Brits have never seen the allure of buying UK shares on the whole. The majority prefer cash savings or investing in property as vehicles toward building wealth. However, here at The Motley Fool, we passionately believe that investing in UK shares shouldn’t just be for professional money managers!

Ticking time bomb

Recently, I came across an alarming stat from InvestEngine:

“Nearly one in five 18-54s say they will be funding their own retirement through a family inheritance.”

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

Personally, I don’t want to rely on an inheritance payout to fund my retirement needs. As life expectancies increase, I may not receive anything until I am too old to enjoy it. Or maybe a family member requires care in old age, leaving little or nothing left for me to inherit.

I want to be in control of my own destiny, not rely on variables that I have no control over.

Everybody has to start somewhere

If I could build a time machine and give my younger self just one piece of advice, then it would be to start investing as early as possible. After all, Warren Buffett bought his first stock when he was only 11. Today he’s one of the richest people in the world.

The earlier one starts investing, then the longer one gives for the magic of compounding to take effect.

Consider, if I’d invested £1,000 in a FTSE 100 tracker when the index was formed in 1984. Today I would have nearly £15,000. But half of my total return would have come in the last 10 years. That’s why time in the market beats trying to time one’s entry and exit points.

Checklist for a starter stock

If I was starting on my investment journey now, then I wouldn’t be looking to invest in risky, speculative plays. I therefore would only consider shares in the FTSE 100.

What I primarily look for is quality. That means it must be growing, profitable and not weighed down by excess debt on the balance sheet.

Once I have identified such a stock, then I never go all in at once. Instead, I will build my position over time. That way, if my original investment thesis turns out to be wrong, my portfolio losses will be limited.

A touch of class

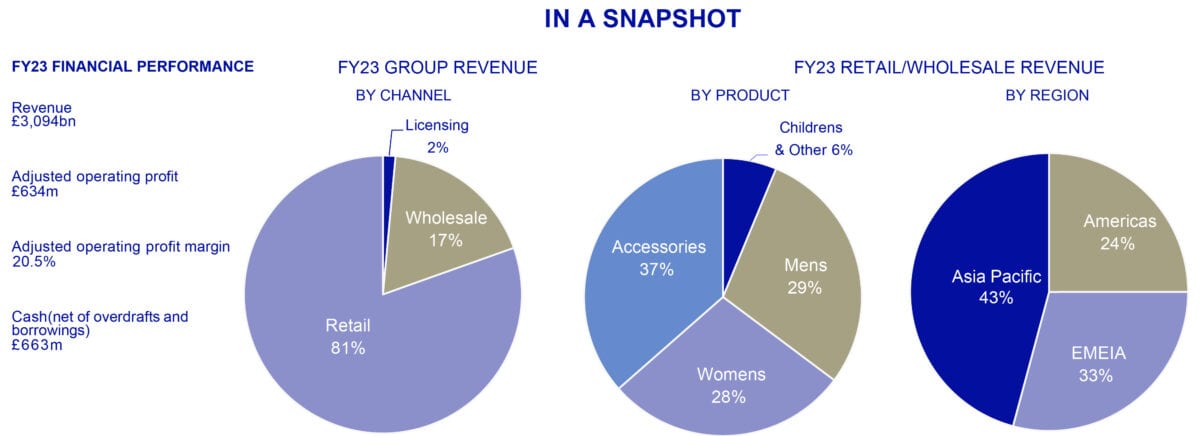

One stock that I really like the look of is high-end fashion brand, Burberry (LSE:BRBY). The following quick-glance factsheet highlights that it ticks all of my ‘quality’ attributes, above.

Source: Burberry

But even good companies can sometimes run into hard times. That’s certainly the case with Burberry. Earlier this month it issued another profit warning. It’s little wonder its share price is down nearly 50% in the past year.

So, is this a temporary blip? I believe so. I invest because I see a long-term growth story. Anything else is just noise.

The luxury customer base continues to expand across generations, spend levels and geographies. Out to 2030, this base is projected to grow 25%. The company has a bold vision to tap into this demand and grow its revenues to £5bn a year.

I certainly view Burberry as a great starter stock. Indeed, I intend to purchase some myself. But as I’ve said already, only a small position at first.