The potential of renewable energy company ITM Power (LSE: ITM) has long been obvious thanks to its promising hydrogen technology — but the share price has moved around dramatically. It has almost tripled over five years, but it is down more than 90% from its peak just over three years ago.

In early trading this morning, the shares jumped 17%. That was following the release of the business’s interim results. Might the company finally have turned the corner – and could now be the right moment to add the shares to my portfolio?

Sales boom

Revenue more than quadrupled compared to the same period last year. That is the sort of sales growth many companies can only dream of.

Still, it was from a low base so the revenues in the first half were £8.9m. That is not chicken feed, but it is also fairly modest in my view.

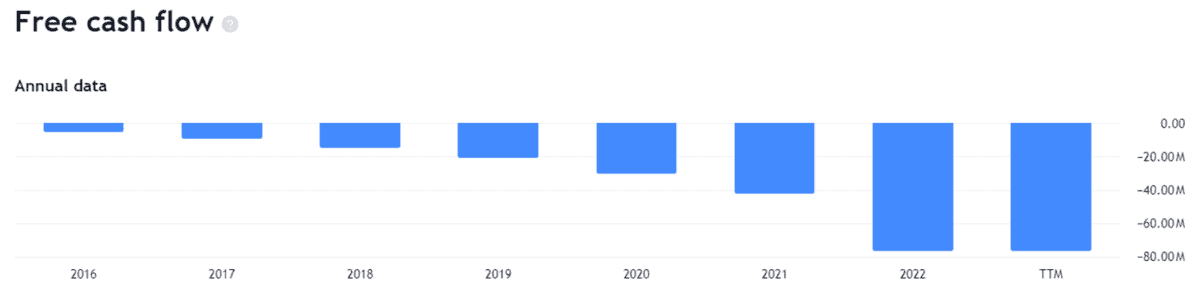

Meanwhile, the company has burnt through over £60m of cash in the past year. Cash burn remains a key risk in my view, as it could lead to further shareholder dilution in future if the business needs to raise more money.

Its current cash pile is £254m, only around £100m less than the market capitalisation. That suggests that investors are assigning the company a valuation of roughly £100m.

The post-tax loss was £18.2m. At more than twice revenues, that alarms me. However, management deserves credit for cutting it by around two thirds compared to the same period last year.

Improving prospects?

For a company with modest revenues and large losses, a 17% jump in the ITM Power share price may seem sizeable. So, why have the shares leapt in this morning’s trading?

After years of seemingly lacking a viable commercial strategy, the interims suggest that a turnaround plan at ITM may be starting to bear fruit.

Clearly a lot of work remains to be done, but sharp sales growth combined with much lower (though still big) losses may point to how the company could perform in future. Indeed, the company described its first half performance as “bringing us one step closer to becoming a profitable company in the future”.

ITM maintained its full-year revenue outlook. It reduced the top end forecast for loss before interest, tax, depreciation and amortisation from £55m to £50m.

To buy or not to buy

I am definitely intrigued by the latest set of figures from the hydrogen company.

Its technology is attractive and growing sales suggest that some target customers feel the same. The stage now seems set for sales growth in coming years combined with ongoing focus on cost management. I do not yet see profit in sight but the possibility of reaching that stage looks higher than it did a year ago, I reckon.

Set against that, buying at today’s share price could yet turn out to be a lucrative move. I feel more upbeat about the firm than I have ever done before.

However, a lot remains to be done and the company is still heavily lossmaking. So, rather than buy now, I will wait and watch for more concrete signs of a sustainably profitable business model.