Some investors may see the falling BT (LSE:BT.A) share price as an attractive opportunity to enhance passive income generation. The telecoms firm currently offers a 6.66% dividend yield, making it one of the strongest on the FTSE 100.

The maths is quite easy here. If I wanted to earn £2,000 a year in dividend payments from BT shares, I’ve got to own £30,000 of the stock. At the moment, that’s 25,862 shares.

So, there’s several things worth considering here. Firstly, should I be buying the shares, and would I want £30,000 of them if I could afford it?

Value can be misleading

Valuation metrics can be misleading. And that appears to be the case here. BT shares trade with a forward price-to-earnings ratio of 7.3.

That’s a 59.2% discount versus the communications sector average and approximately a 40% discount to the FTSE 100 average.

BT looks pretty cheap on other near-term metrics too. It trades with a forward enterprise value-to-EBTIDA ratio of 3.99. In turn, this represents a 54.2% discount versus the sector average.

Likewise, it trades with a forward price-to-sales ratio of 0.54, representing a 55.9% discount to the sector.

All these metrics look great. It’s an ‘A+ grade’ on near-term metrics. However, sometimes near-term metrics can be misleading.

So, why is that? Well, it’s because of growth. BT Group does not offer explosive growth. In fact, according to the consensus forecast — below — it offers almost no growth at all throughout the medium term.

| 2024 | 2025 | 2026 | |

| EPS (p) | 15.5 | 15.1 | 15.9 |

Dividends might not be sustainable

There are several ways to look at the dividend. It looks sustainable today, but it might not be in the future.

Firstly, in 2023, the dividend was covered 2.52 times by earnings. In other words, that’s a payout ratio of 0.4, which is very strong. A dividend coverage ratio above two is normally considered healthy.

However, there are concerns about the debt, cash flow and BT’s capital expenditure (CAPEX) requirements over the coming years.

BT has a net debt in excess of £19.7bn — up from £18.9bn in March — and analysts are forecasting a CAPEX burden around £15bn as the firm continues its rollout of FTTP (fibre to the premises).

BT is targeting taking its fibre product to 15-20m households in the UK, and as a general rule of thumb, it costs around £85m to rollout FTTP to 100,000 households.

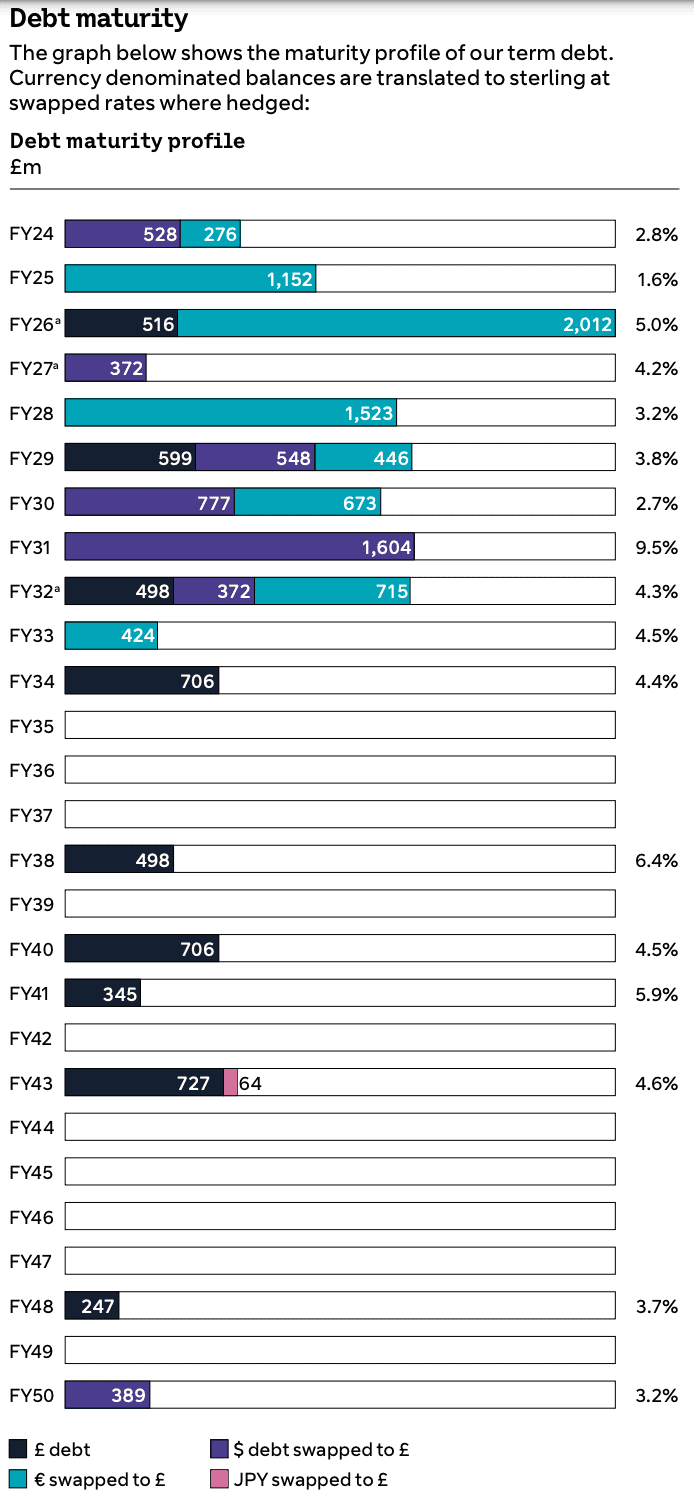

So, this would mean £15bn in CAPEX over the years to 2029. In addition to its sizeable debt burden (debt maturity profile below) these CAPEX requirements could make the dividend less sustainable.

The bottom line

Earnings growth is slow, debt is sizeable, and CAPEX requirements are gigantic. In turn, if I were investing for dividends, I’d look elsewhere. The dividend may looks sustainable now, but CAPEX and debt repayments could eat into earnings as we move through the decade. Even if I were investing £30,000, I wouldn’t be picking BT.