I’ve been combing through the FTSE indexes in search of bargains that might help my portfolio grow. Among the many options, two stocks have attracted my attention, despite being very different from each other. What unites them is their apparent undervalued status.

FTSE 250 high-yielder

First up is Bank of Georgia (LSE: BGEO). Trading on a price-to-earnings (P/E) ratio of 3.4, this Tbilisi-based commercial bank is one the cheapest stocks in the FTSE 250. It also offers a very tasty forward-looking dividend yield of 7.5%.

This prospective payment is covered 3.1 times by forecast earnings. While no payout is certain, that type of high dividend cover is nevertheless reassuring.

Should you invest £1,000 in Bank of Georgia right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bank of Georgia made the list?

Above, we can see that the share price has actually more than doubled in the past five years. A big tailwind since 2021 has been higher net interest margins (the difference between interest earned from loans and paid on deposits).

This has helped the company’s earnings per share grow at a compound annual growth rate of 18% over the past five years.

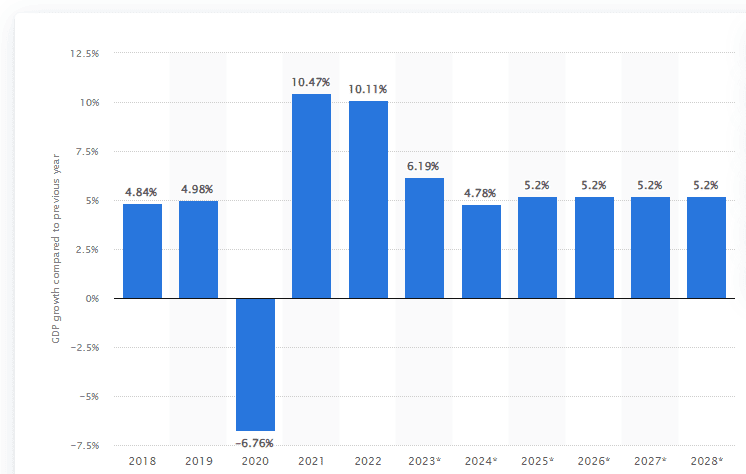

Furthermore, the Georgian economy continues to perform strongly, which is obviously paramount to the bank’s earnings. This healthy economic growth is expected to continue until at least 2028.

So why is the stock still so cheap?

Well, Georgia shares an approximate 723km border with Russia, against whom it lost a brief war in 2008. So there’s perceived geopolitical risk here.

It has also recently gained EU candidate status. While this accession process can be lengthy and challenging, and will be sure to irk Moscow, it should further improve confidence in the country’s economic prospects. Its banking system already complies with the EU’s Basel III regulations.

To sum up, Georgia is a booming trade and logistics hub in the Caucasus. As the country’s leading bank with a market share of around 35%, this cheap high-yield stock looks like a potential buy for my portfolio.

A FTSE 100 faller

My next pick, JD Sports Fashion (LSE: JD), will be far less obscure to UK investors.

On 4 January, the ‘King of Trainers’ issued a profit warning, saying that holiday season trading had been weaker and more promotional than previously anticipated.

Consequently, it now sees a pre-tax profit of £915m-£935m for the year ending 3 February 2024. It had previously set itself an ambitious £1bn profit target.

The share have tanked 32% since this announcement and now trade on an incredibly low P/E ratio of 9.

Clearly, this drop reflects concerns about the difficult economic backdrop. And we can’t rule out things getting worse. Yet the firm still expects full-year organic revenue growth of 8%.

If it can achieve this in tough conditions, it makes me optimistic about better times to come. And surely they will for the global athleisure firm, given the world’s increasing focus on exercise and relaxed everyday dressing.

It’s also important to remember that its competitive position may actually get stronger. I mean, if sales are relatively slow at JD, imagine how bad things are for smaller sports clothing retailers. Many of those might go bust, leaving the company with an even greater future market share.

As such, I’d feel comfortable buying and holding the stock if I had spare cash to invest.