Having fallen 51% over the past 12 months, Atlantic Lithium‘s (LSE:ALL) share price remains locked in a downtrend that started in 2022. Lithium stocks like this have been under severe pressure of late as prices of the silvery-white metal have plummeted.

Signs of growing oversupply have pushed lithium prices to their cheapest since July 2021. Weaker-than-expected electric vehicle (EV) sales have caused inventories to build. And investors are nervous that prices could remain depressed as new supply enters the market and EV sales slow (especially in China).

Should you invest £1,000 in Harbour Energy Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Harbour Energy Plc made the list?

But could Atlantic Lithium shares now be a clever buy at current prices?

Reward vs risk

Atlantic Lithium owns the Ewoyaa lithium project in Ghana. It has designs on getting first material out of the ground in 2025, and is making a good fist of getting this done.

As a potential investor I’m conscious of further price weakness if lithium prices continue sinking. This is part and parcel of purchasing shares in any commodities stock.

Yet the potential long-term rewards of owning this former penny stock remain significant. This is thanks to the massive potential of its Ghanian assets, which was underlined in fresh drilling news on Monday.

Exciting results

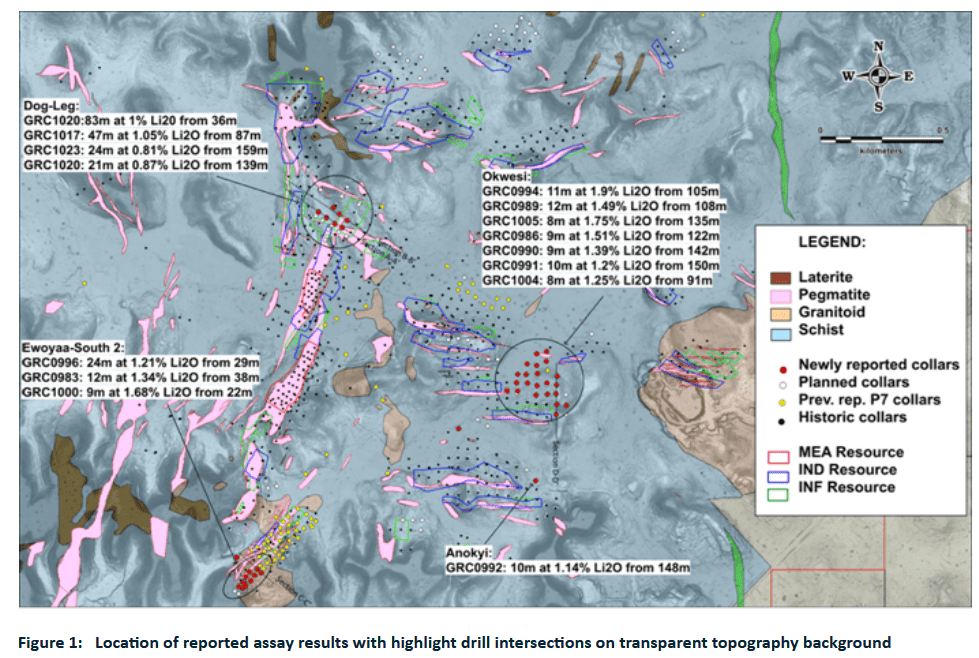

According to Atlantic, most recent exploration work in 2023 revealed “multiple high-grade and broad extensional drill intersections” at the Dog-Leg target, as well as the company’s Okwesi, Anokyi, and Ewoyaa-South 2 deposits.

Atlantic said that the results at Dog-Leg alone provide potential for “significant resource growth“. All of the results are outside of the mineral resource of 35.3m tonnes at 1.25% lithium oxide for Ewoyaa.

In good shape

Today’s (5 February) update is the latest in a string of positive drilling reports from the lithium business. Exploration work can be troublesome and fraught with disappointment, but so far Atlantic has a strong track record on this front that gives me confidence.

I also like this particular lithium miner because it’s in good financial shape to get Ewoyaa off the ground. A solid balance sheet gives it more wiggle room if any operational problems arise and thus reduces the risk to investors.

Piedmont Lithium has vowed to cover $70m of an estimated $185m to develop the monster asset. It will also take care of 50% of any additional costs that spring up. Furthermore, Ghana’s sovereign wealth fund announced last September plans to invest $32.9m in the project.

The verdict

As I say, lithium consumption has been in the doldrums recently, a development that reflects the impact of higher interest rates and China’s turbulent economy. These could remain problems for metal demand in 2024 too.

But the long-term outlook for lithium usage remains pretty solid. EV sales are still tipped to rise strongly in the next 10-20 years as decarbonisation initiatives intensify.

And Atlantic Lithium — whose Ewoyaa project is one of the largest lithium deposits on the planet — could be well placed to capitalise on this. I’ll be looking to add the company to my own portfolio when I next have cash to invest.