When buying FTSE 250 stocks for growth, a self-storage company doesn’t sound like the most exciting business. Yet, when looking at Safestore Holdings (LSE:SAFE), the commercial real estate manager has proven to be an very lucrative investment. In fact, it’s one of the most rewarding stocks on the entire exchange over the last decade.

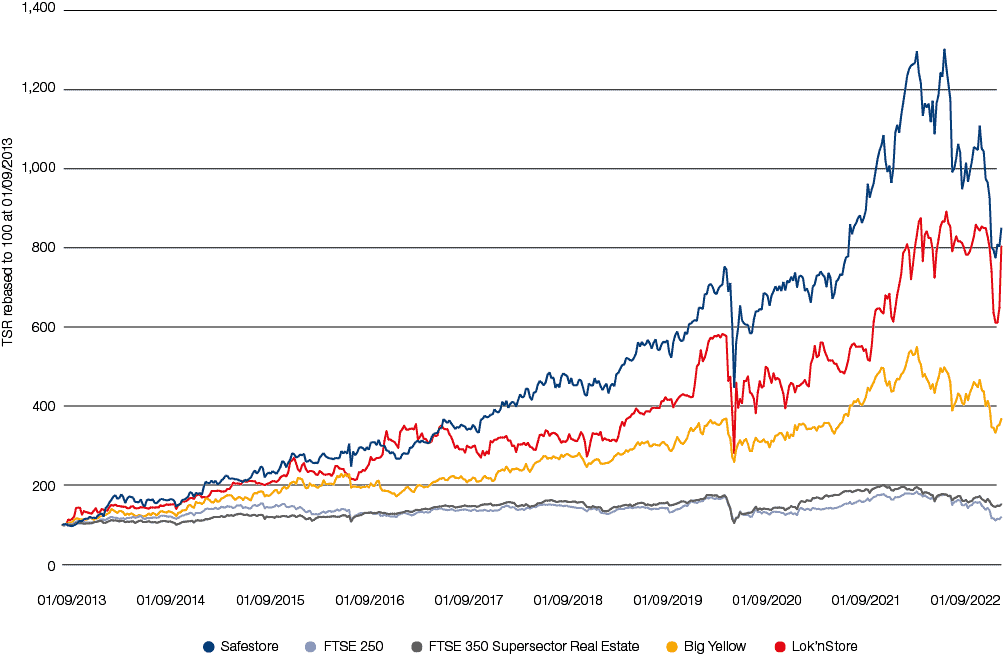

Demand for self-storage solutions among firms and households has been quietly rising under the radar. And management has been capitalising on this momentum both in the UK and in Europe. The result is over a decade of dividend hikes, pushing the total return above and beyond its closest rivals, as well as the FTSE 250 index as a whole.

Yet despite such monumental returns, shares continue to trade at confusingly low multiples. In fact, the price-to-earnings (P/E) ratio sits at just 8.7. What’s going on?

Should you invest £1,000 in Abcam Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Abcam Plc made the list?

Short-term headwinds

As the previous chart clearly demonstrates, the 2010s were a terrific time to be a self-storage landlord. Yet that story changed abruptly in 2021. With inflation rising dramatically, central banks around the world started hiking interest rates, causing property values to tumble. And Safestore’s real estate portfolio wasn’t spared.

In 2023, this downward pressure continued. And with inflationary costs also hitting the wallets of its tenants, the group’s occupancy ended up moving in the wrong direction, falling to around 77%.

But the impact on cash flows seems to have been mitigated, with its remaining customer base seemingly happy paying higher prices for their leased space.

However, moving forward, sticking to its historical growth is likely to be a challenge. Apart from currently seeing adverse operating conditions, a higher cost of borrowing also limits the group’s ability to acquire new properties without adding too much debt to balance sheet.

As such, the Safestore gravy train has come to an end in many investors’ minds. Yet, I’m still optimistic for the long run.

Patience can be profitable

It’s difficult to make firm predictions for industries over the next decade. However, while there are different opinions among research analysts, the general view is that the self-storage sector is set to expand a lot to 2030.

Europe in particular, is expected to lead the pack, given this industry has yet to reach maturity. And that’s a growth avenue management looks keen on walking down, given its investments in the Benelux region. Meanwhile, in the medium term, conditions in the UK appear to be on track to improve.

The Bank of England is seeking to cut interest rates within the next 12 months. That will both lower the cost of debt, as well as easing some of the pressure on household wallets, potentially re-sparking demand and occupancy for Safestore’s services.

Pairing all that with a 4% dividend yield, industry-leading performance (even in the current climate), and a track record of value creation makes me bullish on this business. That’s why it’s already a part of my investment portfolio, and I’m keen to add more at today’s prices.