When share prices are down for a specific FTSE 250 company I like, I also want to make sure its financials are still in check.

Fortunately, in this instance, Big Yellow Group (LSE:BYG) looks geared to grow despite its recent setback.

Here’s why I’m considering it for my portfolio, including the risks I’ve noticed.

Should you invest £1,000 in Boohoo Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Boohoo Group made the list?

What is it?

The organisation is a leader in self-storage in the UK, focusing on providing secure and modern storage units for both business and personal use.

It has a total of 107 sites, and it has branded 24 of these as Armadillo Self Storage.

The firm includes subsidiary businesses like Big Yellow Self Storage Company Limited and Big Yellow Construction Company Limited. The latter deals with construction management as opposed to self-storage. It also owns a property management company.

As such, the organisation has quite a wide range of operations, even though its core business is still storage.

The company actually trades as a real estate investment trust (REIT), so it is essentially a property fund.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Considering the financials

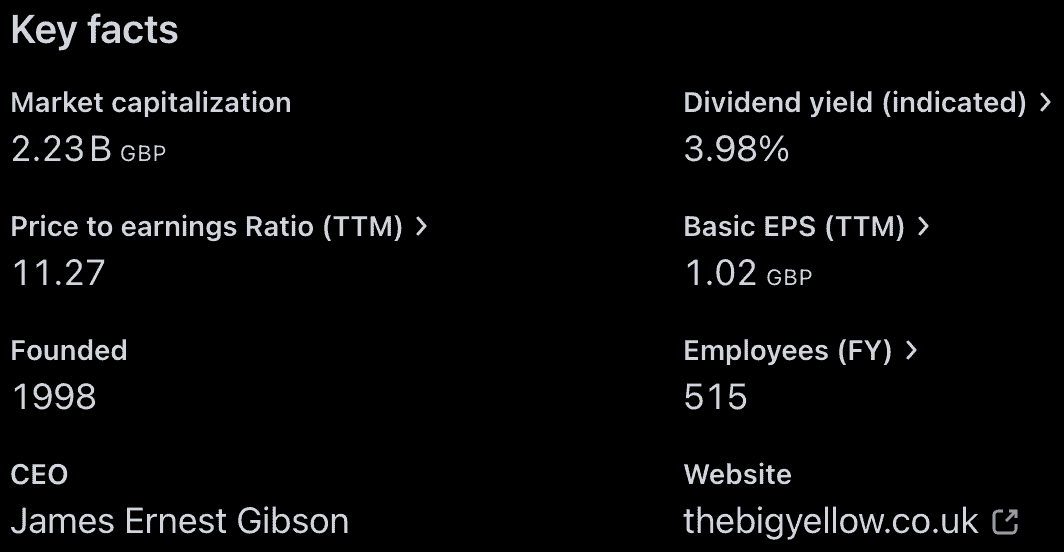

Here’s a nice snapshot of the company:

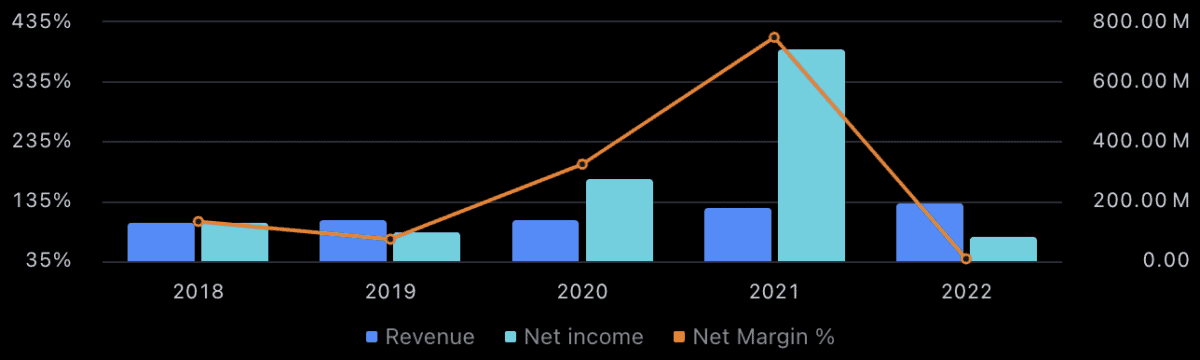

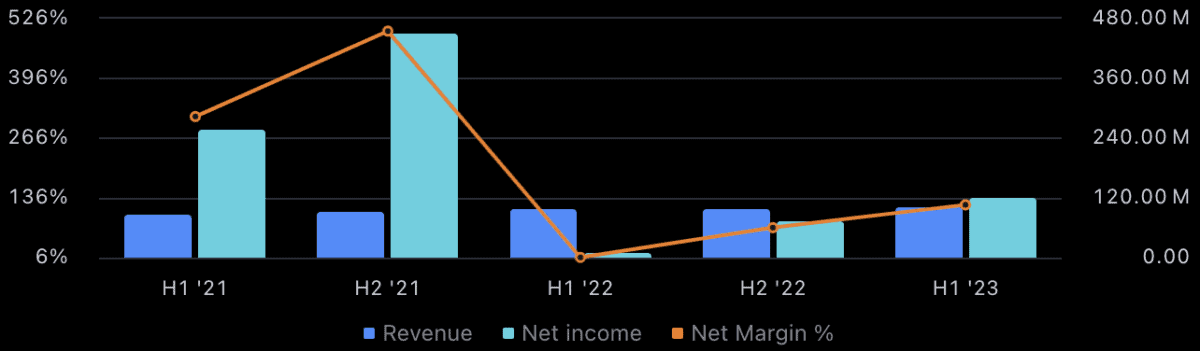

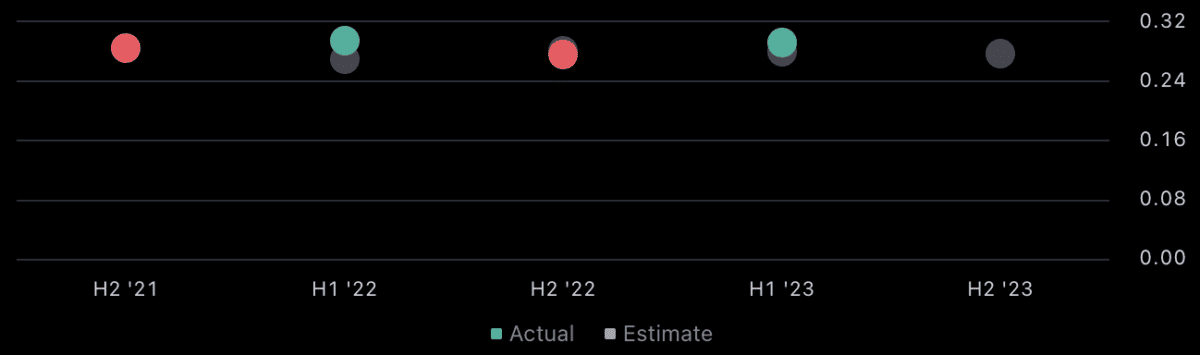

As of the last annual report, the business had a tough year. However, since then, its earnings have improved somewhat:

I often like to buy great companies when they are going through a tough time, as I can buy the shares for cheap.

The thing I’ve noticed is that sincerely excellent businesses almost always pull through momentary hardships.

At the moment, Big Yellow has a price-to-earnings (P/E) ratio of around 11. That’s very cheap compared to a median of 18 for REITs.

However, there’s a risk here: its P/E ratio based on future earnings estimates is a higher 19 or so.

That’s a problem, as it means its earnings are estimated to decrease by analysts:

Is this an opportunity?

I’m not sure this is the best investment right now. It certainly has a lot to offer, but its valuation looks less than ideal, even with the price so low.

I’m not saying its not going to be a long-term winner; I think it will be.

However, choosing shares for my portfolio always means I have to let go of other opportunities. After all, no one has infinite cash, not even Warren Buffett.

You see, based on the present valuation, it looks quite appealing to me. It’s the future earnings potential at the present price I think could be better.

For that reason, this is a company I would choose to hold if I already owned it, but I’m not up for buying it right now.

I’m not forgetting this

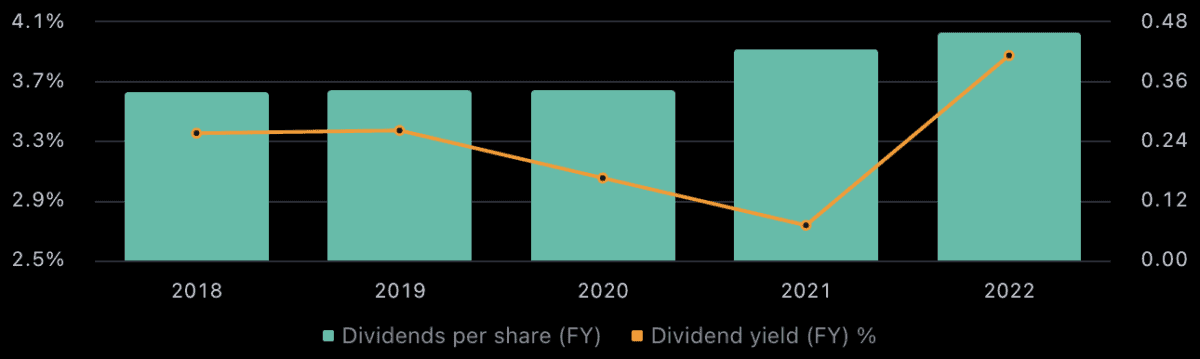

Even though it’s not going into my portfolio, I have to say if the dividend keeps rising, I could see that as a reason to buy. It could make up for a moderate deficiency in the valuation for me.

At present, Big Yellow has a dividend yield of 4%. Not bad at all.