Diageo (LSE: DGE) released its H1 FY 2024 earnings yesterday (30 January) and the share price dropped 3%. Then it recovered a bit and now rests at 2,855p. Yet it’s still down 12% since November.

What’s going on? Here are my thoughts.

Regional problems

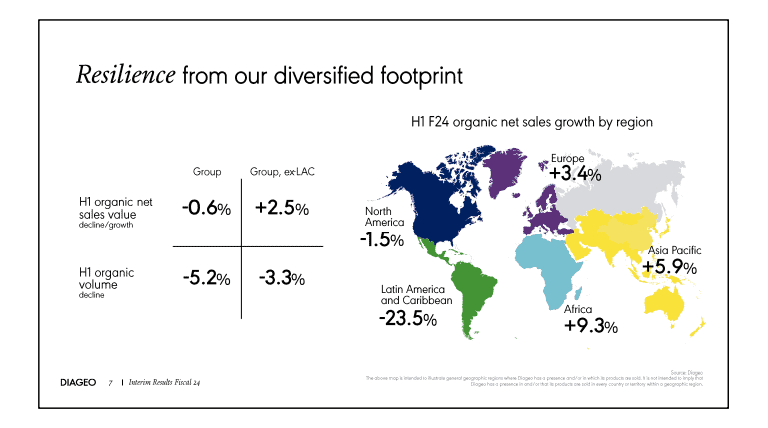

In November, Diageo warned that sales in Latin America and the Caribbean (LAC) region were set to slump by more than 20%. It wasn’t wrong. In H1, sales there dropped 23.5% year on year, and the firm expects a further decline of 10%-20% in H2 (which ends in August).

The issue is an unexpected build-up of unsold booze in Brazil and Mexico, where cash-strapped drinkers have been downgrading from pricier premium spirits like Scotch and tequila.

In Brazil, for example, consumers have started drinking more beer. Meanwhile, Mexico saw a decline in Don Julio tequila consumption and sales of Casamigos — the high-end tequila brand Diageo bought in 2017 from Hollywood star George Clooney — fell 13% overall.

In some ways, I’m not surprised by this tequila decline. The drink is synonymous with celebration, where people often neck the shots with salt and lime. It’s a popular choice for toasts and festive occasions.

However, there’s currently little reason for celebration for many people in the region. Inflation in some of the largest economies has been growing at its fastest pace in over 20 years. In August, Argentina’s annual inflation rate surged 124%!

Rising prices and higher interest rates are obviously a toxic combination for disposable income.

Overall, Diageo’s organic operating profit fell 5.4% in H1, worse than the 4.7% expected by analysts.

There were positives

Yet, somewhat amazingly, the group’s organic net sales only declined 0.6%. Indeed, if we exclude the struggling LAC region, organic net sales actually grew 2.5%.

This was driven by growth in Asia Pacific, Europe and Africa.

For me, this highlights the strength of its diverse portfolio across the world. Falling sales in a couple of high-margin regions are offset by strength elsewhere. Tequila is down in the Americas but Guinness grew double-digits in Europe.

Meanwhile, the company still generated strong free cash flow of $1.5bn while continuing to invest in the potential future growth of its brands.

Finally, despite weaker profits, the interim dividend was hiked 5%. This maintains a record of increases stretching back to Diageo’s formation over 25 years ago.

Wait-and-see mode

Looking ahead, management expects organic net sales growth to improve in H2. And to prevent a repeat of the inventory debacle, it plans to use RFID labels to track cases of spirits as they move through distribution networks.

Now, one thing I’d highlight is that the company is opting not to discount on its premium brands in the US. This could see it lose some market share in the near term, which the market might not like. But long term, management says this will protect brand equity.

I’d go along with this line of thinking, though investors are in wait-and-see mode on this. There’s a lot of uncertainty and the share price could remain volatile.

Yet if there was ever a time to consider investing in Diageo, I’d say it’s now. Expectations are low, the stock is cheap at 17 times forward earnings, and the starting dividend yield is 2.8%.