The recent drop in the JD Sports Fashion (LSE:JD) share price has surely got its shareholders worried. However, I wanted to take a look and see whether this could be a buying opportunity for me or if it’s time I avoid it altogether.

Based on my research, here’s where I think it could go from here.

Explaining the recent drop

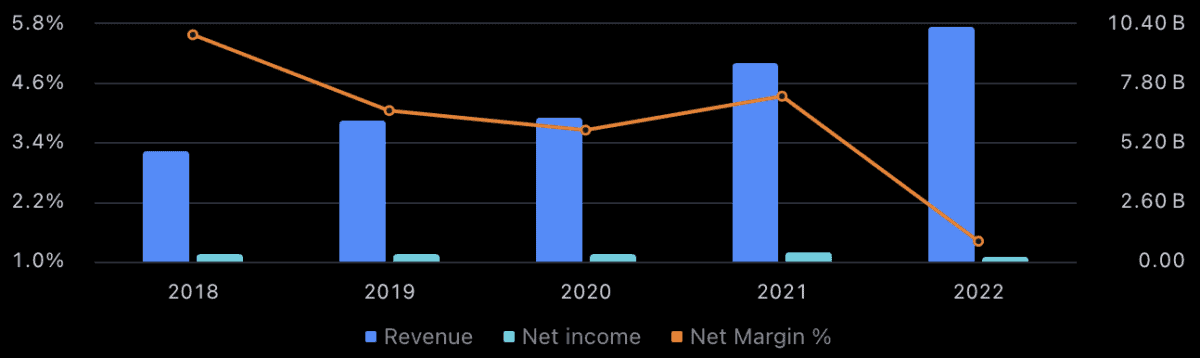

It seems to me that the recent fall in the JD share price, which actually extends as far back as 2021, can be attributed to earnings instabilities. Its net margin has been declining for quite some time:

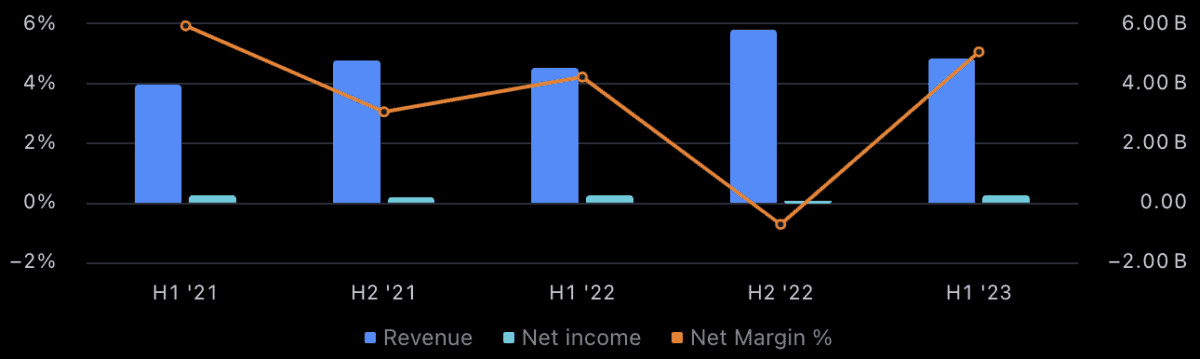

However, recently, it has been making progress in getting this back to normal:

The thing is, analysts are unsure whether these results will last. The consensus for 2024 is that JD Sports will report earnings of £0.12, down from the £0.13 reported for 2023. The good news is, for 2025, the consensus estimate is back up to £0.13 again.

The future seems to bode well for JD Sports based on what I’ve discovered. For example, its revenue has continued to grow steadily on an annual basis, and analysts expect this to continue in 2024 and 2025 without a full year of decreases for five years.

The value opportunity I’ve seen

With the share price dropping so significantly on what seem to be temporary woes, I think this could be an exceptional time for me to buy a stake.

After all, the price-to-earnings ratio at the moment is just nine based on future earnings estimates. That’s certainly cheap, considering the median for the industry is around 15.

Also, I use discounted cash flow analysis to check if an investment might be selling at a good price. By projecting the firm’s expected earnings forward, I can see what its value could be worth today.

Based on my calculation, JD Sports could have as much as a 50% undervaluation in its share price at the moment if it achieves a conservative 10% growth in earnings a year. Its average annual earnings growth rate over the past 10 years is 30%; so my estimate definitely looks achievable.

Risks if I invest

Now, while it might sound like I consider JD an almost perfect investment at the moment, there are certainly some risks.

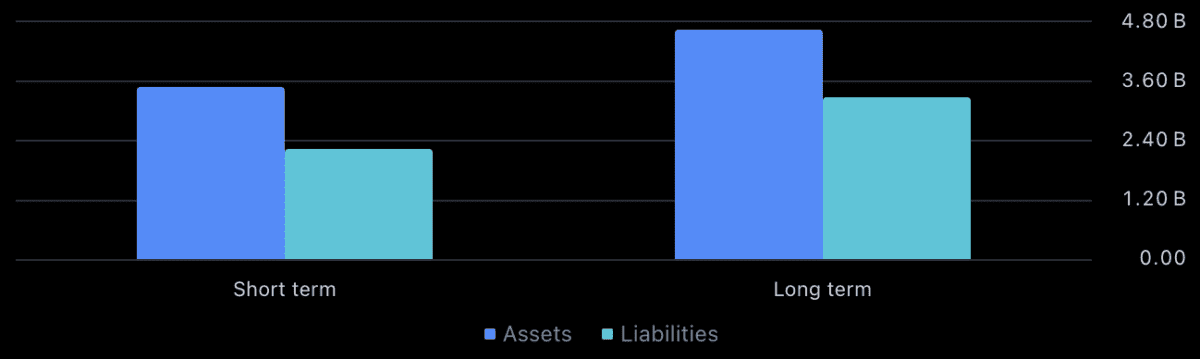

For example, its balance sheet right now is less than ideal, with only 25% of its assets balanced by equity. That means a large 75% of what it owns is proportioned by debts.

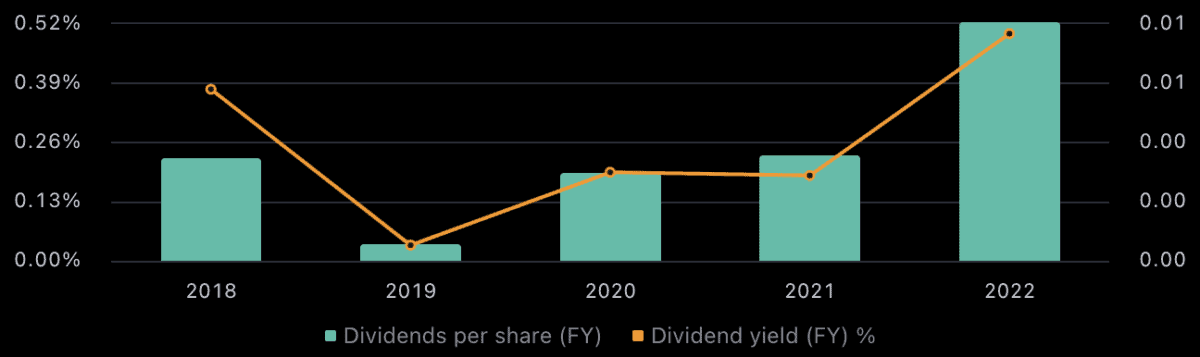

Additionally, JD Sports has a dividend yield of 0.9%, which is in the bottom 15% of companies in its industry. That makes the shares much less attractive if I was seeking passive income, too.

My takeaway

If I was already a shareholder in JD Sports, I’d probably buy more shares now they’re selling on the cheap. This seems to me to be a great time to buy part of a wonderful business at a very rare low price.

I feel quite confident in the business model and financial forecasts for the company. Therefore, this firm is at the top of my watchlist right now. I might buy a stake when I next have some spare cash to invest.