On 1 February 2024, Shell (NYSE:SHEL) shares began to rise to a three-week high on the announcement of a 4% increase to its dividend and an extension of its share buyback program.

The news followed expectation-beating fourth-quarter results and was a positive surprise for current investors.

Looking at the company as a whole, do these developments make the investment a worthy addition to my portfolio?

A closer look at the news

As of the latest earnings report, the firm mentioned $54.2bn in cash flow from operations for the full year 2023, which is the second highest it has ever had.

Annual profits for 2023 are more than $28bn.

Its share buybacks are expected to total a further $3.5bn and are due to be completed before the results of the first quarter of 2024.

These buybacks will reduce the shares outstanding and help to increase the value of the stock.

Additionally, in 2023, it distributed $23bn to shareholders, which is more than 40% of cash flow from operations for the year.

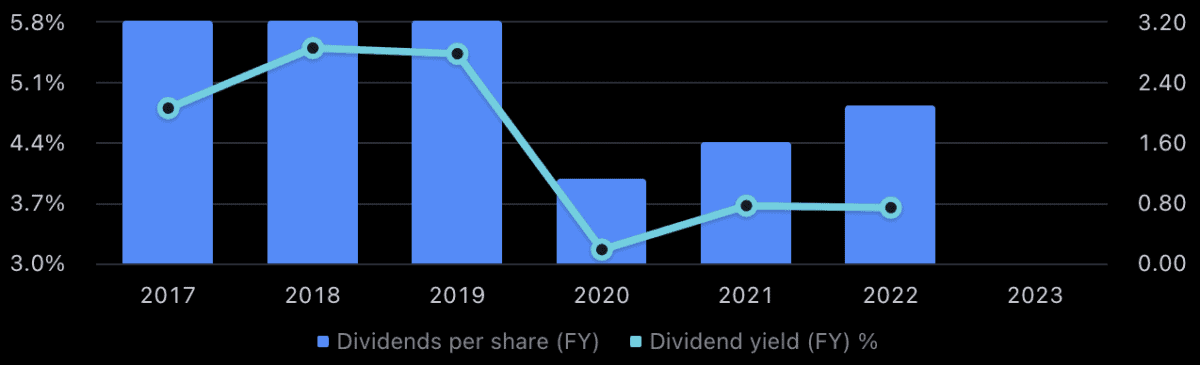

And the nice 4% increase in the dividend now puts the quarterly payment at $0.34 per share.

However, the yield is still lower than it has been in the past:

Investment overview

I think the current value could be an opportunity; its price-to-earnings ratio is just 7.5 right now.

It also has a stable enough balance sheet, in my opinion. While not excellent, it has 46% of its assets balanced by equity. That is roughly in line with the industry norm.

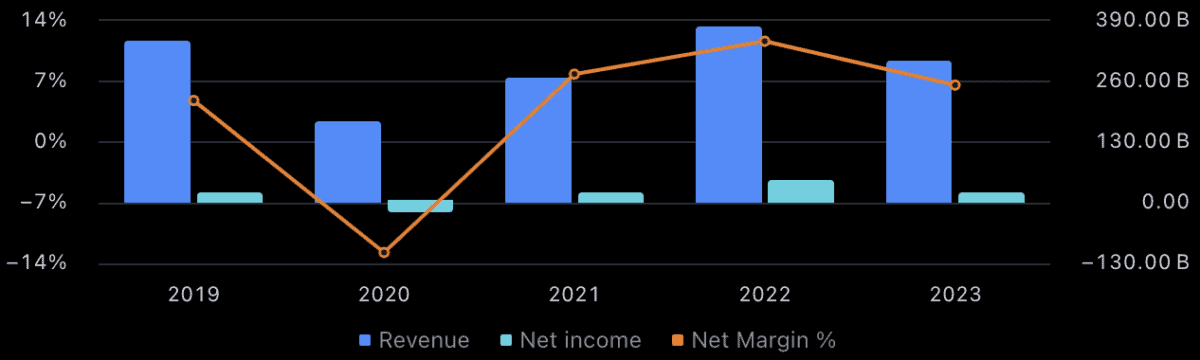

However, the firm’s revenue growth is particularly lacklustre if you ask me. It has grown at a rate of -4.1% over the last 10 years, and only 1.1% over the last five as annual averages.

The firm’s profitability and revenue are also down compared to last year after quite a strong pandemic recovery:

The main risks I see

There is significant tension in the world at this time. Therefore, oil and gas markets are increasingly at risk of being weaponised.

Shell has also strategically withdrawn from the onshore oil sector in Nigeria. This decision was the result of pollution, oil theft, and vandalism of pipelines.

In fact, there is a trend of Western energy companies moving away from onshore fields at the moment.

Offshore operations seem to be more attractive and lower risk. However, it takes immense expenses to build out and transport onshore activities to offshore sites.

Additionally, I’m not massively convinced by Shell’s profitability as it stands.

While it has a net margin of almost 8.5%, which is slightly higher than the industry median, its gross margin is only 18.5%, significantly worse than average.

There are better options for me

Shell has some good things going for it, including its growing dividend.

However, the best time for me to buy the shares looks like it would have been in October 2020, as the price has risen 150% since then.

At the current cost and considering the share price has had quite a volatile history in an industry highly influenced by wider economic factors, the investment doesn’t look promising enough for me.

Therefore, I’m not considering the company for my portfolio.