The Shell (LSE:SHEL) share price pushed up 2.55% — not a small figure for a £160bn-company — in early trading on 1 February, 2024. That came after the energy giant’s fourth quarter results didn’t disappoint, as gas trading made up for falling commodity prices.

Let’s take a closer look at the results, and what this could mean for investors.

Beating expectations

Shell’s management pointed to “exceptional” trading opportunities within the global gas market as well as higher volumes of liquefied natural gas available for sale as profit beat expectations in Q4.

Analysts had expected net income for the three months to 31 December to come in at $6.14bn. Net income actually came in at $7.31bn, down year on year, but still far ahead of expectations. Shell said it would repurchase $3.5bn of shares during Q1, matching buybacks from the previous quarter.

It’s noteworthy that Shell’s chemicals and oil products business saw earnings plummet to just $83m, down sequentially from $1.38bn in Q3. The company said that margins were hammered by oversupply and weak demand.

The London-headquartered company declared a dividend of ¢34.4 a share — 4% higher than a year earlier.

Shell versus peers

Shell is one of the big six vertically integrated oil and gas companies, often referred to as ‘majors’ or traditionally ‘IOCs’ (international oil companies).

The British giant is something of a middling performer versus the rest of the Big Six. It’s certainly cheaper than its American counterparts, and is roughly in line with its European ones. I’ve left Shell’s forward price-to-earnings open as it has only just published its results — it’s the first of the six to do so.

| Shell | BP | Chevron | Eni | ExxonMobil | Total | |

| P/E (trailing 12 months) | 7.31 | 6.78 | 10.9 | N.a. | 10.04 | 6.47 |

| P/E forward | N.a. | 6.14 | 10.33 | 11.76 | 11.69 | 7.02 |

| P/S | 0.63 | 0.47 | 1.32 | 0.50 | 1.21 | 0.70 |

| Net income margin % | 8.64 | 11.36 | 12.56 | 5.14 | 11.74 | 8.58 |

| Debt to equity % | 42.58 | 68.08 | 12.37 | 55.93 | 19.88 | 49.24 |

Equally, Shell’s net income margin doesn’t stand out versus its peers, while its debt is the lowest of the European companies. As I said, there’s nothing outstanding here.

Moving forward

While Shell has a broad portfolio that includes petroleum products and renewable energy, the company’s profitability is tightly linked to hydrocarbon prices.

Thankfully, for Shell at least, oil prices are expected to remain above long-term averages over the next decade. And there are several reasons for this, including a slow transition to renewables and a growing global middle class leading to more cars on the road.

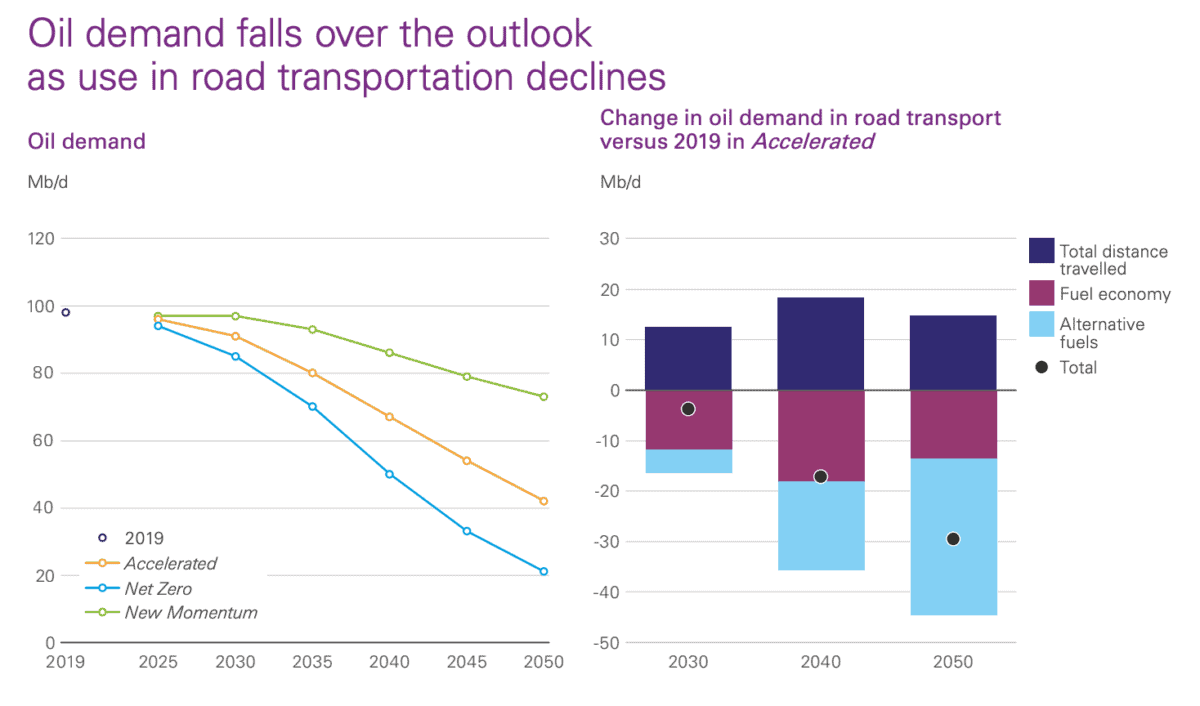

While the below chart shows us that oil demand will fall over the long run, it’s worth recognising that there’s less easy oil today. In other words, oil is becoming harder to extract and that’s not good for supply.

The bottom line

I don’t have any direct exposure to the hydrocarbons sector in my portfolio. And I’m not sure now is the right time for me to do so. Instead of producers, I’m looking more closely at tanker companies at this moment in time. My preference is for Scorpio Tankers, but my brokerage doesn’t offer access.