The BT Group (LSE:BT.A) share price has endured a volatile five years, but it’s in a particularly poor position today. Currently, the FTSE 100 telecoms giant trades at a 52-week low, with the shares changing hands for 106p each.

So, is the stock a steal considering today’s beaten-down valuation and chunky dividend yield? Or does a weak balance sheet mean investors should avoid this company?

Here’s what the charts say.

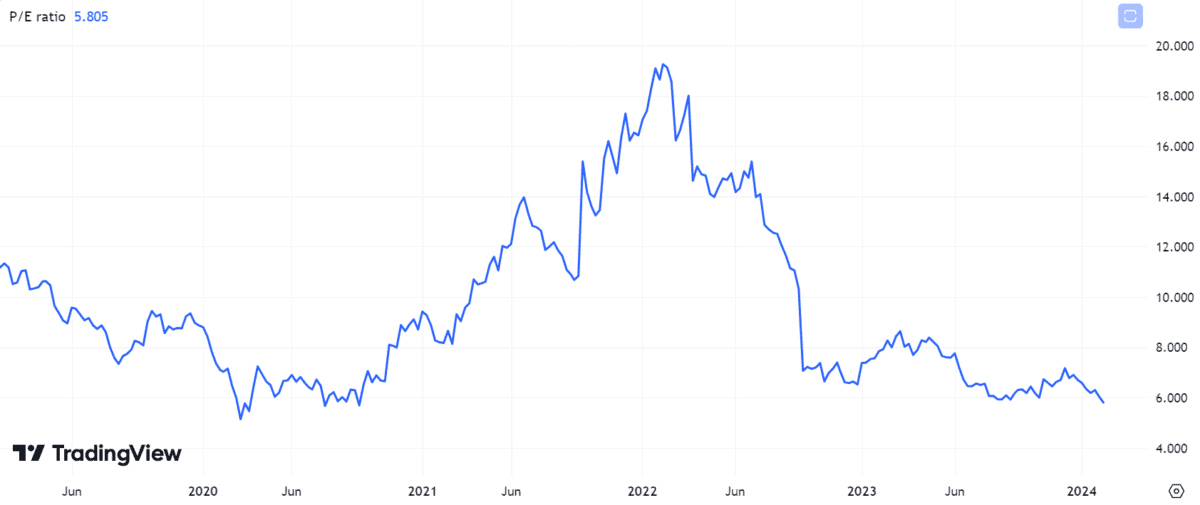

Valuation

Using the price-to-earnings (P/E) ratio as a valuation gauge, BT shares look cheap. With a multiple of around 5.8 times, the stock’s currently trading at the bottom end of where it’s been over the past five years.

In addition, the company’s forward P/E ratio is in the same ballpark and the average investment ratio across FTSE 100 shares is a fair bit higher.

BT’s latest results revealed some reasons to be optimistic. The group’s on course to deliver £6.1bn in profits for FY 2023. Strong adjusted turnover and price hikes for its Openreach broadband service have helped to brighten the outlook.

However, a cheap valuation doesn’t guarantee positive future returns. The business currently faces a series of class action lawsuits over claims it used a dominant market position to overcharge around 3m landline customers. If BT’s unsuccessful, it could be liable to pay compensation of up to £1.3bn.

No doubt legal risks are contributing to the stock’s depressed valuation. Potential investors would be wise to bear this in mind.

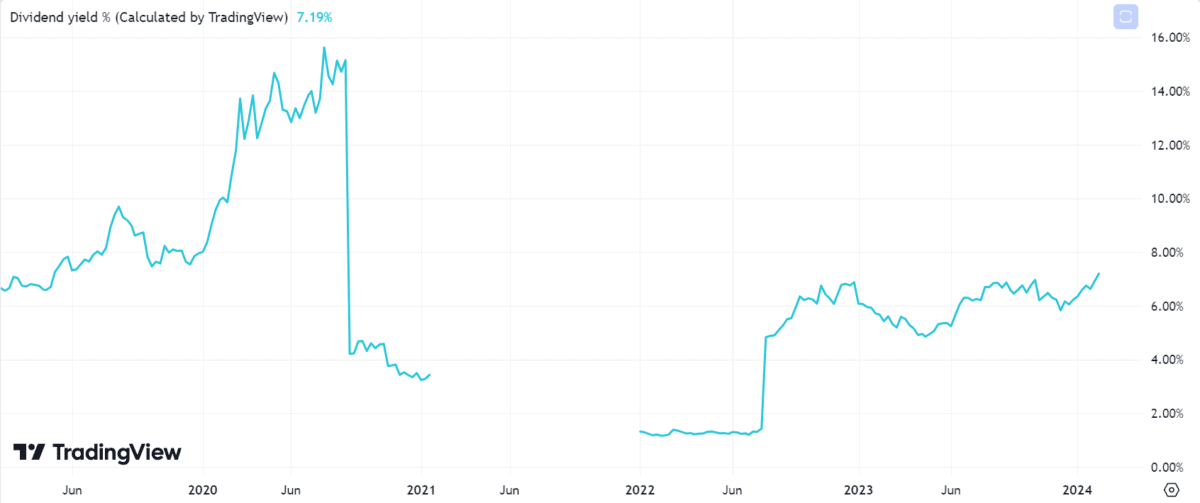

Dividends

One advantage of the falling BT share price is the positive effect this has had on the stock’s dividend yield. BT now offers market-leading payouts with its highest yield since 2020 and one that’s well above the FTSE 100 average.

Moreover, forecast dividend cover looks robust at 2.5 times earnings. With that margin of safety, BT shares could be potentially attractive additions to a passive income portfolio.

That said, the company’s dividend history isn’t flawless. Shareholder distributions were suspended for the first time in 36 years during the pandemic.

While this might have been an exceptional time, it’s worth noting that FTSE 100 Dividend Aristocrats, such as BAE Systems, Diageo, and National Grid, continued to reward investors with regular cash payouts.

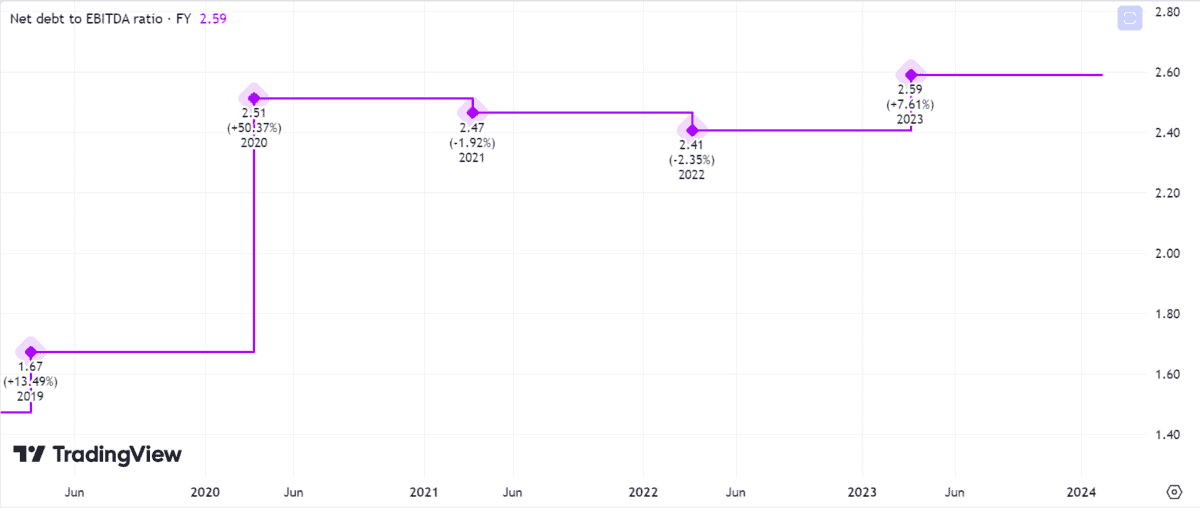

Debt

Finally, valuation metrics like the P/E ratio don’t provide investors with crucial information regarding the health of the company’s balance sheet.

In this regard, I have some major concerns about BT shares.

The company’s net debt-to-EBITDA ratio has ballooned in recent years. It continues to head in the wrong direction. Total net debt is expected to reach £20.48bn by 2025.

Granted, the board’s making moves to streamline the business, including plans for 55,000 job cuts by 2030 to be partially replaced by AI and automation.

Nevertheless, in a high interest rate environment that could persist for a while yet, high net debt levels could continue to weigh on recovery prospects for the BT share price.

A stock to consider?

Overall, I have too many concerns about the health of BT’s business and legal troubles to invest.

Potential investors might be handsomely rewarded with juicy dividend payouts, but it’s not enough to tempt me to buy the shares, even if the valuation looks cheap right now.