Even though I’m an investor primarily focused on US shares, holding great British companies from the FTSE 100 is a no-brainer to me for portfolio diversification.

Owning companies from around the world gives me protection against country-specific risks.

So, I’ve been looking for new UK shares to buy recently, and I think Experian (LSE:EXPN) could make the cut.

Should you invest £1,000 in BAE Systems right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BAE Systems made the list?

Because I take time to make an investment decision, this one is on my watchlist instead of in my portfolio just yet.

Understanding Experian

Experian is a global leader in credit reporting and marketing, providing services for both individual consumers and businesses. It’s also one of the Big Three credit agencies, alongside Equifax and TransUnion.

As well as credit reporting and marketing, the firm also performs data analytics, identity theft protection, and credit monitoring, among other operations.

Why I like the stock

I think the company’s financial statements have some really strong points, including the firm’s margins. It has a net margin of over 15%, for example, which is high against an industry median of around 4%.

Net income — the bottom line — is a good indicator of a quality company, in my opinion. However, it’s not all I look for. Revenue — or top-line growth — is also vital to assess.

If I don’t consider both the top and bottom line, I could buy a business that’s growing fast but not profitably. Also, I could buy a company that’s earning well for now but not growing total income at all.

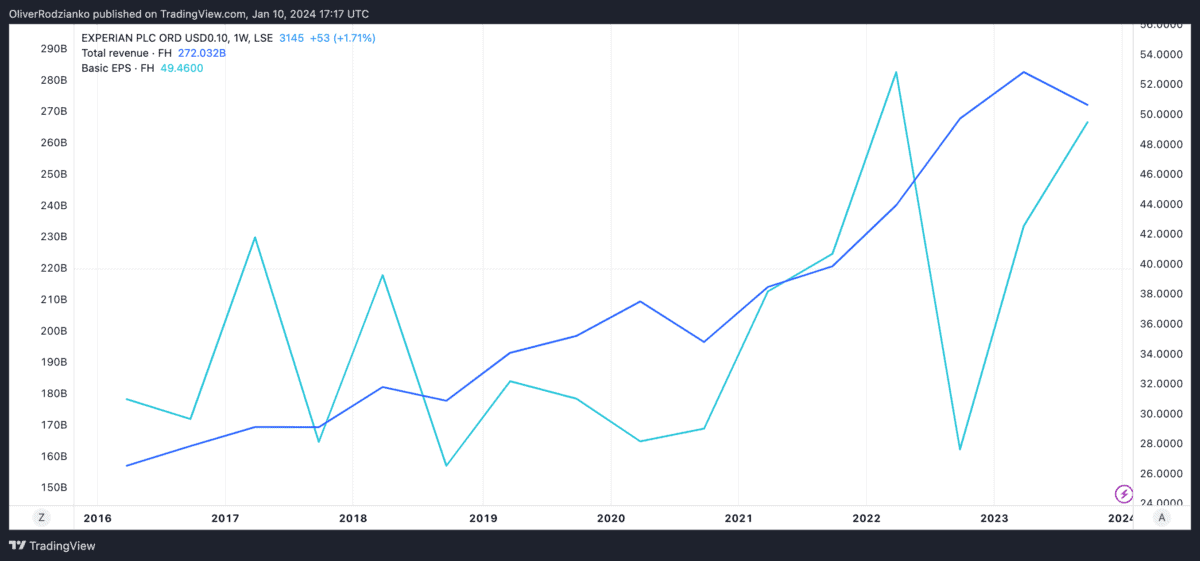

Thankfully, Experian’s three-year average annual revenue growth rate is 8.8%. That’s quite healthy, in my opinion.

That said, as we can see from the chart below, the firm’s earnings per share have had a shakier ride than its revenues.

There are risks

Other than those recent earnings volatility, there are more key risks I’m making sure I take note of.

First, the company doesn’t seem to have nearly enough cash on its books to pay off its debts. The last report in 2023 presented a situation where the firm had £172m in cash and £3.4bn in debt… ouch!

Yet the balance sheet is showing signs of improving over the long term. On the whole, it isn’t terrible. For example, 37% of assets are balanced by shareholder’s equity. That’s okay to me.

Experian’s price-to-earnings ratio based on future earnings is also around 25. So, I wouldn’t exactly call the shares a value investment.

It’s on my watchlist

I think there are lots of positives about Experian shares. However, I don’t think investing in the company is a time-sensitive decision. Therefore I’ll be patient to further assess whether this is something I want in my portfolio for the long term.

In the meantime, I’ll keep an eye on it. After all, it does seem to be up there with some of the best UK shares, even considering the risks.