novice investors can lose money. It’s not about choosing companies we like, but picking stocks based on research and sound investment advice.

Investing for growth

Most of my recent investments have been growth focused. That’s because I’m looking at earning a second income in 20 years or so, and that’s reflected in the nature of the stocks I’ve picked.

Here’s my investments over the past six months. As we can see, they tend to be growth-oriented companies.

| Pick | Performance |

| Abercrombie | 19% |

| AppLovin | 17.9% |

| Burberry | -20% |

| Celestica | 27.7% |

| Dorain LPG | -20.1% |

| GigaCloud Technology | 30.7% |

| Meta | 52.1% |

| Nvidia | 41.8% |

| Powell Industries | 55.9% |

| Rolls-Royce | 31% |

Investing for income

Let’s assume I’m able to actualise an annual average return of 10%. In other words, my investments grow by 10% each year. Assuming I’m starting with nothing and investing £200 a month, after 20 years I’d have £153,139.

So if I wanted to turn that into a second income, I’d ideally be investing in dividend-paying stocks. One of my top dividend stocks is Phoenix Group (LSE:PHNX). It’s not hugely exciting, but offers investors an enticing 9.7% dividend yield.

It’s actually the biggest dividend-paying insurance stock on the FTSE 100, and insurance companies tend to be fairly strong when it comes to yields. That’s largely because they’re established companies with little need to reinvest for growth, and their stable cash flows make dividend payments easier.

The company certainly could have a stronger dividend coverage ratio. It currently stands at 1.6 times, which means earnings are equal to 1.6 times the dividend payments. Normally, a ratio of two times is considered strong.

Nonetheless, this is the type of no-thrills stock I’d be looking to in order to help me turn my £153,139 into a second income. Of course, if I put all my money in Phoenix Group, I’d receive around £15,000 a year and, hopefully, this figure would grow as well-run companies increase their dividend payments over time.

However, it’s prudent to invest in a broad array of stocks. So at best, I could probably actualise a yield of 8%. Meaning my £153,139 could generate £12,251 annually.