It’s not easy to exactly quantify just how undervalued a specific company may be. However, Warren Buffett and his mentor, Benjamin Graham, were the masters at finding cheap shares.

I’ve found one business called Nobility Homes (OTC:NOBH), which I think definitely makes the cut as a strong value investment.

So, I’m going to break down what it does, why I like it, and a valuation method for it that’s in line with Buffett’s long-term investment strategy.

Should you invest £1,000 in Alliance Witan right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Alliance Witan made the list?

Nobility Homes

The business primarily focuses on designing, producing, and selling manufactured and modular homes.

Its centres its operations in Florida, and it offers a range of price points and designs.

The company also works through its own sales centres and has a network of independent distributors.

All of Nobility’s revenue comes from the US, and it’s focusing on expanding beyond Florida.

Strong financials

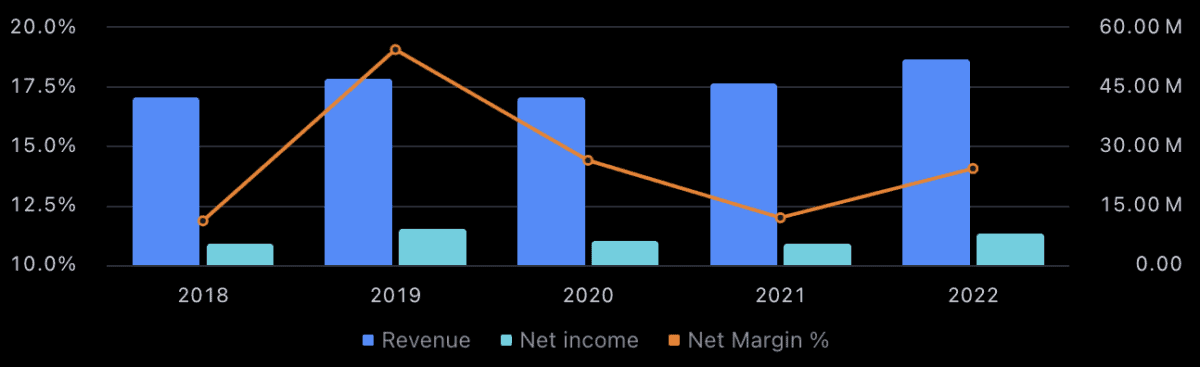

While the organisation had a slow couple of years between 2019 and 2021, since then, it has been growing nicely again:

Nobility Homes also has a dividend yield of around 3%, which adds value to the investment.

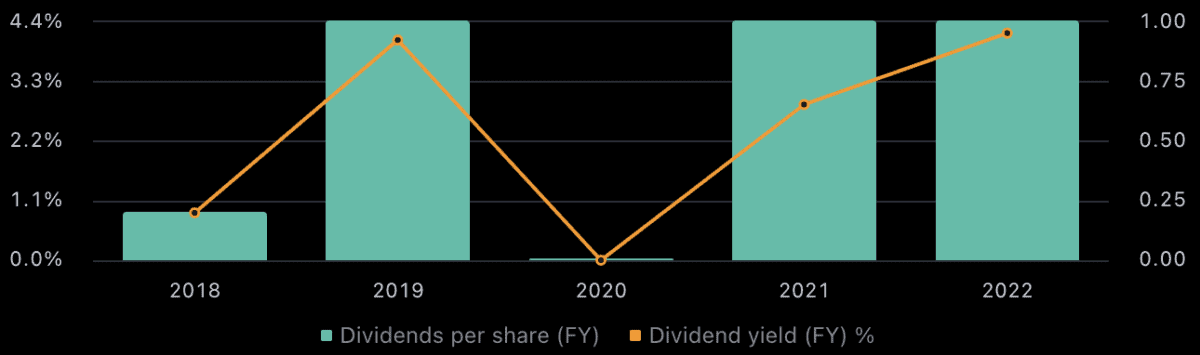

In 2020, this did take a dip due to the pandemic, but now it’s back to normal:

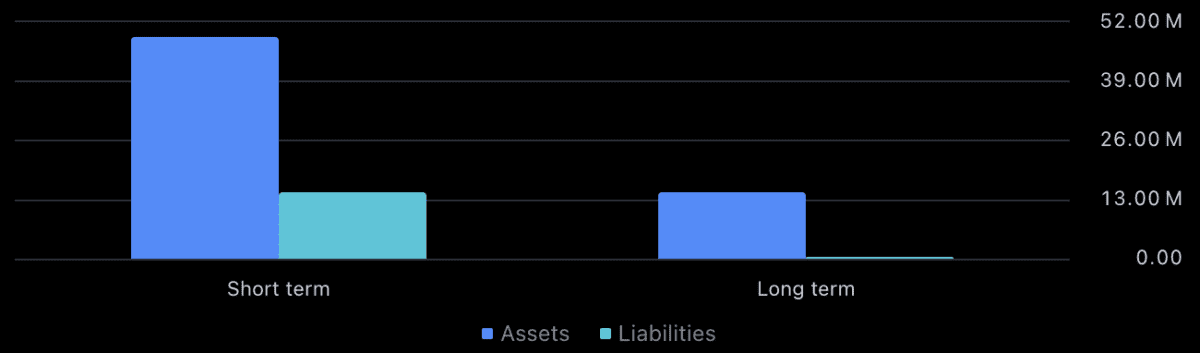

Additionally, the firm has way more assets than liabilities on its balance sheet. I always look for this because it shows stability in the business.

If a company has too much debt, I usually tend to stay away.

Buffett-inspired valuation

To gauge whether this investment might be selling for below what it’s worth, I used a valuation method called discounted cash flow analysis.

Buffett doesn’t perform this type of calculation, but he has said he agrees with the concept. It’s also inspired by his mentor’s value investing methodology.

I projected the earnings of the company forward, assuming a very conservative 10% growth for the next 10 years as an average.

I arrived at an estimate that each share of the company is worth $59.

That predicted growth is lower than it could be as, over the last 10 years, the earnings have actually grown at over 45% on average per year.

If the company continues to expand beyond Florida, my estimate could actually be too low.

By growing its earnings at 20% per year on average over the next 10 years, the fair value of each share right now could be $115. That’s a 70% discount.

Core risks

Now, even though the past earnings of Nobility Homes are very good, that’s no guarantee of future results.

Any economic hardship that hits the economy in Florida could mean lower earnings for the 10 years ahead. Indeed, growth could even be negative if something really bad happens to the business.

The housing market can be sensitive, and Nobility Homes would be directly affected by a sector recession or, even worse, a crash.

To buy or not to buy?

This company is great, in my opinion. It’s also small, so it has a lot of room to grow. At such a low valuation, with good operations and stable financials, I’ve added this one to my watchlist.

I reckon I’ll buy some of the shares this month.