As inflation continues to run hot, I need to find ways to get my money to work as hard as possible for me. My favoured approach is to buy high-yielding FTSE 100 shares, to boost my passive income streams. With a decade-long track record of increasing payouts, I don’t need to look any further than shares in Legal & General (LSE: LGEN).

Growing dividends

First and foremost, I invest in businesses committed to shareholder value creation. Since 2016, Legal & General has paid out dividends of over £7.7bn, and its dividend per share (DPS) has increased 46%.

What I really like is that it has clearly laid out its dividend policy for both the 2023 and 2024 financial years.

For the financial year ending March 2024, it intends to pay out 20.34p. Of this, 5.71p has been paid by means of an interim dividend. This is 5% higher than last year.

Next year, DPS will grow another 5% to 21.36p. At today’s share price, that puts it on a forward yield of 8.5%, one of the highest in the FTSE 100. But, of course, no dividend is ever guaranteed.

Dividend sustainability

Naturally, I only want to invest in businesses that can support dividend increases into the future.

In 2020, it laid out its five-year ambition of growing earnings per share (EPS) faster than DPS. With cash and capital generation growing faster than dividends, I expect to see this translate into a pipeline of growth opportunities.

Today, it invests in growth industries including clean technology, renewable energy, health and life sciences, and urban regeneration programs.

Business model synergies

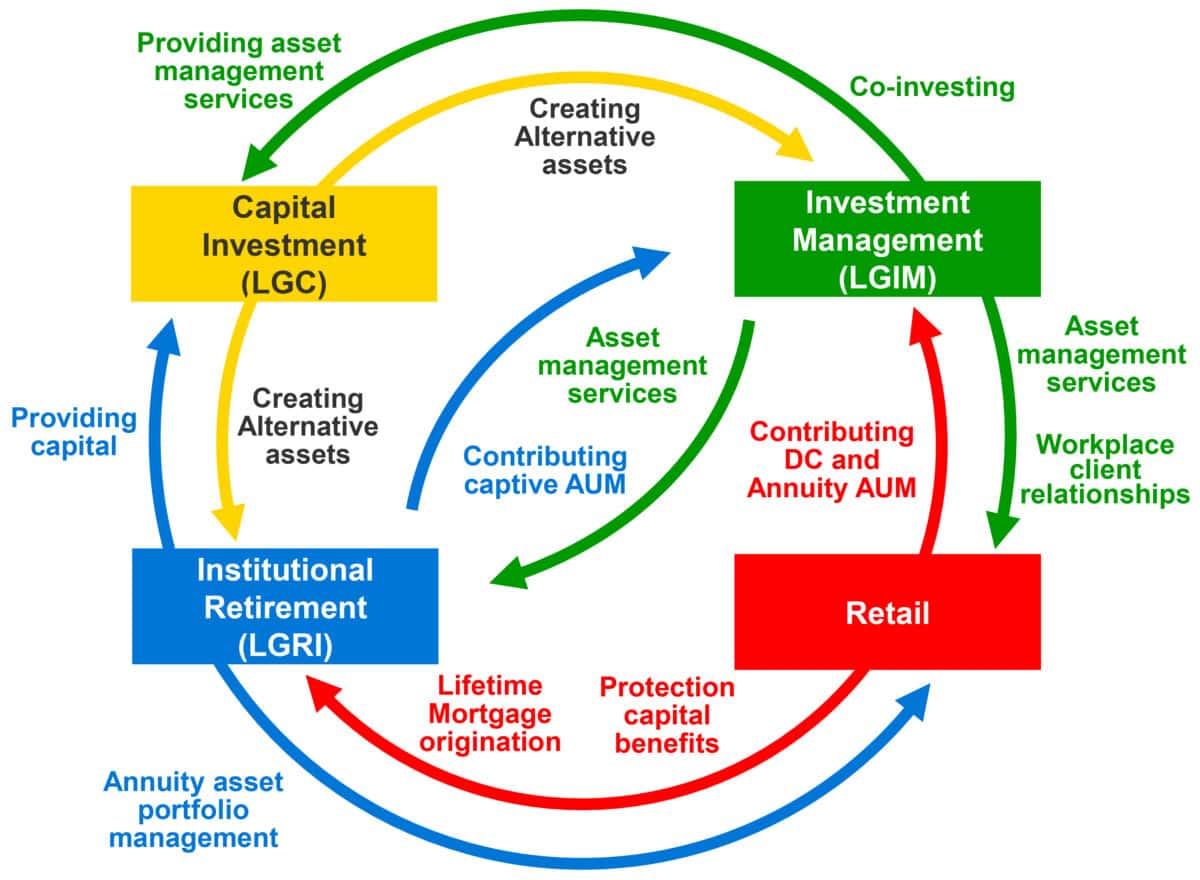

One characteristic of Legal & General’s business model that I think is not fully appreciated by the market is the extent of the positive interplay between its four divisions. This interconnectivity enables it to drive a consistent return on equity (ROE) of 20%.

The following infographic highlights the synergies between these four divisions.

Source: Legal & General

This synergy is a source of competitive advantage for the business. It demonstrates to me that the value and performance of its four divisions combined is greater than the sum of its separate parts.

Recession risk

My base case remains that the UK, and indeed global, economy is heading into a recession. If this plays out then there is little doubt that stock markets will decline, probably significantly.

As an investment management firm, Legal & General’s fate is intertwined with the wider economic environment, something of which it has no control over. Last year’s banking crisis highlighted how volatile its share price can become when bad news hits.

However, I view the company as having one of the most compelling growth stories over the next 10-plus years. Ageing demographics and the growing trend of individuals taking more control over retirement savings is one such mega opportunity.

The firm is also at the forefront of investing in the real economy. A significant part of the government’s ‘levelling up’ programme is bringing in private sector institutional capital to support regeneration of the built environment.

I am so confident in the long-term performance of its share price, that it’s one of only a handful of companies in which I always re-invest my dividends.