After a difficult pandemic period, Compass Group (LSE:CPG) is back on top.

While its net income has grown at a less-than-stellar rate between 2022 and 2023, I think the FTSE 100 company’s shares are still worth considering for my portfolio.

Owning some shares in this hospitality giant could help me get a bit of breathing room from my heavy focus on technology.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

A closer look at the company

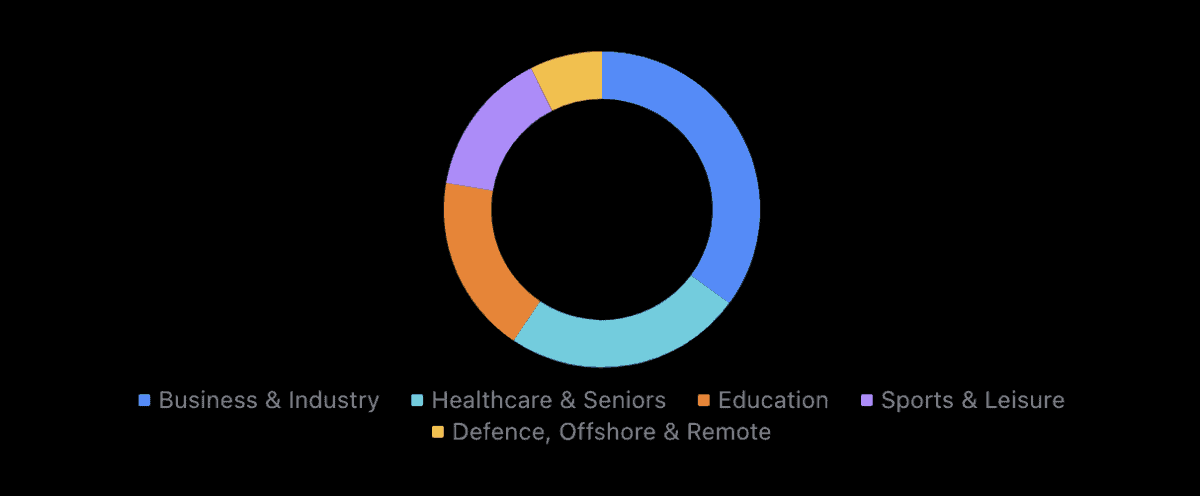

Compass Group’s core operations include catering services, facility management, vending and convenience services, and specialist services.

For example, it offers corporate catering, and large event hospitality. Also, it offers food for educational institutions like schools and universities. Additionally, the company cleans and maintains buildings and provides security.

The diverse capabilities of Compass allow it to give a full service to clients from one single provider. And in a specialist sense, it provides healthcare and senior living facilities.

Why I think it’s promising

Over the last 10 years, the company has averaged around a 12% annual return on average.

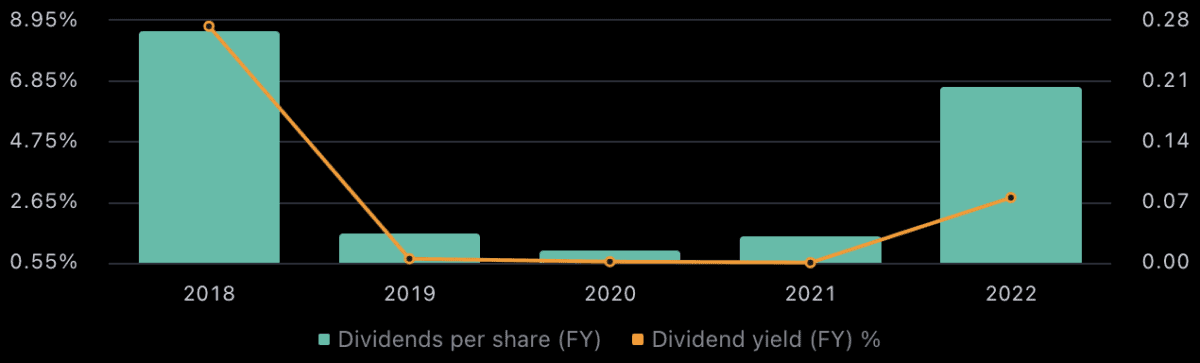

Also, during that time, it paid a nice dividend to shareholders.

While the dividend has been a bit lower than historically, recently, it’s on the up. It’s currently yielding 2% a year, which is a nice addition to that average 12% in price gains!

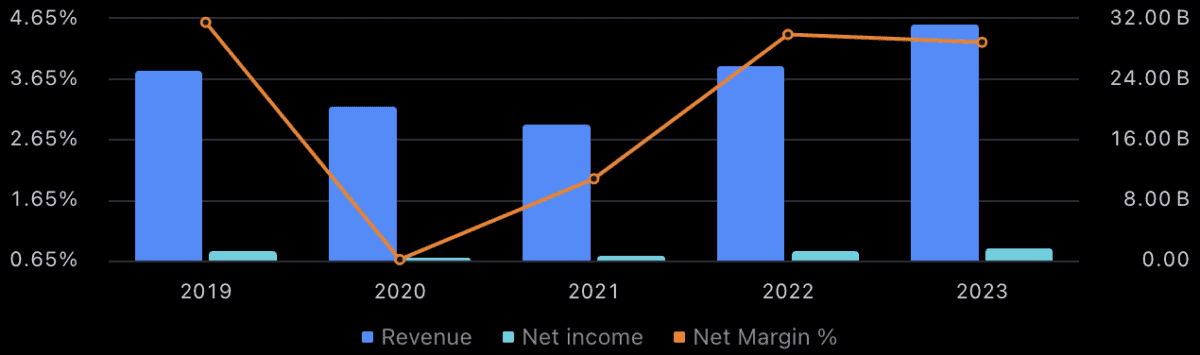

Here’s a visual representation of how the firm recovered financially from the pandemic:

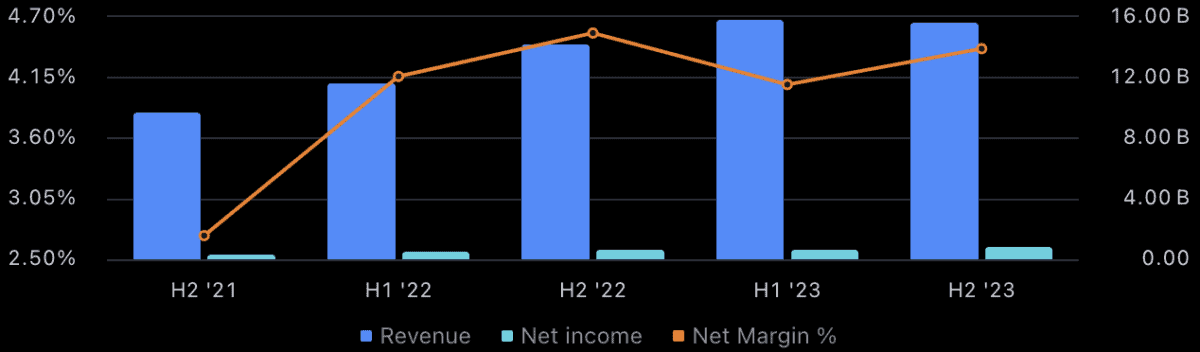

And I can also look at this on a quarterly basis since the middle of 2021. I can see that it’s starting to struggle to grow a bit since halfway through 2022.

It’s been a tough economic environment for everybody right now, so personally I wouldn’t blame the company too much. I’m sure things will pick up once inflation and interest rates have stabilised a bit.

The good news is it has had a revenue growth rate of 14% on average over the last three years. Additionally, it has a net margin of 4.2%, which is pretty good considering the industry median of 2%.

Valuation

Compass group is getting cheaper.

While at the moment, its price-to-earnings (P/E) ratio is around 29, higher than the industry norm, its P/E ratio based on future earnings estimates is much lower, around 17.5.

That could mean the company is around fairly valued right now if I take into account the future earning potential of the business.

After all, the industry median P/E ratio based on future income is also 17.5.

Risks

Compass Group’s balance sheet could be better. It has only 30% of its assets proportioned by equity right now.

This could mean if something else like a pandemic struck, shutting down global hospitality, the firm could be hit harder than otherwise.

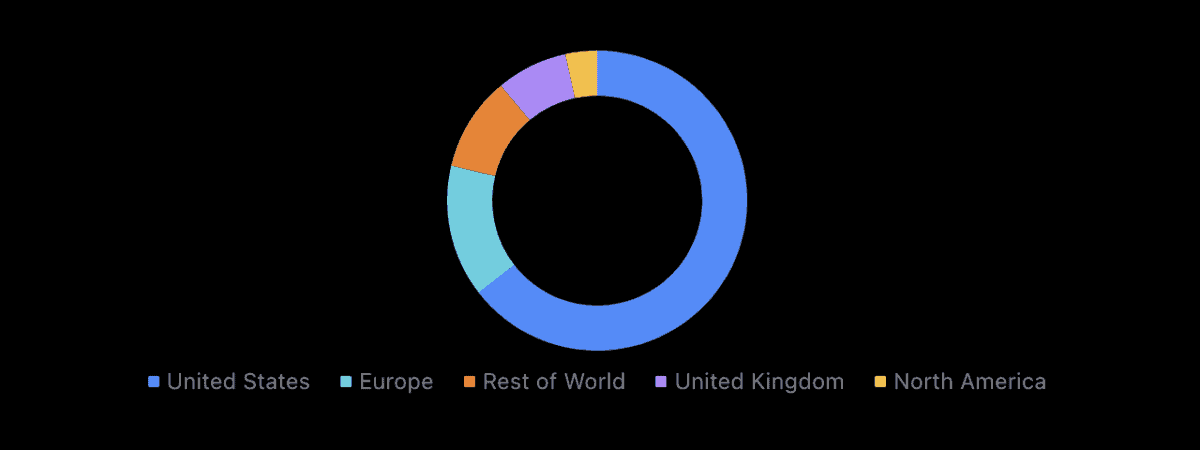

Also, while the organisation is globally diversified, a lot of its operations are in the US. If the States got caught up in an economic crisis, Compass isn’t necessarily that well protected.

It’s on my watchlist

This company looks great. I even worked for it when I was a teenager to earn some extra cash.

It might be a nice full circle to also become an investor. The financials certainly look good enough to make it a logical choice.

Maybe I’ll buy some of the shares later in the year.