It’s been a dreadful three years for investors in NIO (NYSE: NIO) stock. Over that period, it’s down a shocking 90% and recently plumbed a 52-week low.

Should I try to catch this falling knife at $6? Let’s discuss.

Things to like

At first glance, there are a number of things that I find appealing about NIO from an investment perspective. First, it sells electric vehicles (EVs) in China, which is by far the world’s largest EV market.

According to Bloomberg’s New Energy Finance report, EV sales are set to grow to 56m by 2040, up from about 6.6m in 2021. That will represent approximately 58% of global car sales, with China expected to maintain its leading position.

Second, NIO has established its premium brand in the highly competitive Chinese market, suggesting it might have an easier time succeeding in less competitive foreign markets. That’s not guaranteed, of course, but Elon Musk has said that Tesla‘s stiffest competition will likely come from global Chinese manufacturers.

Third, the firm is extremely forward-thinking. It has built out 2,226 battery-swapping stations as part of its ‘battery-as-a-service’ subscription package. This offers customers the ability to swap an EV battery in as little as three minutes.

It plans to build another 1,000 of these NIO Power stations in 2024, including across Europe. Notably, it has announced partnerships here and is opening up its swapping network to the entire Chinese EV industry.

In the medium term, this has the potential to improve the company’s finances as it shares the R&D and cost burden while opening up licencing fee possibilities.

Many unknowns

My problem is that for every positive I also see a potential negative. The ongoing EV price war isn’t ideal for profit margins. NIO’s vehicle margin contracted to 11% in Q3 2023 versus 16.4% in Q3 2022.

Meanwhile, it’ll have to keep marketing expenses high, especially as it rolls out new models. In the last quarter, selling, general, and administrative expenses rose 37.5% year on year and 28.1% sequentially from the previous quarter.

Furthermore, successful international expansion isn’t guaranteed. The European Commission is considering punitive tariffs to stop China from flooding the EU market with state-subsidised EVs.

I’d imagine there will be similar tough talking around US-China trade relations as part of the forthcoming US election.

Finally, the battery-swapping stations could ultimately prove to be a money pit rather than a unique value proposition. That said, there have been 32m such swaps to date and managements says it is the “most trusted charging solution” for customers.

My move

My biggest concern, however, is that the firm is moving further away from profitability.

In Q3, it reported strong sales of $2.38bn, which was 47% higher than last year. But the company’s quarterly operating loss grew 25% to $664m, driven in part by new model launches.

As of September, the cash position remained strong at $6.2bn, but I find the mounting losses worrying.

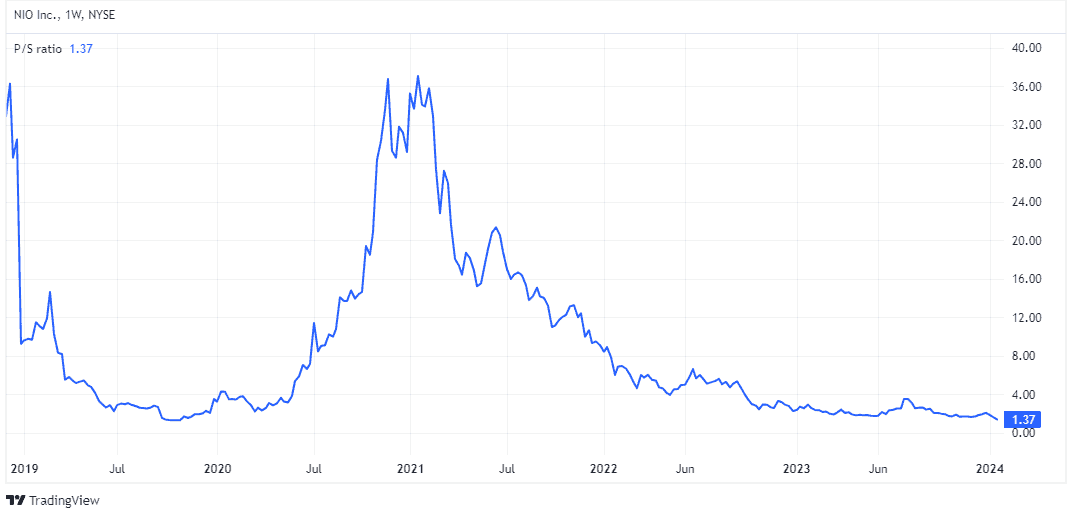

This probably explains why the stock is trading at a price-to-sales multiple of just 1.37. That’s the cheapest it’s ever been.

For context, Tesla trades for a P/S ratio of 7.7 and Rivian Automotive 3.85. While the stock appears dirt cheap, it’s still too risky for me. I think it may fall further.