With a Stocks and Shares ISA, I can invest up to £20,000 a year and only pay tax on any capital gains above £12,000. That can equate to a lot of extra savings per year if my investments do well.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

The limitations imposed by a Stocks and Shares ISA taught me to invest more responsibly. I found that after reaching my £20,000 limit, I couldn’t reinvest withdrawals I’d made that year. This helped me discover the magic of compounding returns because I was motivated to invest for longer.

Which shares to pick?

Picking shares is no easy feat. Even the world’s most experienced investors make mistakes on occasion. I find it best to select companies in my area of expertise because I understand them better.

One example is the US-based computer chip manufacturer Nvidia (NYSE:NVDA). As a key supplier of computing power to the artificial intelligence (AI) industry, Nvidia has enjoyed spectacular success in the past five years. It’s up an incredible 1,400% since January 2019, climbing from $40 to $600 a share. Even after such extended growth, analysts predict a further 30% earnings growth per year for the stock.

Usually, companies with a market cap as large as Nvidia ($1.5trn) don’t make such rapid gains in short periods. Subsequently, I worry the share price could lack a solid foundation, putting it at risk of sudden and unexpected volatility from external factors.

In particular, I think geopolitical tensions between China and the West could disrupt Nvidia’s supply chain. Nevertheless, I still believe the company’s impressive history exemplifies a share that would be good for my Stocks and Shares ISA.

My passive income strategy

I’d aim for a well-balanced portfolio that delivers 10% annual returns on average. To achieve this rate, I would need to monitor markets closely and select stocks that perform exceptionally well year on year (yoy). Recent examples of FTSE 100 stocks that have delivered high returns include Rolls-Royce, Carnival Corp, and Marks & Spencer Group.

Aiming for a rate this high comes with a fair degree of risk, as I would need to make assessments based on past performance and assumptions about the future. To minimise my risk exposure, I would dedicate a fair portion of my ISA to a few exchange-traded funds (ETFs) that track indexes with stable, reliable returns.

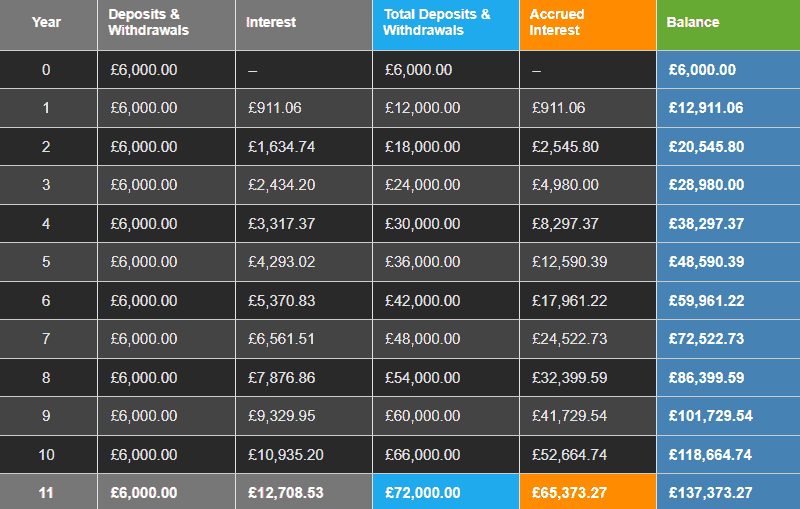

- Starting with £6,000, I’d add £500 per month from my salary for the next 10 years.

- The compounding returns will help me reach £118,664 by the tenth year.

- That’s a healthy £10,935 in returns (assuming I can maintain my 10% average return rate).

- By the eleventh year, I would be earning over £1,000 a month in passive income.

Keeping it simple

For those without the time to manage a portfolio, a Stocks and Shares ISA still offers benefits. I think a good option is to invest in an index tracking ETF like the iShares Core FTSE 100, which provides exposure to major UK companies like Shell, AstraZeneca, and Unilever. It’s managed by professionals who regularly rebalance it to maximise returns, so investors needn’t worry about doing the hard work.