I’m building a list of top FTSE 100 and FTSE 250 shares to buy when I next have cash to invest. Here are two I’m hoping to buy before their share prices spring higher.

Industry giant

Financial services providers like Legal & General Group (LSE:LGEN) face an ongoing battle to grow earnings as tough economic conditions sap consumer spending.

Should you invest £1,000 in Bluefield Solar Income Fund Limited right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bluefield Solar Income Fund Limited made the list?

Between January and June last year, operating profit at this particular FTSE 100 firm dropped 2%. But the prospect of further short-term stress doesn’t put me off. I opened a stake in the life insurance, wealth and pensions giant last year as I believe it will deliver exceptional long-term returns.

And at current prices, I’m hoping to add to my holdings. At 239p per share, it carries a brilliant 9% dividend yield for 2024, while its price-to-earnings (P/E) ratio sits at a rock-bottom 9.1 times.

Dividend growth at Legal & General since 2014. Chart by TradingView

Legal & General is a leader in financial services, and in the UK it has around 10m policyholders across the savings, protection, mortgage and retirement segments. As populations rapidly age across its territories, it has a great chance to grow customer numbers sharply from current levels.

I also like L&G shares because of the company’s cash-rich balance sheet. A strong solvency ratio (which came in at 230% in June) gives it firepower to make acquisitions, invest in the business, and to continue growing the dividend.

Sunny side up

Investing in renewable energy stocks could also help me make terrific returns as the move away from fossil fuels accelerates. I already own shares in investment trust The Renewables Infrastructure Group, and I’m seeking to buy more green energy shares to boost my exposure.

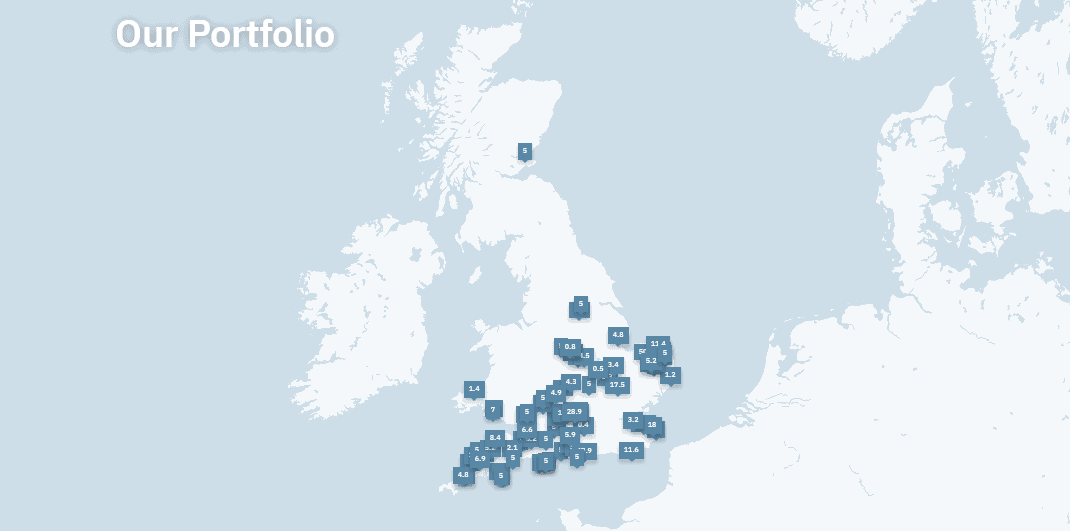

One such business on my radar today is Bluefield Solar Income Fund (LSE:BSIF), which has a portfolio of more than 200 solar farms in the UK.

Demand for green energy is soaring as oil and gas becomes increasingly unfashionable. According to Carbon Brief, electricity generated from fossil fuels in the UK dropped to its lowest since 1957 last year as renewables capacity stepped higher.

Of course there’s no guarantee that Bluefield will be able to capitalise on this growth industry. During cloudy conditions, power generation can slump which, in turn, can pull profits lower. Technological failures can also play havoc with the bottom line.

However, this FTSE 250 operator’s extensive asset portfolio helps to reduce this risk. As the map below shows, its portfolio of UK solar farms is pretty impressive.

I think Bluefield is an especially great stock to buy at current prices. At 114p, the company’s share price trades at a whopping discount to the value of the firm’s assets. Its net asset value (NAV) per share is currently estimated at around 136.7p.

The renewable energy play also carries a mighty 7.6% dividend yield today.

Like Legal & General, I think it could be a great way to generate a large (and growing) passive income in the years ahead.