Earning an abundant second income for little (or no) effort in retirement is the dream of all investors. It’s my plan to achieve this by building a diversified portfolio of FTSE 100 and FTSE 250 dividend shares.

How much one will be need to have accrued by retirement age differs from person to person. But a good strategy could be to follow what the Pensions and Lifetime Savings Association thinks the average Brit will need once they hit retirement age.

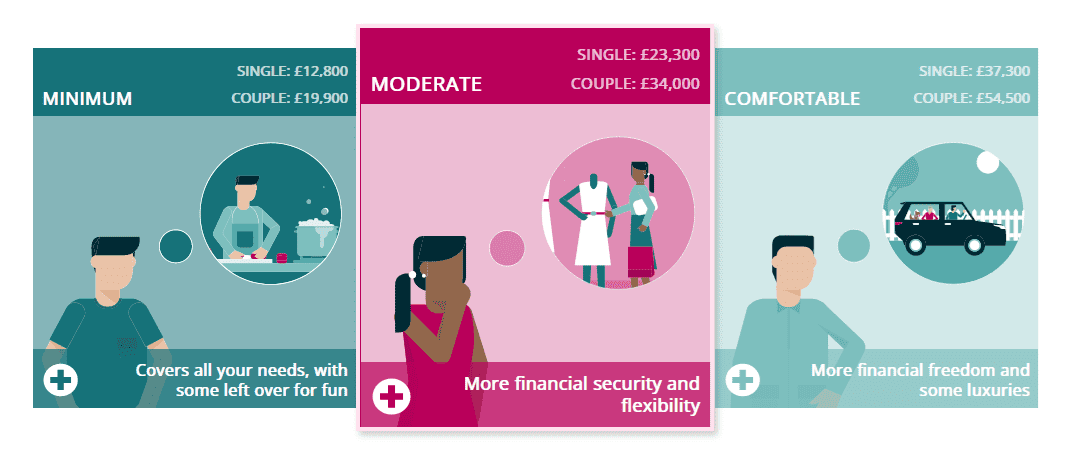

They believe retirees will need an annual income of £23,300 to enjoy a ‘moderate’ standard of living. A much-higher figure of £37,300 is needed for individuals to live comfortably.

Here’s my plan

This leaves a big problem for people who are relying on the State Pension to fund their retirement. As of April, the pension is scheduled to come in at just £11,502 a year.

This leaves a shortfall of around £25,800 for those who want to enjoy a ‘comfortable’ standard of living. And I believe this disparity will grow even larger by the time I myself hang up my work apron for good as the cost of living and social care soars.

But I’m not panicking. While future profits are not guaranteed, the stunning returns UK share investors have made in recent decades suggest I could live comfortably regardless of what the future holds for the State Pension.

Compound gains

My optimism is based on the exceptional returns that FTSE 100 and FTSE 250 stocks have delivered over the long term.

Footsie investors who reinvested all of their dividends between 2010 and 2019 enjoyed an average annual return of 8.3% between. Meanwhile, those who bought FTSE 250 stocks enjoyed an even better yearly return of 13%.*

Reinvesting dividends is the key to supercharging one’s long-term wealth. Doing this with dividends allows me to accumulate more shares, leading to increased dividend payouts and thus the chance to buy additional shares.

Over time, this mathematical miracle (known as compounding) can help me make market-beating returns.

* Figures courtesy of IG Group.

A £3,337 second income

Now I’ll show you how compounding can help me make a passive income in retirement. Let’s say that I have a lump sum of £20,000 to build a balanced portfolio of UK blue-chip stocks.

Over the space of 30 years, and with an extra £200 invested each month, I would have built an impressive nest egg of £1,001,225 to retire on. That’s based on the average 10.65% return for FTSE 100 and FTSE 250 stocks during the 2010s.

If I then drew down 4% of this amount a year, I would have an excellent monthly income of £3,337. On an annual basis this works at £40,049.

That would be enough to give me that comfortable retirement that the PLSA describes. And that’s not even taking into account the extra boost that the State Pension will provide to my finances.

There could be bumps along the way. But I’m confident that, with the right investment strategy (and help from experts like The Motley Fool) I could make a large passive income for my later years.