The Greggs (LSE:GRG) share price has been on an impressive 10-year run, rising over 400% during that timeframe. That’s a 40% rise in price on average every year.

The company looks so strong to me on so many measures. For example, its growth and profitability look stellar to me. I’ll dive into exactly what in both of those areas I find promising.

However, every investment has risks. Those of Greggs include certain valuation concerns and some balance sheet issues at present.

Greggs in 2024

The company is a Britain-based company that produces and sells retail bakery food and drinks.

This year, it is focusing on expansion, including internationally. It wants to open about 150 new restaurants after a 20% sales growth reported in 2023. To do this, it has £195m of cash on hand.

As of 2023 year-end, it had a total of 2,473 shops in operation.

Greggs has also expanded its delivery service with Uber Eats to 710 shops, significantly adding to its existing capabilities with Just Eat.

High growth and high profits

Greggs has a 13.3% future revenue growth average estimated by analysts for the next three to five years. That’s in the top 10% of companies in its industry.

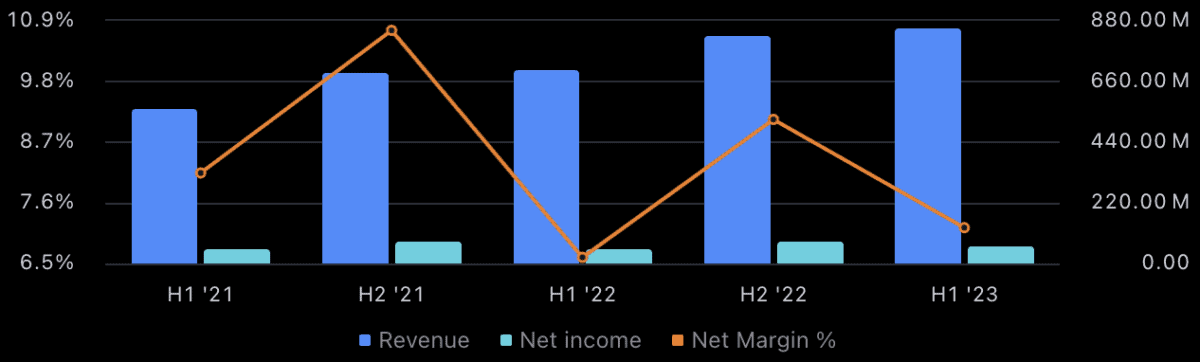

Over the last year, the company has grown its revenue at a rate of 21%. And while its net income has had a slightly bumpier ride recently, that’s only really short-term turbulence.

Looking at the business as a whole, it has a massive 61% gross margin. That’s in the top 5% of companies in its industry.

Additionally, its net margin of 8% is in the top 10% of its competitors. That’s impressive to me.

There’s been some decrease in its gross margin recently, however, other than that, I think the success looks set to continue.

Balance sheet and valuation risks

At the moment, 46% of Greggs’ total assets are balanced by equity. That means it has more debts than assets at this time.

However, this is slightly uncommon for the business. It’s usually had around 64% in equity over the last 10 years.

The largest risk I can see for Greggs at this time is its valuation based on some measures. For example, it has a price-to-earnings ratio of almost 20 at the moment.

While the shares are down around 23% from their high in 2021, I don’t think they exactly look cheap even now.

Based on how the share price has moved in the past, some volatility is quite likely if I become a shareholder.

Therefore, I need to make sure I’m comfortable being in the red for a while until the growth catches up over a few years. That’s not necessarily something I mind.

I think it’s strong

Based on my research on the company, I believe it is worth me owning. It’s also a simple business model and one I feel comfortable understanding.

While the price isn’t ideal, the growth and earnings of the business and expansion possibilities make me optimistic. I think the success is likely to continue based on consensus analyst estimates and the operations the company has underway.

Next time I look at making some investments, I think I’m going to buy some of the shares.